Does Coinbase Wallet report to the IRS?

If you are using Coinbase Wallet to store your cryptocurrency, you may be wondering if it reports to the IRS. The answer is no, Coinbase Wallet does not report to the IRS. However, if you are using Coinbase Wallet to trade or exchange cryptocurrency, those transactions may be subject to taxation.

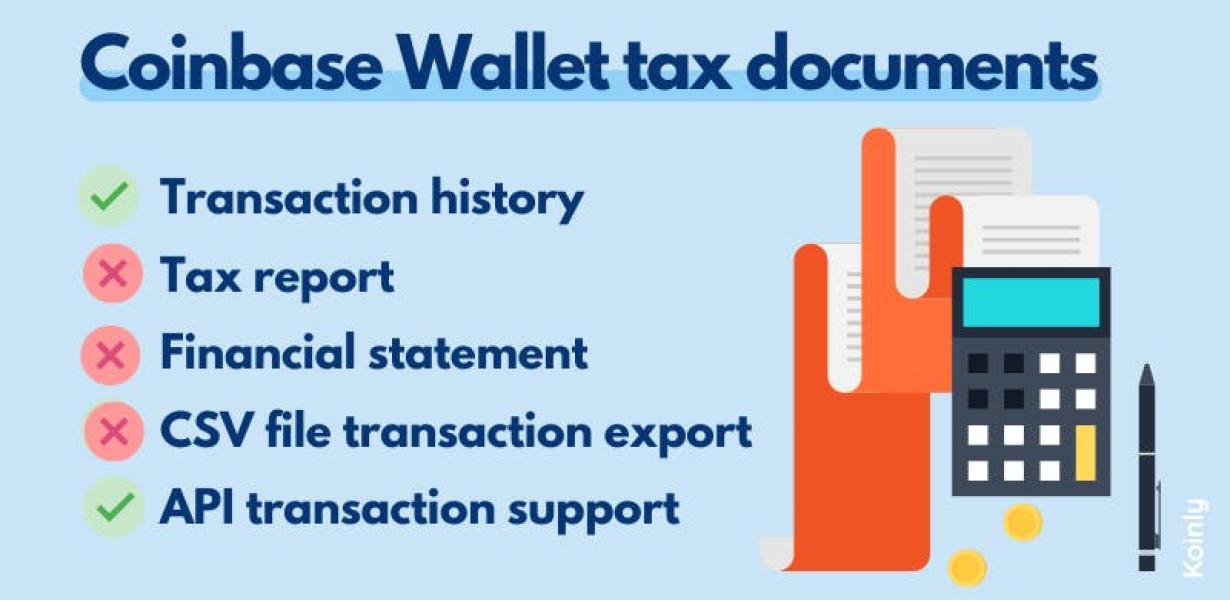

Coinbase Wallet and IRS Reporting: What You Need to Know

If you own or use a Coinbase wallet, you'll need to report any taxable income generated from trading or using the Coinbase platform. Here are the specifics:

Income from Coinbase trading: You'll need to report any taxable income generated from trading on the Coinbase platform. This includes both profits and losses.

Income from Coinbase transactions: You'll also need to report any taxable income generated from transactions conducted on the Coinbase platform. This includes both sales and purchases.

Income from Coinbase wallets: You'll also need to report any taxable income generated from transactions conducted in your Coinbase wallet. This includes both transactions conducted and assets held in your wallet.

How Does Coinbase Wallet Reporting Work?

Coinbase Wallet reporting is a system that allows Coinbase to monitor and analyze user activity. This helps the company improve its product and make informed decisions about how to serve its users.

When you create a new account on Coinbase, the company will ask you to provide your name, email address, and a password. Coinbase will also request that you provide a phone number. You can choose to remain anonymous, but this may limit your access to some features of the platform.

Once you have registered with Coinbase, the company will send you a confirmation email. This email will include a link that you can use to activate your account. Once your account is activated, you will be able to sign in and start using the platform.

Coinbase will periodically send you automated messages to notify you of changes or updates to the platform. These messages will include important information about the product, such as new features or updates. You can choose to opt out of these messages at any time.

What Does Coinbase Wallet Reporting to the IRS Mean for You?

If you are a Coinbase user and have Coinbase Wallet, then the IRS may be interested in your activity. Coinbase Wallet is a digital asset wallet that allows users to store, buy, and sell bitcoin, bitcoin cash, ethereum, and other cryptocurrencies.

When you open a Coinbase Wallet account, the IRS may require you to provide information about your transactions, including the amount of money you spent and the date of the transaction. If you make a purchase or sale of cryptocurrency through Coinbase Wallet, the IRS may also want to know the price of the cryptocurrency at the time of the transaction.

If you have Coinbase Wallet and make a cryptocurrency purchase or sale, it's important to keep track of all the information related to your transaction, including the date, amount, and price of the cryptocurrency. If you ever have questions about your Coinbase Wallet reporting to the IRS, please contact our team.

Coinbase Wallet and Your Taxes: What You Need to Know

If you use a bitcoin wallet like Coinbase, you will need to pay taxes on your bitcoin holdings. Here’s what you need to know.

First, let’s clarify what is considered taxable income for bitcoin holders. Generally speaking, any income generated from the sale of bitcoin or other digital assets is taxable. This includes any capital gains or losses that you may experience.

Now that we’ve covered what bitcoin is and what it is taxable for, it’s time to talk about how you should report your bitcoin holdings on your tax return. Generally speaking, you will need to report your bitcoin holdings on your Form 1099-MISC. You will also need to include the value of your bitcoin holdings in your overall taxable income.

Remember, if you are using a bitcoin wallet like Coinbase, you will need to pay taxes on your bitcoin holdings. However, by following these steps, you should be able to accurately report your bitcoin holdings on your tax return and pay the appropriate taxes.

How to Handle Coinbase Wallet Reporting to the IRS

If you have Coinbase Wallet or GDAX account and you have reported income from cryptocurrency trading to the IRS, there are specific steps you need to take.

First, make sure that you have filed your 2017 tax return. If you have not yet filed your return, you will need to do so before you can follow the Coinbase Wallet or GDAX account reporting instructions below.

Once you have filed your return, you will need to contact the IRS to begin the process of filing your cryptocurrency trading income. You will need to provide the IRS with your Coinbase Wallet or GDAX account login information, as well as your tax return information.

The IRS will then need to review your cryptocurrency trading income and determine whether it is taxable. If it is taxable, the IRS will then need to assess a tax liability against you.

Once the IRS has determined the tax liability, it will send you a bill. You will then need to pay the tax liability with either a check or money order.

If you have any questions about cryptocurrency trading and tax reporting, please contact the IRS.

What to Do If Coinbase Wallet Reports to the IRS

If Coinbase reports to the IRS that you have failed to report your cryptocurrency income, there are a few things you can do in order to rectify the situation. First, you will need to contact Coinbase and explain the situation. Coinbase may be able to provide you with a form 8892, which you can use to report your cryptocurrency income. Additionally, you may be able to get a waiver from the IRS if you can prove that you were not aware of the requirement to report your income.