Is Coinbase FDIC insured?

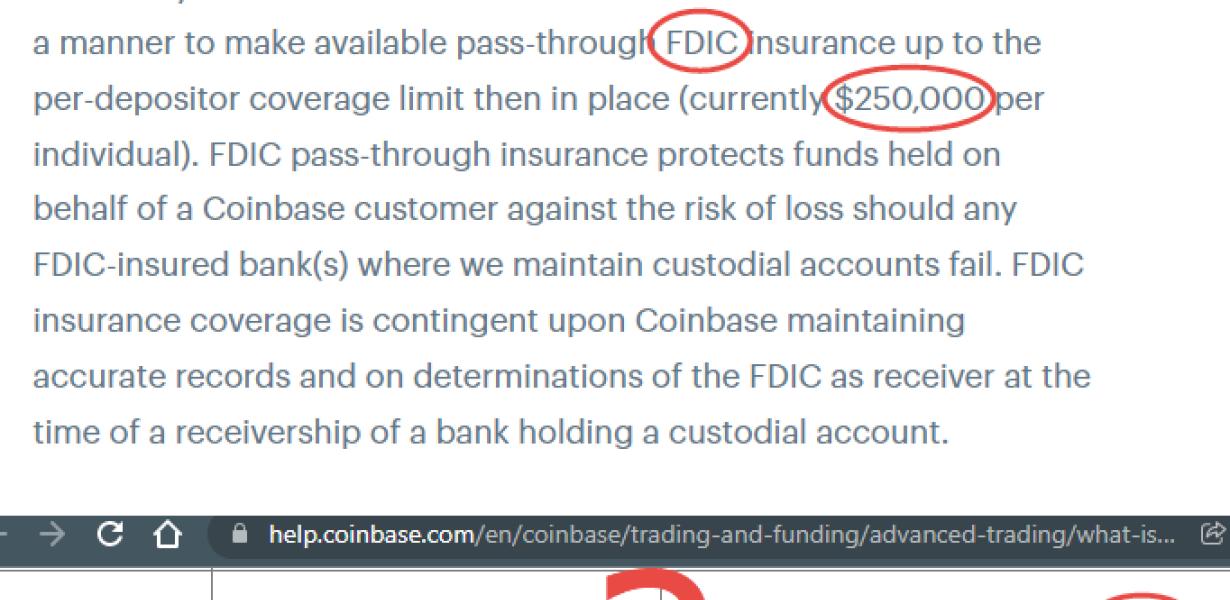

Coinbase is a digital asset exchange company headquartered in San Francisco, California. They are a regulated and licensed US financial institution, meaning they are held to high standards of consumer protection. One benefit of this is that Coinbase accounts are FDIC insured up to $250,000.

Is Coinbase FDIC Insured? – Here's What You Need to Know

Coinbase is not FDIC insured, meaning that if something goes wrong with your account, Coinbase will not be able to help you out.

Coinbase FDIC Insurance: What You Need to Know

Coinbase has insurance in place through the FDIC. This means that in the event of a financial crisis, Coinbase will be able to provide assistance to its customers.

In order to qualify for FDIC insurance, Coinbase must meet certain requirements. These requirements include being a national banking association, having a deposit insurance policy from the Federal Deposit Insurance Corporation, and being in good financial standing.

In the event of a financial crisis, Coinbase will provide its customers with access to their accounts and funds. Coinbase will also work to help customers mitigate their losses.

What Does Coinbase's FDIC Insurance Mean for You?

Coinbase has FDIC insurance, meaning that in the event of a financial collapse, Coinbase would be able to repay depositors up to $250,000 per account.

FDIC Insurance and Coinbase: What You Should Know

Both FDIC insurance and Coinbase are important tools for cryptocurrency investors.

FDIC Insurance

FDIC insurance is a government-backed program that helps protect consumers’ deposits in banks. Coinbase is one of the few companies that offer FDIC insurance, which gives customers peace of mind when investing in cryptocurrencies.

Coinbase also offers a variety of other financial products, such as a brokerage account and a lending service. These products make Coinbase a one-stop shop for cryptocurrency investors.

Coinbase is one of the most popular platforms for buying and selling cryptocurrencies. It offers a user-friendly platform and provides 24/7 customer support. Coinbase also offers a variety of financial products, such as a brokerage account and a lending service. These products make Coinbase a one-stop shop for cryptocurrency investors.

Is Your Coinbase Balance Protected by FDIC Insurance?

Yes, Coinbase's FDIC insurance protects your balance up to $250,000.

What You Need to Know About Coinbase and FDIC Insurance

Coinbase is one of the most popular digital wallets for cryptocurrencies. It allows its users to buy, sell, and store digital assets such as Bitcoin, Ethereum, and Litecoin. Coinbase also offers a digital wallet for fiat currencies, such as US dollars and euros.

In order to use Coinbase, you need to provide your name, email address, and a password. You can also create a new account if you do not have an existing one.

Coinbase is not a bank and does not offer banking services. As such, Coinbase does not have FDIC insurance. This means that if Coinbase were to go bankrupt, its customers would not be protected by the Federal Deposit Insurance Corporation (FDIC).