Metamask is staking.

Metamask is a digital wallet that allows users to store, send, and receive cryptocurrency. It also allows users to buy and sell cryptocurrency. Metamask is staking allows users to earn interest on their cryptocurrency holdings.

MetaMask Staking: How to Get Started

1. Install the MetaMask extension.

2. Open the MetaMask extension and click on the “Staking” button.

3. On the “Staking” page, you will need to input the amount of ETH you want to stake.

4. Click on the “Submit” button to begin staking your ETH.

MetaMask Staking: The Benefits

and Drawbacks

One of the benefits of staking on a decentralized platform like MetaMask is that there are no real-world costs associated with staking. This means that anyone with a MetaMask account can stake their coins, regardless of their financial status.

However, one potential drawback of staking on a decentralized platform like MetaMask is that it can be difficult to track your holdings. Because stake rewards are generated based on the number of tokens that you hold, it can be difficult to determine exactly how many coins you own.

Another potential drawback of staking on a decentralized platform like MetaMask is that it can be difficult to predict which projects will be successful. Because stake rewards are generated based on the amount of staked coins, it’s possible that a project that is poorly designed will fail to generate any rewards.

MetaMask Staking: The Risks

and Rewards

One of the most important aspects of cryptocurrency investment is understanding the risks and rewards associated with each investment. Cryptocurrencies are highly speculative, which means that there is a high degree of risk involved. However, rewards can be substantial if a cryptocurrency is successful.

Cryptocurrencies are highly volatile, meaning that their value can change rapidly. This can be a major risk for investors, as prices can swing widely in response to minor events. It is important to understand the risks involved before investing in any cryptocurrency, as even a well-established coin can experience a significant price decline if the market becomes volatile.

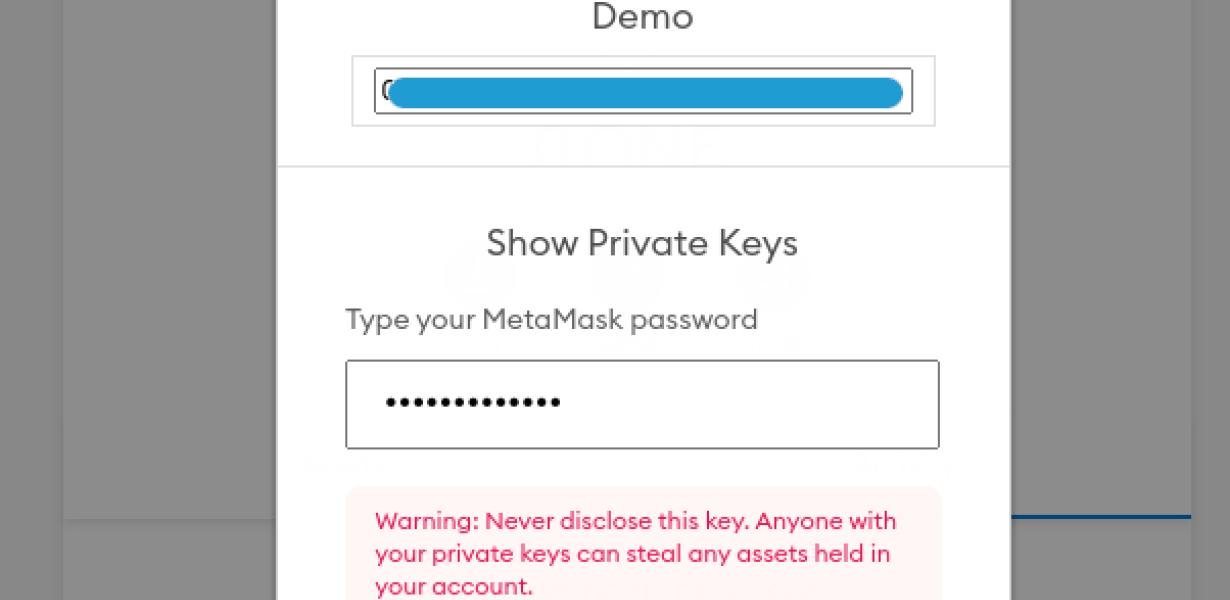

Another important risk is security. Cryptocurrencies are highly vulnerable to hacking, and even small losses can have a serious impact on an investment. It is essential to keep your cryptocurrency holdings safe, by using a secure wallet and keeping your passwords private.

However, there are also substantial rewards associated with cryptocurrencies. Cryptocurrencies are decentralized, meaning that there is no central authority that can control or manipulate the currency. This means that cryptocurrencies are immune to government interference and manipulation. As a result, cryptocurrencies are seen as a safe investment, as they are not subject to the same economic risks as traditional assets.

As with any investment, it is essential to do your own research before investing in cryptocurrencies. Cryptocurrency prices are highly volatile, and there is a high degree of risk involved. However, there are also substantial rewards associated with cryptocurrencies, which means that they could be an exciting investment for those who are prepared to take the risks.

MetaMask Staking: How to Maximize Your Returns

Maximizing your returns on Mask Staking can be done in a few different ways.

1. Choose the Right Mask

It is important to choose the right Mask for Staking. There are a number of different Mask types available, and each has its own benefits and drawbacks.

2. Maximize Your Return on Investment (ROI)

When staking Masks, it is important to maximize your return on investment (ROI). This means making sure that you are getting the most out of your Masks.

3. Hold Masks for Long-term Returns

It is important to hold Masks for long-term returns. This means reinvesting your rewards back into the Mask network to increase your returns.

MetaMask Staking: The Pros and Cons

When it comes to staking, there are pros and cons to both Monero and Ethereum.

Monero Pros:

-Low fees: Monero transactions are some of the lowest in the market, making it a good option for those looking to save on gas costs.

-Private transactions: Monero transactions are private by default, making it an ideal choice for those looking to keep their financial information private.

-Ease of use: Monero is easy to use, making it a good option for those who are new to cryptocurrency.

Ethereum Cons:

-High fees: Ethereum transactions can be expensive, making it a less popular option for those looking to save on gas costs.

-Long wait times: Ethereum can sometimes have long wait times, making it less ideal for those looking to quickly make a transaction.

MetaMask Staking: What You Need to Know

Cryptocurrency staking has been gaining a lot of attention in the past few years. And for good reason!

Staking is a way to earn rewards (in the form of cryptocurrency) for holding a cryptocurrency, rather than simply spending it.

There are a few different types of staking, and each has its own benefits and drawbacks. In this article, we’ll cover how cryptocurrency staking works, and what you need to know about the different types of staking.

What is Cryptocurrency Staking?

Cryptocurrency staking is a way to earn rewards (in the form of cryptocurrency) for holding a cryptocurrency, rather than simply spending it.

There are a few different types of staking, and each has its own benefits and drawbacks. In this article, we’ll cover how cryptocurrency staking works, and what you need to know about the different types of staking.

Types of Cryptocurrency Staking

There are three main types of cryptocurrency staking:

1) Proof of Work (POW) staking: This is the most common type of cryptocurrency staking. POW staking involves contributing computing power to help secure the network. As more people contribute their computing power, the network becomes more secure. In return for contributing their computing power, holders of POW-based cryptocurrencies earn rewards (in the form of cryptocurrency) every time their blockchain is validated.

2) Proof of Stake (PoS) staking: PoS staking is similar to POW staking, but it uses a different methodology. PoS stakers don’t need to contribute their computing power to the network. Instead, they hold tokens that act as “stakecoins”. These tokens give holders a chance to earn rewards (in the form of cryptocurrency) based on how much stake they hold. As long as they hold at least one stakecoin, they are eligible to earn rewards.

3) Hybrid PoW/PoS staking: This type of staking combines features of both POW and PoS staking. Holders of hybrid PoW/PoS coins earn rewards (in the form of cryptocurrency) both based on their stake and their PoS holdings. This makes hybrid PoW/PoS coins one of the most versatile types of cryptocurrency staking.

Benefits of Cryptocurrency Staking

There are a few benefits to cryptocurrency staking.

1) Earn Rewards: Cryptocurrency stakers earn rewards (in the form of cryptocurrency) every time their blockchain is validated. This gives holders of cryptocurrencies with staking capabilities an incentive to keep their coins healthy and secure.

2) Keep Your Coins Safe: By holding onto your coins, you help protect them from being stolen or destroyed. This is especially important if you plan on using your cryptocurrencies for day-to-day transactions.

3) Increased Security: By contributing your computing power to the network, you help make it more secure. This is especially important in times of high volatility.

Drawbacks of Cryptocurrency Staking

There are a few drawbacks to cryptocurrency staking.

1) Higher Volatility: Cryptocurrencies with staking capabilities are often more volatile than cryptocurrencies without staking capabilities. This is because holders of cryptocurrencies with staking capabilities are more likely to sell their coins in times of high volatility.

2) Higher Transaction Fees: Cryptocurrency stakers often pay higher transaction fees than holders of non-staking cryptocurrencies. This is because stakers are required to contribute their computing power to the network in order to earn rewards.

3) Higher Risk: By holding onto your coins, you increase your risk of losing them. This is especially important if you don’t have any experience trading cryptocurrencies or you don’t have enough money saved up to cover potential losses.

MetaMask Staking: A Beginner's Guide

What is a blockchain?

A blockchain is a digital ledger of all cryptocurrency transactions. It is constantly growing as “completed” blocks are added to it with a new set of recordings. Each node in the network shares this complete copy of the blockchain. There are a number of reasons why developers are exploring blockchain technology, but one of the most important is that it allows for secure, transparent and tamper-proof transactions.

MetaMask Staking: The Basics

Setting up a staking wallet on the Ethereum network is simple. First, create an Ethereum wallet using MyEtherWallet or another online Ethereum wallet.

Once your wallet is created, you will need to add a new address to it. Add a new address by going to MyEtherWallet, clicking on the “Add New Address” button and entering the following information:

Address: 0x9090f2b1aabf03dffc1b965b7cfbdddcdc

Gas Limit: 2000000

Once you have added the address and set the gas limit, you are ready to stake your ERC-20 tokens!

To stake your tokens, you will first need to open a Mist wallet and connect to the Ethereum network. Once connected, open the Mist wallet and click on the “Tokens” tab. In the “Token Balances” section, find the token you want to stake and click on the “Stake” button.

On the “Stake Transaction” dialog, you will need to provide the following information:

Token Address: The address of the ERC-20 token you are staking

Bidasker Contract Address: The address of the contract you are staking with (usually this is 0x0)

Token Symbol: The symbol of the ERC-20 token you are staking

Amount of Ether to Send: The amount of Ether you want to send to the bidasker contract

Once you have entered all of the information, click on the “Generate Transaction” button. Mist will then generate a transaction containing your staked tokens and send it to the bidasker contract.

MetaMask Staking: An Introduction

In this article, we will introduce you to the concept of staking and how it works with the Ethereum blockchain. We will also explain what EthereumMask is and how it can be used to earn rewards while using the Ethereum blockchain.

What is EthereumMask?

EthereumMask is a browser extension that allows users to earn rewards while using the Ethereum blockchain.

How does EthereumMask work?

When you install EthereumMask, it adds a new tab to your browser window that connects to the Ethereum network. Whenever you make a transaction on the Ethereum network, the EthereumMask app will automatically claim a reward in ETH (the native currency of the Ethereum blockchain) from the Ethereum Foundation.

What are the benefits of using EthereumMask?

There are many benefits to using EthereumMask. First, it allows you to earn rewards for using the Ethereum blockchain. Second, it is a convenient way to stay up-to-date with the latest Ethereum news and developments. And lastly, it is a safe and easy way to use the Ethereum blockchain.

How can I install EthereumMask?

EthereumMask can be installed from the Chrome web store or from the official website.

MetaMask Staking: FAQs

This document contains answers to frequently asked questions about staking with the MetaMask wallet.

Can I stake using the MetaMask wallet?

Yes, you can stake using the MetaMask wallet. To do so, open the MetaMask wallet and go to the "Staking" tab. You will then need to set up a staking address and specify the amount of MMB you want to stake. After setting up your staking address, you can start staking by clicking the "Start Staking" button.

How do I set up a staking address?

To set up a staking address, open the MetaMask wallet and go to the "Staking" tab. Under "Staking Address," you will need to provide your Ethereum address and specify the amount of MMB you want to stake.

How much MMB can I stake per day?

You can stake up to 100 MMB per day.