How to put money into a trust wallet?

If you're looking to put money into a trust wallet, there are a few things you'll need to do. First, you'll need to find a reputable trust wallet provider. Once you've found a provider, you'll need to create an account and deposit money into the account. After that, you'll be able to use the money in the trust wallet to make purchases or send money to others.

How to Put Money Into a Trust Wallet

To put money into a trust wallet, you will need to open a trust account with a financial institution. Once you have opened the account, you will need to transfer money into the account. You can do this by either depositing cash or transferring funds from another account.

The Benefits of Putting Money Into a Trust Wallet

There are many benefits to putting money into a trust wallet. Some of the benefits include:

1. Tax advantages. When you put money into a trust wallet, you can enjoy tax advantages. For example, if you are in the 25% tax bracket, you will have to pay taxes on the money that you put into the trust wallet at the 25% rate. However, if the money is invested in an account that is held in a trustee wallet, you will not have to pay taxes on the money. This can save you a significant amount of money in taxes.

2. Increased security. When you put money into a trust wallet, you are increasing your security. The money is not accessible to you or to anyone else who might want to access it. This increased security can give you peace of mind.

3. Increased liquidity. When you put money into a trust wallet, you are increasing the liquidity of the money. This means that the money will be available to use immediately. This can be helpful if you need the money urgently and do not have time to wait for the money to be transferred from your bank account.

4. Reduced risk. When you put money into a trust wallet, you are reducing the risk of losing the money. This is because the money is not accessible to you or to anyone else who might want to access it.

The Process of Putting Money Into a Trust Wallet

The process of putting money into a trust wallet is relatively simple. First, you will need to create a trust account. This can be done by contacting your bank or trust company and asking for assistance in setting up a trust account. Once you have created your trust account, you will need to deposit money into the account. This can be done by transferring money from your bank or other financial institution into the trust account. Once the money is in the trust account, you will need to create a trustee arrangement. This can be done by contacting a lawyer or trust advisor and asking them to help you create a trustee arrangement. The trustee arrangement will outline who will be responsible for managing the money in the trust account and how the money will be used.

Why You Should Put Money Into a Trust Wallet

There are a few reasons why you might want to put money into a trust wallet. One reason is that a trust wallet can help you keep track of your assets and protect them from being spent without your permission. Another reason is that a trust wallet can help you avoid probate and other legal costs associated with transferring assets to another person.

How to Get the Most Out of Your Trust Wallet

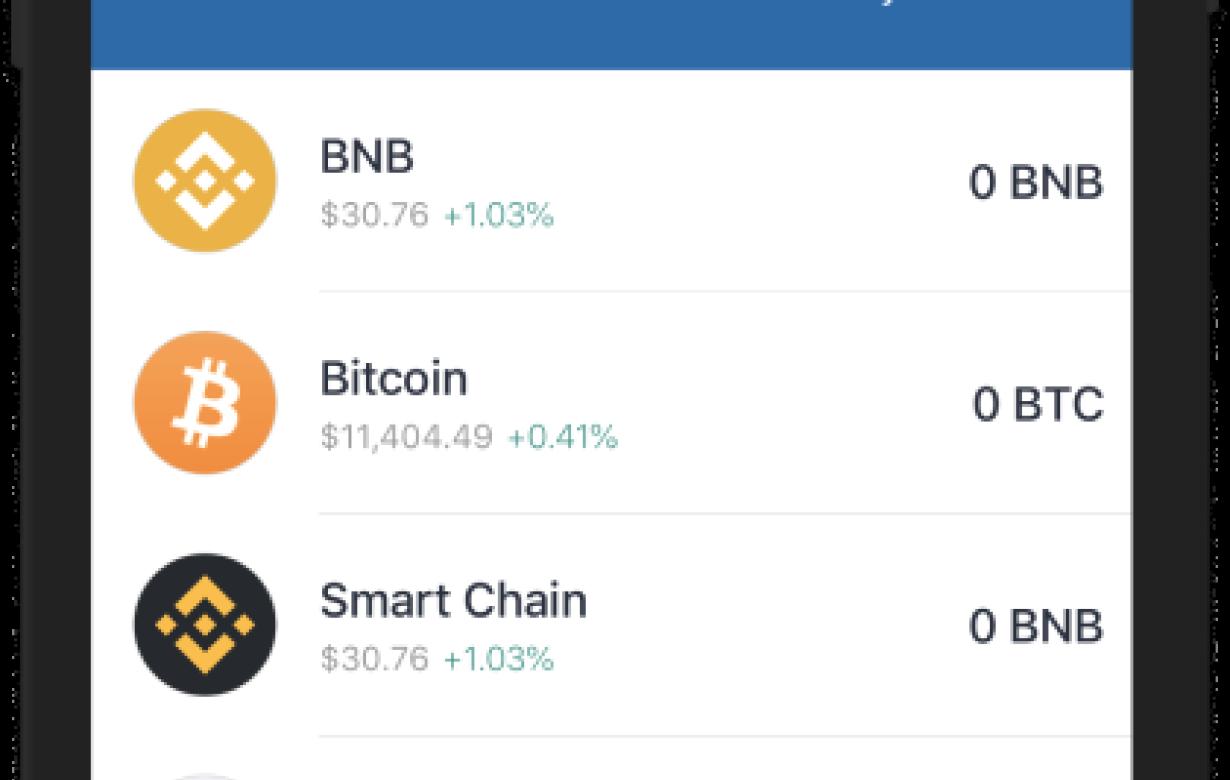

There are a few ways to get the most out of your Trust Wallet. First, make sure you have a Trust Wallet account and create a secure password. Second, use your Trust Wallet account to store your bitcoin, ether, and other digital assets. Finally, use your Trust Wallet account to buy and sell cryptocurrencies and other digital assets.

Making the Most of Your Trust Wallet

Your trust wallet is a unique tool that can help you save and manage your money in a more efficient way. Here are a few tips to help you make the most of your trust wallet:

1. Use Your Trust Wallet to Store Your Money Apart from Credit Cards and Other Financial Accounts

Your trust wallet is designed to help you save and manage your money in a more efficient way. One way to use your trust wallet is to store your money apart from other financial accounts. This can help you keep track of your finances and avoid potential financial pitfalls.

2. Use Your Trust Wallet to Make Purchases using Cash or Debit Cards

Another way to make use of your trust wallet is to use it to make purchases using cash or debit cards. This can help you avoid fees associated with using other financial accounts. Additionally, it can help you keep track of your spending and avoid unnecessary debt.

3. Use Your Trust Wallet to Manage Your Money for Long-Term Goals

One final tip is to use your trust wallet to manage your money for long-term goals. This can help you save money and achieve your financial goals faster. By using your trust wallet, you can avoid unnecessary fees and headaches.

Tips for Putting Money Into a Trust Wallet

There are a few things to keep in mind when putting money into a trust wallet. First, make sure to choose a trust that is reputable and has a good track record. Second, be sure to invest the money in a low-risk asset such as stocks or bonds. Finally, make sure to regularly review the trust's financial statements to make sure that the money is being invested wisely.

Tricks for Putting Money Into a Trust Wallet

There are a few tricks you can use to help you put money into a trust wallet more easily.

First, consider investing in a trust-automated investment services (TAIS) account. These accounts allow you to easily invest your money in a variety of trust-managed funds, which are typically very conservative and stable investments.

Second, make sure you have a good understanding of the trust's investment policies and goals. This will help you better understand which funds to choose and how much money to put into each one.

Finally, make sure you regularly review your trust's financial statements and make any necessary changes to your investment mix as needed. This will help ensure that your money is being invested wisely and that the trust is financially stable.

Secrets for Putting Money Into a Trust Wallet

There are a few tips that can be helpful when it comes to putting money into a trust wallet. First, make sure that the trust is registered with the IRS. This will help to ensure that all tax liabilities are taken care of. Second, use a trust accountant. This will help to ensure that the money is properly invested and managed. Finally, make sure to keep track of all investment activity and changes so that taxes and estate planning matters can be handled efficiently.