Metamask Tax Calculator

The Metamask tax calculator is a tool that allows you to calculate the amount of taxes you owe on your cryptocurrency holdings. The calculator takes into account the current market value of your assets, as well as any taxes that have already been paid on them.

Metamask Tax Calculator: The Ultimate Guide

If you’re considering using a metamask tax calculator, read on for our top tips.

Metamask is a great tool for protecting your privacy and anonymity when participating in cryptocurrency exchanges and other online activities.

The biggest downside to metamask is that it is not available on all platforms, so you may not be able to use it if you don’t have a desktop or mobile device.

To use metamask, you first need to create a metamask account. This can be done by visiting metamask.io and clicking on the “Sign Up” button. Once you have created your account, you will need to download the metamask app. The app can be found on the App Store or Google Play Store.

Once you have downloaded the app and logged in, you will need to create a new account. To do this, click on the “Add Account” button in the upper left corner of the screen. This will bring up the following screen:

On this screen, you will need to enter your name, email address, and password. After you have entered the necessary information, click on the “Create New Account” button.

Now that you have created your metamask account, you will need to create a wallet. To do this, click on the “Wallets” tab in the upper left corner of the screen and then click on the “Create New Wallet” button.

On this screen, you will need to enter your metamask account name and password. After you have entered the necessary information, click on the “Create Wallet” button.

Now that you have created your metamask account and wallet, you are ready to start using the tool. To start using metamask, click on the “Sign In” button in the upper left corner of the screen. This will bring up the following screen:

On this screen, you will need to enter your metamask account name and password. After you have entered the necessary information, click on the “Sign In” button.

Once you have signed in to your metamask account, you will see the following screen:

On this screen, you will see all of the coins and tokens that you have access to. In order to add a new coin or token, click on the “Add Coin” or “Add Token” buttons.

After you have added a new coin or token, you will need to select it from the list. To do this, click on the “Select Coin” or “Select Token” button.

After you have selected a coin or token, you will need to enter the following information:

1) Name: This is the name of the coin or token.

2) Symbol: This is the symbol for the coin or token.

3) Decimals: This is the number of decimals for the coin or token.

4) Price: This is the price of the coin or token.

5) Volume: This is the volume of the coin or token over the past 24 hours.

6) Market Cap: This is the market cap of the coin or token.

7) Supply: This is the total supply of the coin or token.

8) Circulating Supply: This is the circulating supply of the coin or token.

9) Total Supply: This is the total supply of the coin or token.

After you have entered the necessary information, click on the “Submit” button.

Now that you have added a new coin or token, you will need to select it from the list. To do this, click on the “Select Coin” or “Select Token” button.

After you have selected a coin or token, you will need to enter the following information:

1) Name: This is the name of the coin or token.

2) Symbol: This is the symbol for the coin or token.

3) Decimals: This is the number of decimals for the coin or token.

4) Price: This is the price of the coin or token.

5) Volume: This is the volume of the coin or token over the past 24 hours.

6) Market Cap: This is the market cap of the coin or token.

7) Supply: This is the total supply of the coin or token.

8) Circulating Supply: This is the circulating supply of the coin or token.

9) Total Supply: This is the total supply of the coin or token.

How to Use the Metamask Tax Calculator

1. To use the Metamask tax calculator, first download and install the Metamask desktop app.

2. Open the Metamask app and create a new account.

3. Click on the triangle in the top left corner of the app and select “Tools”.

4. In the Tools menu, click on the “Tax Calculator” button.

5. On the Tax Calculator page, enter your personal information including your Ethereum address and the amount of cryptocurrency you own.

6. Click on the “Calculate” button to generate your tax bill.

The Metamask Tax Calculator: A Step-By-Step Guide

This Metamask Tax Calculator is designed to help you estimate the tax you will pay on your Ethereum holdings. This calculator takes into account all the relevant factors, such as your income and deductions.

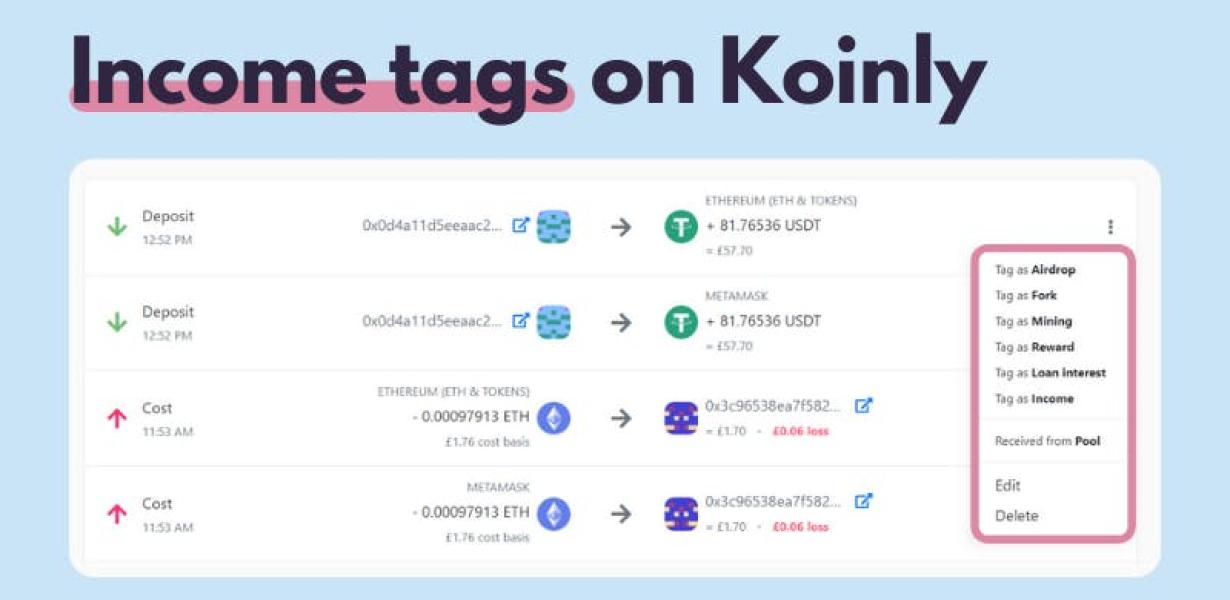

1. Enter your total income:

Income refers to all your sources of income, including salary, dividends, and other forms of income.

2. Enter your deductions:

You can deduct any amount you pay in taxes from your income. This includes federal, state, and local taxes, as well as any expenses you incur while filing your taxes.

3. Calculate your net income:

Your net income is the total amount of income minus any applicable taxes.

4. Calculate your tax liability:

Your tax liability is the total amount of taxes you owe, minus any applicable deductions.

5. Pay your taxes:

Once you have calculated your tax liability, you can pay it by submitting a payment plan or making a direct payment to the IRS.

Metamask Tax Calculator: The Basics

The Metamask Tax Calculator is a tool that can help you calculate the tax implications of using Metamask to purchase and sell cryptocurrencies.

When you use the Metamask Tax Calculator, you will be asked to input relevant information about your personal financial situation. This includes your annual income, taxable income, and filing status.

Once you have entered your information, the Metamask Tax Calculator will provide you with an estimate of your total tax liability for the year. This estimate will include both federal and state taxes.

If you have any questions about the Metamask Tax Calculator or about cryptocurrency taxation in general, please feel free to contact us. We are happy to help you understand your tax obligations related to cryptocurrency transactions.

Metamask Tax Calculator: FAQs

What is Metamask?

Metamask is a JavaScript-based extension that allows users to interact with Ethereum dapps and smart contracts. It provides a user interface for managing transactions, access to decentralized applications (DApps), and more.

How does Metamask work?

Metamask connects to the Ethereum network and automatically manages all of your transactions. You don’t need to worry about any of the details - Metamask takes care of everything for you.

What are the benefits of using Metamask?

There are many benefits to using Metamask. First, it makes interacting with Ethereum dapps and smart contracts easier. Second, it provides a user interface for managing transactions and accessing DApps. Finally, Metamask protects your identity by encrypting your data.

Can I use Metamask without an Ethereum wallet?

Yes, you can use Metamask without an Ethereum wallet. However, if you do not want to use an Ethereum wallet, you will need to create one first.

How much does it cost to use Metamask?

There is no cost to use Metamask.

Metamask Tax Calculator: Tips and Tricks

If you are new to Metamask, here is a quick guide to help you get started:

1. Download the Metamask app and create an account.

2. Click on the “Settings” button in the app.

3. Under “Accounts and Keys,” click on the “Add Account” button.

4. Enter the Metamask address (this is the address where your Metamask tokens will be stored) and click on the “Create Account” button.

5. Click on the “View Wallet Info” button to view your Metamask balance and transactions.

Metamask Tax Calculator: Pros and Cons

The biggest pro of using a metamask tax calculator is that it can help you to stay ahead of potential tax liabilities. By using a calculator, you can estimate your tax liability and make any necessary adjustments before filing your taxes.

However, using a metamask tax calculator can also be risky. If you underestimate your tax liability, you may end up owing more money in taxes than you expected. In addition, if you have significant income or assets outside of your taxable account, you may be required to pay additional taxes. Therefore, it is important to consult with a tax professional if you plan to use a metamask tax calculator.

The Pros and Cons of Using the Metamask Tax Calculator

Pros of using the Metamask Tax Calculator:

The calculator can help you determine your tax liability in a simple and straightforward manner.

The calculator can be used to calculate taxes for any country or jurisdiction.

The calculator is easy to use and can be accessed from any device.

Cons of using the Metamask Tax Calculator:

How the Metamask Tax Calculator Can Benefit You

The Metamask tax calculator can be of great help to individuals who are looking to understand the potential tax implications of their cryptocurrency holdings. By using this calculator, users can input their personal information and see how much tax they may owe on any gains or losses they may experience. Additionally, the calculator can provide insights into how various tax treatments might impact an individual's overall tax bill.

Should You Use the Metamask Tax Calculator?

The Metamask tax calculator is a helpful tool if you are unsure of how your taxes will be affected by upcoming changes to the Ethereum network. However, please note that the calculator is not a definitive source of information and should not be relied on as such.

What Are the Advantages and Disadvantages of the Metamask Tax Calculator?

The advantages of the Metamask tax calculator are that it is easy to use and is a fast way to calculate taxes. The disadvantages of the Metamask tax calculator are that it is not always accurate, and it does not provide information about other taxes that may be payable.

Is the Metamask Tax Calculator Right for You?

There is no one-size-fits-all answer to this question, as the Metamask Tax Calculator will vary depending on your personal financial situation. However, if you are unsure whether or not the calculator is right for you, we suggest reading through the following tips to help you decide:

If you primarily use Metamask to purchase cryptocurrencies, then the calculator may be right for you.

If you primarily use Metamask to make transactions outside of the cryptocurrency market, then the calculator may not be right for you.