Trust Wallet Taxbit

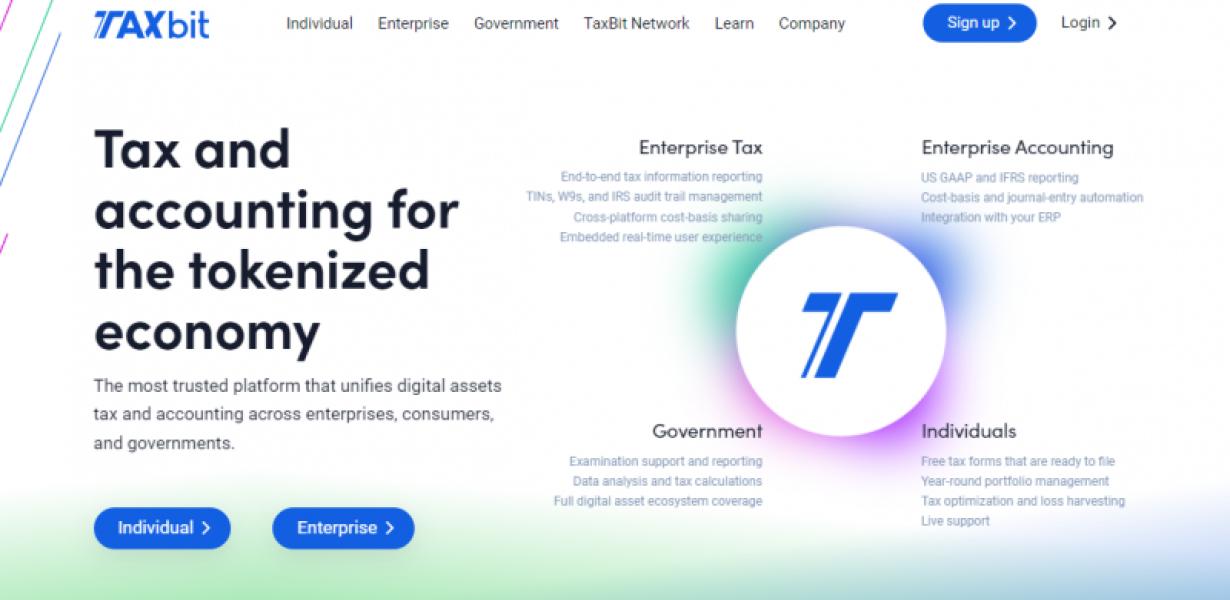

Trust Wallet Taxbit is a cryptocurrency tax software application that allows users to track their capital gains and losses for tax purposes. The app is available for Android and iOS devices, and connects to popular cryptocurrency exchanges including Coinbase, Binance, and Kraken. Trust Wallet Taxbit also offers a desktop version for Windows and MacOS.

How to Use Trust Wallet to Save on Taxes

1. Open Trust Wallet and create a new wallet.

2. Tap on the "Add Funds" button.

3. Enter the amount of money you want to deposit into your wallet and tap on the "Deposit" button.

4. Select the country in which you want to file your taxes and tap on the "File Taxes" button.

5. Enter your income information and tap on the "Pay Taxes" button.

6. Review your tax filing information and make any necessary changes. Tap on the "Submit Tax Return" button to finalize your tax filing process.

3 Ways to Use Trust Wallet to Reduce Your Tax Bill

1. Use Trust Wallet to keep track of your income and expenses. This will help you reduce your taxable income.

2. Use Trust Wallet to donate to charitable organizations. This will reduce your taxable income and increase your good karma.

3. Use Trust Wallet to invest in stocks and other financial assets. This will help you increase your wealth and reduce your taxable income.

5 Tips for Using Trust Wallet to Lower Your Taxes

1. Use Trust Wallet to create an account and sign in.

2. Review your tax filings and identify any items you may have overpaid or underpaid taxes on in the past.

3. Use the Tax Calculator on the Trust Wallet website to estimate your 2017 tax liability and make any necessary adjustments.

4. Upload your tax return files (.pdf, .xls, etc.) to Trust Wallet and make sure all information is correct before submitting.

5. Use the Tax Refunds feature on Trust Wallet to receive a refund of any overpaid or underpaid taxes owed, as well as any applicable interest.

10 Tricks for Paying Less Taxes with Trust Wallet

There are a number of tricks you can use to pay less taxes with Trust Wallet.

1. Use Tax Loss Harvesting

One way to reduce your taxable income is to use tax loss harvesting. This is when you sell assets that have decreased in value since you purchased them, in order to reduce your taxable income.

2. Claim Deductions for Home Repairs and Improvements

You can claim deductions for home repairs and improvements in your tax filing. This includes things like installing new windows or doors, fixing leaks, or upgrading the electrical system.

3. Invest in Tax-Free Bonds and ETFs

You can also invest in tax-free bonds and ETFs in order to reduce your taxable income. Tax-free bonds are issued by the government and are exempt from federal and state taxes. ETFs are baskets of securities that track an index, such as the S&P 500. This way, you’re still able to benefit from the growth of the stock market while avoiding capital gains taxes.

4. Make Use of Tax-Free Retirement Accounts

You can make use of tax-free retirement accounts in order to reduce your taxable income. These include things like 401(k)s and IRAs. You can also make use of these accounts to save for retirement.

5. Claim Deductions for Medical Expenses

You can claim deductions for medical expenses in your tax filing. This includes things like doctor’s visits, prescription drugs, and hospital bills.

6. Claim Deductions for Child Care Expenses

You can also claim deductions for child care expenses in your tax filing. This includes things like daycare fees, nursery school fees, and educational programs for your children.

7. Claim Deductions for Moving Expenses

You can also claim deductions for moving expenses in your tax filing. This includes things like costs for packing and moving your belongings, as well as travel costs associated with moving.

8. Claim Deductions for Charitable Contributions

You can also claim deductions for charitable contributions in your tax filing. This includes things like donations to registered charities, as well as donations to non-profit organizations.

9. Use 529 Plans to Save for Your Children’s Education

You can use 529 plans to save for your children’s education. This includes things like contributing to a 529 plan before your child is born, or contributing after your child is born but before they start school.

10. Use Tax-Deductible Retirement Planning Tools

You can also use tax-deductible retirement planning tools in order to reduce your taxable income. These include things like employer-sponsored retirement plans, individual retirement accounts (IRAs), and 457(b) plans.

How to Get the Most Out of Trust Wallet for Tax Savings

The Trust Wallet is a mobile app that allows users to easily save and track their taxes. The Trust Wallet offers a variety of features that make tax filing simpler, including:

- A simple and intuitive user interface that makes filing taxes easy.

- The ability to save your tax information for future use.

- The ability to track your tax deductions and credits.

- The ability to share your tax information with family and friends.

If you are looking for a mobile app that will make filing taxes easier, the Trust Wallet is a great option. The app offers a variety of features that will help you save money on your taxes, and it is easy to use.

7 Ways to Use Trust Wallet for Maximum Tax Benefits

1. Use Trust Wallet to file your taxes early. The IRS allows you to electronically file your taxes using the e-file option through the IRS website. You can do this as early as April 15th of the year following the tax year. If you use Trust Wallet to file your taxes, you can save yourself time and money by using the app to do your tax filing. You can also use Trust Wallet to manage your tax deductions and credits.

2. Use Trust Wallet to make estimated tax payments. The IRS offers several options for making estimated tax payments. You can make estimated tax payments using the e-file option through the IRS website. You can also make estimated tax payments using the IRS’s online payment system, My Payment. Alternatively, you can make estimated tax payments by check. If you use Trust Wallet to make estimated tax payments, you can keep track of your payments and deductions using the app.

3. Use Trust Wallet to save on taxes. There are several ways that you can save on taxes using Trust Wallet. You can use the app to manage your tax deductions and credits. You can also use the app to make estimated tax payments. And you can save on taxes by filing your taxes using the e-file option through the IRS website.

4. Use Trust Wallet to get a head start on your taxes. The IRS offers several ways to get a head start on your taxes. You can use the app to manage your tax deductions and credits. You can also use the app to make estimated tax payments. And you can save on taxes by filing your taxes using the e-file option through the IRS website.

5. Use Trust Wallet to stay organized and compliant with the tax laws. The IRS offers several ways to stay organized and compliant with the tax laws. You can use the app to manage your tax deductions and credits. You can also use the app to make estimated tax payments. And you can save on taxes by filing your taxes using the e-file option through the IRS website.

How to Maximize Your Savings with Trust Wallet and Taxes

There are a few things that you can do to maximize your savings with Trust Wallet and taxes.

First, make sure to keep track of your income and expenses. This will help you to understand where your money is going and what you can cut back on.

Second, invest your money in tax-advantaged accounts. This will help you to save on your taxes and increase your overall savings.

Finally, use Trust Wallet to make automatic deposits into your savings account. This will help you to save even more money each month.

9 Ways to Use Trust Wallet to Save on Your Taxes

1. Use Trust Wallet to pay your taxes with cryptocurrency.

2. Use Trust Wallet to track your cryptocurrency holdings and transactions.

3. Use Trust Wallet to manage your tax-deductible cryptocurrency investments.

4. Use Trust Wallet to claim your cryptocurrency losses on your taxes.

5. Use Trust Wallet to securely store your cryptocurrency wealth.

6. Use Trust Wallet to securely send and receive cryptocurrency payments.

7. Use Trust Wallet to manage your cryptocurrency portfolio across multiple platforms.

6 Tips for Using Trust Wallet to Save on Taxes

1. Use trust wallet to keep track of all your tax-related transactions. This will help you stay organized and ensure that you are paying the correct amount of taxes.

2. Make sure to file your tax returns as soon as possible. This will help you receive the most favorable tax treatment possible.

3. Use trust wallet to track your income and expenses. This will help you save money on taxes by ensuring that you are paying the correct amount of taxes on your income and expenses.

4. Try to minimize the amount of money that you owe in taxes by saving money on your taxes through tax deductions and credits.

5. Consult a tax professional if you have any questions about how to save money on taxes through trust wallet. They can help you maximize your tax savings opportunities.

How You Can Use Trust Wallet to Save on Taxes

If you are an individual taxpayer, you can use Trust Wallet to electronically file your taxes. Trust Wallet offers a variety of features that make tax filing easier, including:

- Automatic filing of your taxes based on your income and deductions

- Pre-populated tax forms that you can electronically file

- Secure online filing with the IRS

- 24/7 support for filing your taxes

If you are a business taxpayer, you can use Trust Wallet to:

- Easily manage your finances and taxes

- Manage your expenses and taxes

- Access real-time tax information

- Track your tax deductions and credits

- Automatically submit your taxes

4 Ways to Use Trust Wallet for Greater Tax Savings

1. Use Trust Wallet to file your taxes electronically. This will save you time and money, as you won’t have to file paper tax returns.

2. Use Trust Wallet to keep track of your income and expenses. This will help you stay within your tax brackets and avoid penalties.

3. Use Trust Wallet to make contributions to your retirement account. Doing so will help you save for retirement and reduce your taxable income.

4. Use Trust Wallet to invest in Tax-deferred accounts, such as IRAs and 401ks. Doing so will allow you to defer taxes on your income and grow your savings over time.

The Ultimate Guide to Saving Money with Trust Wallet and Taxes

If you’re looking to save money on your taxes, you should consider using a tax-saving tool like Trust Wallet.

Trust Wallet is a mobile app that helps you track your finances and make smart tax decisions. It’s free to download and use, and it can help you save on your taxes by automating your tax filing process.

Here are some tips on how to use Trust Wallet to save on your taxes:

1. Use Trust Wallet to track your income and expenses.

Trust Wallet helps you track your income and expenses so you can see where you’re spending your money and what tax deductions and credits you may be eligible for. This information can help you save money on your taxes.

2. Use Trust Wallet to file your taxes automatically.

Trust Wallet can help you file your taxes automatically using its built-in tax preparation tool. This tool can help you save time and money by filing your taxes automatically.

3. Use Trust Wallet to make smart tax decisions.

Trust Wallet offers advice on how to save money on your taxes based on your specific financial situation. This advice can help you make smart tax decisions that will save you money in the long run.