Does Metamask send 1099?

The answer is no. Metamask does not send 1099 forms.

Does Metamask Send 1099?

Metamask does not send 1099s.

How to File Taxes with Metamask

To file taxes with Metamask, open the Metamask app and click on the three lines in the top left corner. Then, click on "Settings."

Next, click on "Add Account."

On the next screen, enter your Metamask address and password. Then, click on "Create Account."

Next, click on "Taxes."

On the next screen, you will need to select the country in which you reside. Next, you will need to select the type of tax you are filing. Finally, you will need to select the year in which you would like to file your taxes.

Once you have completed all of the necessary selections, click on "File Taxes." You will then be prompted to provide yourMetamask address and password. After you have provided these details, Metamask will begin to process your taxes.

Metamask and Taxes - What You Need to Know

What is a Metamask?

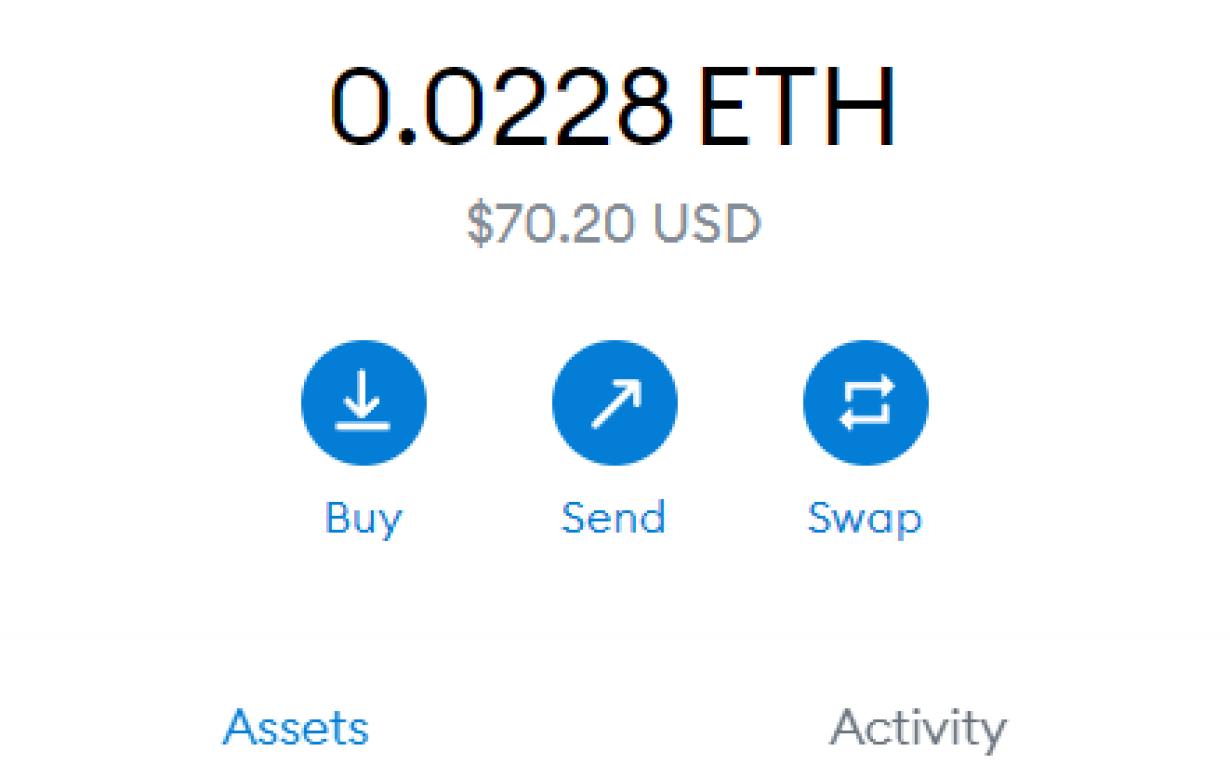

Metamask is a blockchain-based software that allows users to interact with the Ethereum network. It provides a user interface for managing Ethereum accounts, sending and receiving transactions, and accessing smart contracts.

How Does Metamask Work?

When you install Metamask on your computer, it generates a new Ethereum address for you. You can then use this address to make transactions on the Ethereum network.

When you make a transaction, Metamask first checks to see if the transaction is valid. If it is, Metamask will then send the Ether (the cryptocurrency used on the Ethereum network) to the recipient's Ethereum address.

What Are the Taxes Associated with Metamask?

There are no specific taxes associated with using Metamask. However, you should be aware of any potential tax implications when using cryptocurrency, including when using Metamask. You should consult with your tax professional to determine whether any taxes may apply when using Metamask.

1099 Forms and Metamask - What's the Connection?

Forms and Metamask are two different tools that work together to help you manage your cryptocurrency. Forms lets you create and manage your own forms, while Metamask helps you sign and send transactions on the Ethereum blockchain.

Do I Need to Send a 1099 Form If I Use Metamask?

If you are a U.S. taxpayer and you use Metamask to purchase digital assets, you will need to send a 1099-MISC form to the IRS.

What is a 1099 Form and Do I Need to Send One for Metamask?

A 1099 form is a tax form that is used to report income to the IRS. You do not need to send a 1099 form for Metamask.

How to Avoid Issues When Filing Taxes with Metamask

When filing taxes with Metamask, it is important to be aware of the following:

Make sure to use a METAMASK ACCOUNT to file taxes

Do not use a personal account to file taxes

Do not share your METAMASK ACCOUNT with anyone

Make sure to keep your METAMASK ACCOUNT secure

If you have any questions about filing taxes with Metamask, please contact our support team.

Get Your Taxes in Order Before Using Metamask

If you use Metamask, it’s important to get your taxes in order before using it. The tax implications of using Metamask are complex, and it’s important to consult with a tax professional if you have any questions.

Here are some things to keep in mind when using Metamask:

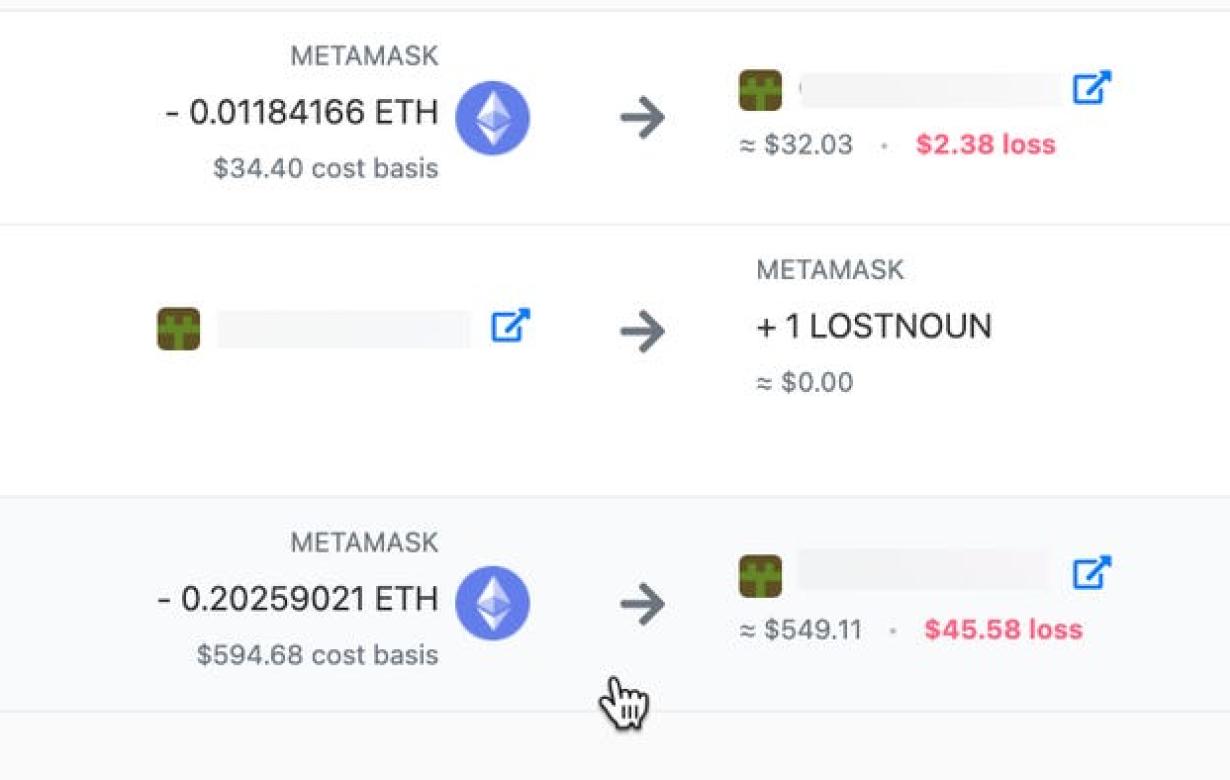

You may have to pay taxes on the value of the cryptocurrency you hold in Metamask.

Metamask doesn’t actually hold the cryptocurrency – it merely stores the private keys that allow you to access the cryptocurrency. This means that you could lose all of your cryptocurrency if your computer is stolen or destroyed.

You may have to pay capital gains taxes on the value of the cryptocurrency you hold in Metamask.

Depending on the country you live in, you may also have to pay income taxes on the cryptocurrency you hold in Metamask. Consult a tax professional for more information.