Is sending crypto to another wallet taxable?

Sending cryptocurrency to another wallet may be taxable, depending on the circumstances. If you are sending cryptocurrency as a gift, it is generally not taxable. However, if you are selling cryptocurrency, you may be subject to capital gains taxes.

The IRS Weighs In On Crypto Taxes: What You Need To Know

The IRS has released guidance on how to report cryptocurrency transactions and gains. The guidance covers both individuals and businesses.

Individuals

If you are an individual and you have a gain or loss from cryptocurrency transactions, you need to report it on your tax return. You will need to include the fair market value of the cryptocurrency at the time of the transaction, as well as the cost basis of the cryptocurrency.

Businesses

If you are a business, you will need to report any cryptocurrency transactions that generate a gain or loss. You will need to include the fair market value of the cryptocurrency at the time of the transaction, as well as the cost basis of the cryptocurrency.

Crypto Taxes: What You Need To Know

Crypto taxes are a hot topic right now. Tax laws governing digital assets are still in the development stage, and the tax implications of crypto transactions are still being sorted out. Here are some key things to know about crypto taxes:

1. Cryptoassets are treated as property for tax purposes.

2. Cryptoassets are subject to capital gains and income taxes.

3. Taxpayers may be able to deduct expenses related to buying, trading, and holding cryptoassets.

4. Tax authorities may require taxpayers to report their crypto holdings and transactions.

5. Tax laws surrounding cryptoassets are still evolving, so taxpayers should consult with a tax advisor to ensure they are fully aware of their specific tax obligations.

How To File Crypto Taxes: A Step-By-Step Guide

If you are a cryptocurrency investor, you may be wondering how to file taxes on your profits. This article provides a step-by-step guide on how to file crypto taxes.

1. Decide if You Are a “Profit” Investor

The first step is to decide if you are a “profit” investor. If you made a profit from your cryptocurrency investments, you will need to report that income on your tax return.

There is no specific definition of a “profit,” but generally speaking, you are considered to have made a profit if your total gains from your cryptocurrency investments exceed your total losses. If you had any negative net worth (assets minus liabilities) from your cryptocurrency investments, you will not be considered to have made a profit.

2. Report Your Gains and Losses

Once you have determined whether you are a “profit” investor, you need to report your gains and losses on your tax return.

Your gains include any increases in the value of your cryptocurrency investments above the amount you initially invested. Your losses include any decreases in the value of your cryptocurrency investments below the amount you initially invested.

3. Report Your Gains and Losses in Gross Income

Next, you will need to report your gross income from your cryptocurrency investments on your tax return. This includes any gains from your cryptocurrency investments as well as any income earned from other sources (such as wages, tips, and rental income).

4. Report Your Gains and Losses in Net Income

Finally, you will need to report your net income from your cryptocurrency investments on your tax return. This includes all of your gross income minus any losses from your cryptocurrency investments.

5. Pay Tax on Your Gains and Losses

Once you have reported your gains and losses on your tax return, you will need to pay tax on them. This includes paying taxes on your gross income as well as any losses that were deductible on your tax return.

Who Pays Taxes On Crypto? Everything You Need To Know

If you are wondering who pays taxes on crypto profits, then you have come to the right place. In this article, we will outline the different tax treatments of crypto and reveal who pays taxes on crypto profits.

Cryptocurrencies are not considered legal tender in most countries, which means that they do not fall under the jurisdiction of the country's taxation system. This means that crypto profits are not subject to taxation by the country in which the profits were made. However, many countries have started to impose their own taxation rules on crypto profits, which means that taxpayers may have to pay tax on their crypto profits even if they are not resident in a country that taxes cryptocurrencies.

There are a few key factors to consider when determining whether or not you will have to pay tax on your crypto profits. These factors include whether you are a resident of a country that taxes cryptocurrency profits, whether you have made any crypto profits in that country, and whether you have converted your crypto profits into fiat currency.

If you are a resident of a country that taxes cryptocurrency profits, then you will most likely have to pay tax on your crypto profits. This means that even if you are not a resident of a country that taxes cryptocurrency profits, you may still have to pay tax on your crypto profits if you have converted them into fiat currency.

If you have made any crypto profits in a country that taxes cryptocurrency profits, then you will most likely have to pay tax on those profits. This means that even if you are not a resident of a country that taxes cryptocurrency profits, you may still have to pay tax on your crypto profits if you have converted them into fiat currency.

Finally, if you have converted your crypto profits into fiat currency, then you will most likely have to pay tax on those profits. This means that even if you are not a resident of a country that taxes cryptocurrency profits, you may still have to pay tax on your crypto profits if you have converted them into fiat currency.

What Are The Tax implications Of Sending Crypto To Another Wallet?

When sending crypto to another wallet, you are technically transferring the crypto to a new address. This means that you will need to pay taxes on the value of the crypto that you are transferring. The way in which you pay taxes depends on the country that you reside in.

In most cases, you will need to report the value of the crypto that you transferred to your tax authority. This will involve filing a tax return and documenting the value of the crypto that you transferred. You will also need to pay taxes on the value of the crypto that you transferred.

There are a few exceptions to this rule. For example, if you are a foreign national and you are moving cryptoassets out of a country that has an embargo on cryptocurrency, then you will not need to report the value of the crypto that you transferred.

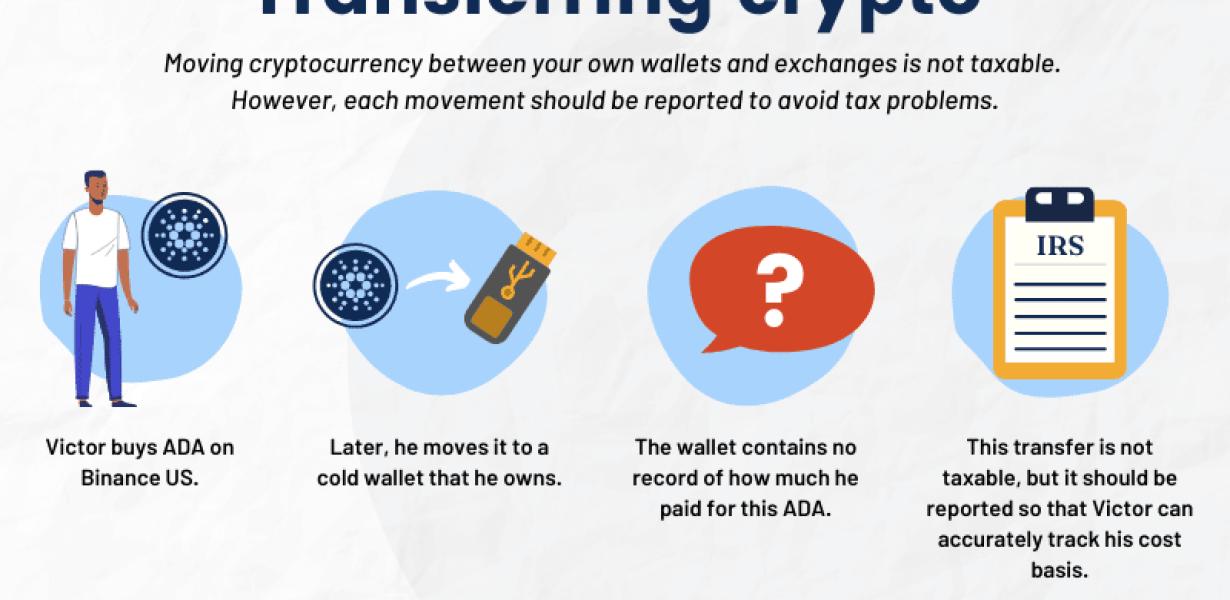

Do I Have To Pay Taxes On Crypto I Send To Another Wallet?

No, you don't have to pay taxes on cryptocurrency you send to another wallet. However, you may have to pay taxes on any gains you make when you sell the cryptocurrency.

How Will Sending Crypto To Another Wallet Affect My Taxes?

There is no definitive answer, as the tax treatment of cryptocurrencies will depend on a number of factors including the country in which you reside, the specific cryptocurrency you are sending, and the specific wallet in which the crypto is sent. However, generally speaking, if you send crypto to a wallet outside of your own personal possession, it will likely be treated as a taxable event. Depending on the country in which you reside, this could result in a significant tax liability.

What Are The Tax Consequences Of Sending Crypto To Another Wallet?

The tax consequences of sending crypto to another wallet depend on the type of crypto you're sending and the country you're sending it to.

For example, if you're sending Bitcoin, Ethereum, or Bitcoin Cash to a wallet in a different country, the tax consequences will depend on the country you're sending it to. For example, in some countries, such as Japan, Bitcoin, Ethereum, and Bitcoin Cash are considered as capital assets, which means that they are subject to capital gains tax. In other countries, such as the United States, Bitcoin and Ethereum are considered as property, which means that they are not subject to capital gains tax.

If you're sending crypto to a wallet in your own country, the tax consequences will depend on the type of crypto you're sending and the country you're sending it to. For example, in some countries, such as the United States, Ethereum is considered as property, which means that it is not subject to capital gains tax. In other countries, such as Japan, Ethereum is considered as capital assets, which means that it is subject to capital gains tax.

What Happens To My Taxes When I Send Crypto To Another Wallet?

When you send crypto to another wallet, the crypto is not actually sent to the other wallet. Instead, it is moved from your original wallet to the new wallet. This means that you still have ownership of the crypto and can use it as you please.

How Does Sending Crypto To Another Wallet Affect My Taxes?

There is no definitive answer to this question as it depends on the individual's taxes and tax laws. However, generally speaking, sending crypto to another wallet or digital account will likely be considered a taxable event. Depending on the tax laws in place, this may result in a gain or loss of value that must be reported on the individual's tax return.