Will the IRS look into Metamask?

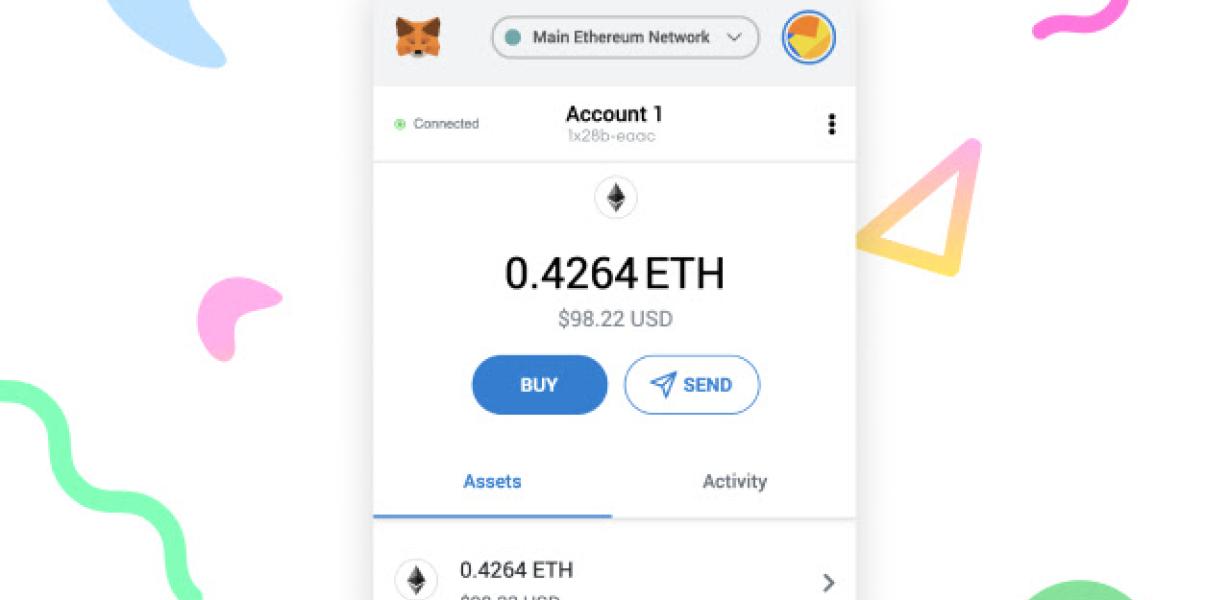

The IRS has not yet announced whether or not they will investigate Metamask, but many people believe that they will. Metamask is a popular cryptocurrency wallet that allows users to store and trade cryptocurrencies.

The IRS is Investigating Metamask for Tax Evasion

Metamask is a cryptocurrency and blockchain application that allows users to conduct transactions without revealing their identities. The IRS has reportedly launched an investigation into the company and its owners for possible tax evasion.

Metamask is a Cryptocurrency and Blockchain Application

Metamask is a cryptocurrency and blockchain application that allows users to conduct transactions without revealing their identities. The application was developed by the company Metamask, LLC. Metamask is a subsidiary of the company Ethereum, LLC.

The IRS Has Reportedly Launched an Investigation into Metamask for Tax Evasion

According to reports, the IRS has launched an investigation into Metamask and its owners for possible tax evasion. The investigation is reportedly based on allegations that Metamask and its owners have used the company to evade taxes.

The investigation is still in its early stages, and no charges have yet been filed. However, if the IRS finds that Metamask and its owners have violated any tax laws, they could face serious penalties.

How Metamask Works

Metamask is a cryptocurrency and blockchain application that allows users to conduct transactions without revealing their identities. Transactions are conducted through the use of masks, which are unique addresses that represent each individual user.

Each mask is linked to a unique account address, which is also known as a private key. When a user wants to make a transaction, they simply need to send their mask to the recipient, along with the required funds. The recipient can then use the mask to access the funds, without revealing their identity.

Metamask is not the only application that allows users to conduct transactions without revealing their identities. Other applications that fall into this category include Bitcoin and Ethereum wallets, as well as Tor and VPN services.

However, Metamask is unique in that it allows users to use the same mask to access their funds from anywhere in the world. This makes it easier for users to stay anonymous, and avoid being tracked by the government or other third-party entities.

The Potential Impact of the IRS' Investigation on Metamask and its Owners

If the IRS finds that Metamask and its owners have violated any tax laws, they could face serious penalties. These penalties could include fines, prison time, and loss of assets.

In addition, Metamask and its owners could face difficulties in accessing financial resources and credit ratings. This could make it difficult for them to continue operating the business, or even start new projects.

The Investigation Is Still In Its Early Stages

Thus far, there has been no indication that Metamask or its owners have violated any tax laws. However, the investigation is still in its early stages, and it is possible that charges will be filed in the future. Given this uncertainty, it is important for anyone who may be affected by the investigation to consult with an attorney.

Metamask Under Investigation by the IRS

According to a report by The Verge, the IRS is currently investigating whether or not the so-called "metamask" Chrome extension is constituting a form of digital currency. If it is found that the extension is in fact functioning as a digital currency, it could result in the company behind it being subject to taxation and regulation.

The investigation was first revealed by the Financial Times, who reported that the IRS had sent letters to several companies asking for information about their dealings with metamask. While it is still unclear whether or not metamask is in fact functioning as a digital currency, if it is, it could result in the company behind it being subject to taxation and regulation.

The IRS is Looking Into Metamask for Potential Tax Fraud

The Internal Revenue Service is reportedly investigating the cryptocurrency metamask for potential tax fraud. The IRS has reportedly been in contact with the company behind metamask, Bitfinex, about their users’ activity on the platform.

The company behind metamask, Bitfinex, has reportedly been providing information to the IRS about its users’ transactions on the platform. The IRS is reportedly looking into whether the users have been using metamask to avoid paying taxes.

The IRS has not released any statement about its investigation into metamask. However, it is possible that the agency is looking into potential tax fraud on the part of the users of metamask. If the IRS finds that the users of metamask have been using the platform to avoid paying taxes, the agency may take action against them.

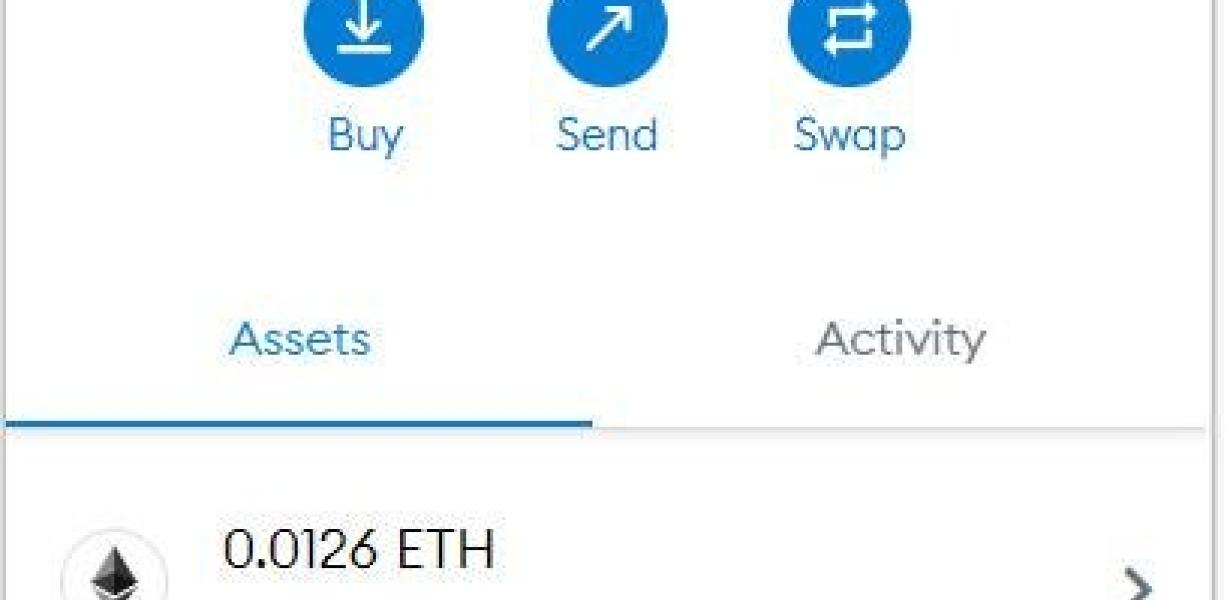

Metamask is a cryptocurrency platform that allows users to use the cryptocurrency Ethereum to buy and sell cryptocurrencies. The platform is popular among cryptocurrency traders because it offers a variety of features that other platforms do not, including the ability to trade cryptocurrencies without having to register with a new exchange.

If you are worried that you may have been involved in tax fraud through your use of metamask, you should contact a tax lawyer for advice. A tax lawyer can help you understand the complex tax laws governing cryptocurrency transactions and can provide you with advice about how to avoid getting caught up in an IRS investigation.

Metamask Could Be in Hot Water With the IRS

If you are using a metamask wallet to purchase cryptocurrencies, it may be in violation of federal tax law. The IRS has not yet clarified whether or not cryptocurrency transactions are considered taxable events, but the agency has stated that all forms of digital currency are considered property. As such, any form of income generated from cryptocurrency transactions may be subject to taxation.

If you are using a metamask wallet to purchase cryptocurrencies, it may be in violation of federal tax law.

The IRS has not yet clarified whether or not cryptocurrency transactions are considered taxable events, but the agency has stated that all forms of digital currency are considered property. As such, any form of income generated from cryptocurrency transactions may be subject to taxation.

If you are unsure whether or not your cryptocurrency transactions are subject to taxation, it is advisable to consult with a tax professional. In the meantime, be sure to keep accurate records of all transactions made with your metamask wallet in order to avoid any potential tax issues.

Is the IRS Investigating Metamask?

There is no public information available regarding the IRS’s investigation of Metamask.

What Does the IRS Investigation Into Metamask Mean?

The IRS investigation into Metamask means that the agency is looking into the platform’s tax compliance and whether it is complying with tax laws. If the IRS finds that Metamask is not complying with tax laws, the platform could be fined or face other penalties.

Why is the IRS Investigating Metamask?

The IRS has not publicly announced that it is investigating Metamask, but the agency has been increasingly active in its enforcement of cryptocurrency taxes. In February, the IRS announced that it was targeting cryptocurrency exchanges that did not properly report their income. The agency has also been aggressively pursuing taxpayers who have failed to report their cryptocurrency profits.

What Could Happen if the IRS Finds wrongdoing by Metamask?

If the IRS finds that Metamask has engaged in wrongdoing, they could take various actions, such as issuing a warning, fine, or seizing assets. Additionally, Metamask may face legal action from individuals who were wronged.

What to Know About the IRS Investigation Into Metamask

The IRS is investigating the cryptocurrency metamask. The investigation is focused on whether or not metamask is a form of financial aid.

If metamask is found to be a form of financial aid, the company may have to pay back taxes.

The investigation is still in its early stages.

How the IRS Investigation Into Metamask Could Impact You

If you're using Metamask, the IRS may be investigating your use of the cryptocurrency. Metamask is a platform that allows users to purchase and trade cryptocurrencies like Bitcoin and Ethereum.

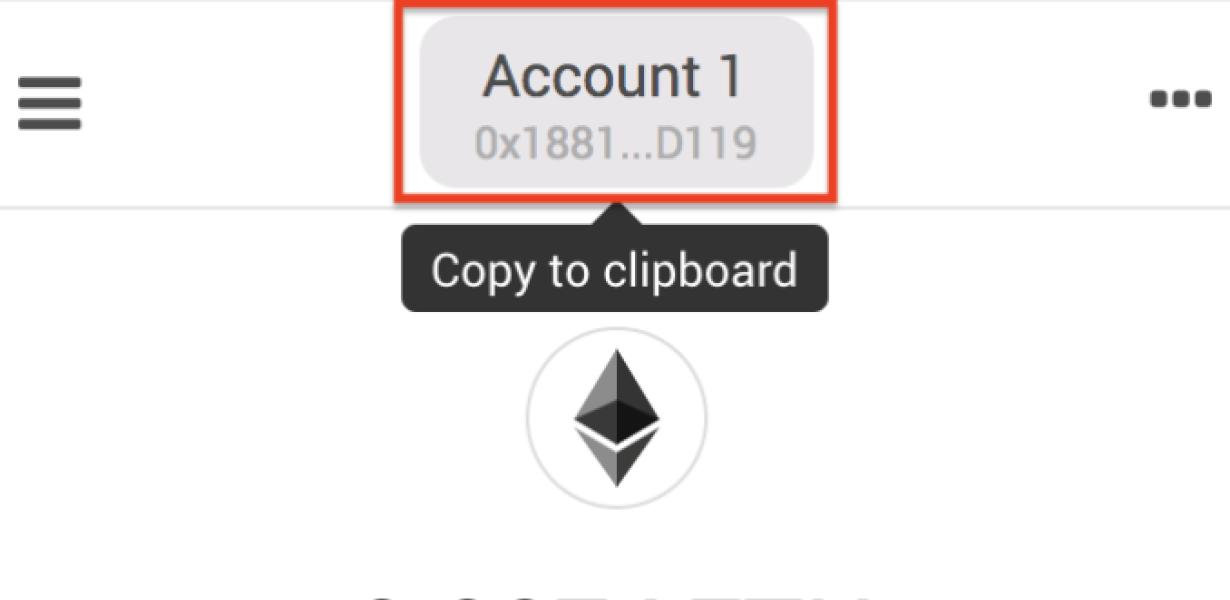

If the IRS is investigating your use of Metamask, they may ask for documentation related to your transactions. This could include copies of your purchase and sale transactions, your Metamask account information, and other information related to your use of Metamask.

If you're subject to an IRS investigation, you may need to respond to their requests, and you may need to provide documentation related to your cryptocurrency use. If you fail to respond or provide the requested information, you may be subject to penalties.

If you're using Metamask, it's important to keep track of any IRS investigations into your cryptocurrency use, and to comply with any requests for documentation.