Do I have to report Metamask on taxes?

If you use Metamask to manage your cryptocurrency investments, you may be wondering if you need to report it on your taxes. The answer is maybe. It depends on how you use Metamask and what type of cryptocurrency you are holding in it. If you are using Metamask solely for personal use, then you likely do not need to report it on your taxes. However, if you are using Metamask to trade cryptocurrency or to manage investments for a business, then you will need to report it on your taxes.

do i have to report metamask on taxes?

There is no need to report Metamask on taxes.

Metamask and Taxes: What You Need to Know

When you use a metamask to purchase cryptocurrency, you may be subject to taxes. Here is what you need to know about how taxes may apply to cryptocurrency transactions.

Before You Buy

First, you should understand that cryptocurrency is treated as property for tax purposes. This means that you are considered to own the cryptocurrency, and you are responsible for paying taxes on it.

When You Buy Cryptocurrency

Second, when you buy cryptocurrency, the IRS may consider the purchase to be a sale. This means that you will have to pay taxes on the cryptocurrency sale, even if you never use it or sell it.

When You Use Cryptocurrency

Finally, if you use cryptocurrency to purchase goods or services, the IRS may consider the transaction to be a taxable event. In this case, you will have to pay taxes on the value of the cryptocurrency, as well as any income that you earn from the transaction.

How to Report Metamask on Your Taxes

If you have metamask, you should report it on your taxes. To do this, you will need to find the IRS form 8886, which is used to report digital assets. You will need to fill out this form and provide the following information:

Your metamask address

The amount of metamask you own

The currency you used to purchase metamask

Once you have filled out this form, you will need to send it to the IRS.

Everything You Need to Know About Reporting Metamask on Your Taxes

If you are using Metamask to trade cryptocurrencies and are reporting your profits and losses on your taxes, then you will need to follow some specific steps.

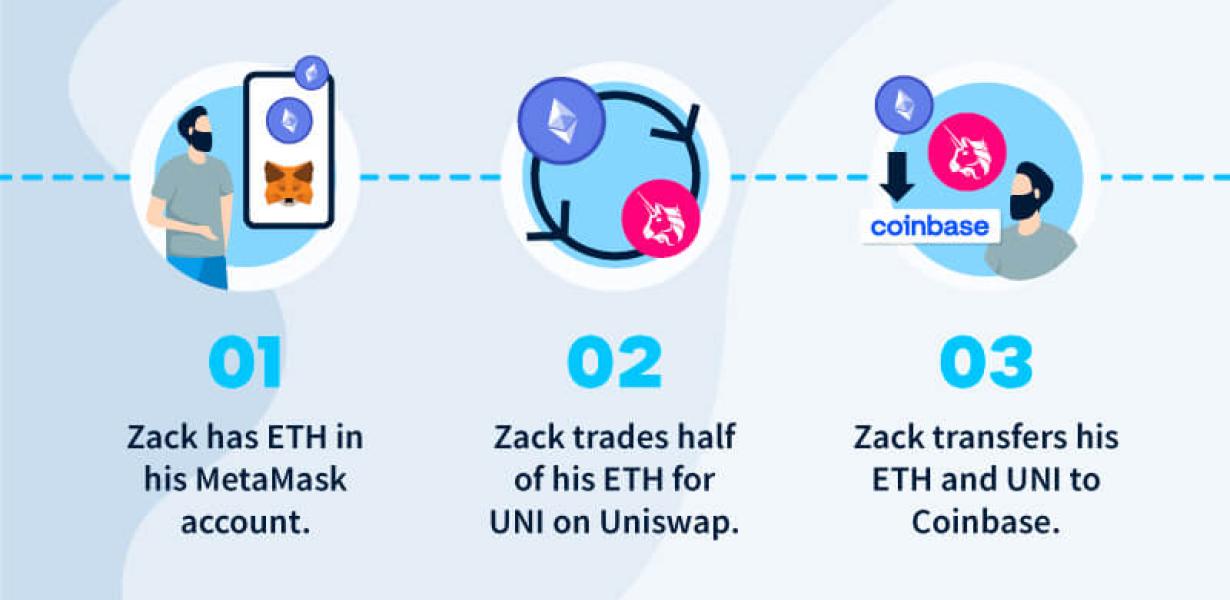

First, you will need to set up a cryptocurrency wallet on your computer or phone. You can find a list of some of the most popular wallets here. Once you have set up your wallet, you will need to install the Metamask extension. You can find the extension here. Once you have installed the extension and logged in, you will need to create a new account. This account will be used to trade cryptocurrencies and report your profits and losses. Next, you will need to connect your Coinbase account to your Metamask account. You can do this by clicking on the three lines in the top right corner of the Metamask window and selecting “Connect Coinbase Account.” After you have connected your Coinbase account, you will need to click on the “Send” button and enter your Coinbase address and password. After you have entered your information, you will need to click on the “Confirm” button. Finally, you will need to click on the “Submit” button. After you have submitted your information, Metamask will display your latest transactions and profits and losses.

What Are the Tax Implications of Using Metamask?

The tax implications of using Metamask depend on whether you are a resident of the United States or not. If you are not a U.S. resident, then you will not be subject to U.S. taxes on the income you earn from using Metamask. However, if you are a U.S. resident, then you will likely be subject to U.S. taxes on the income you earn from using Metamask.

Do I Have to Pay Taxes on My Metamask Transactions?

No, you do not have to pay taxes on your metamask transactions.

How to Handle Metamask Taxes When Filing Your Return

Metamask taxes are handled differently depending on whether you are an individual or a corporation.

Individuals

If you are an individual, you will need to include the metamask value in your taxable income. Metamask values are reported on Form 1040, Line 21.

If you are a resident of a country that has a value-added tax, you will also need to include the metamask value in your taxable income. Metamask values are reported on Form 1040, Line 22.

Corporations

If you are a corporation, you will not need to include the metamask value in your taxable income. Metamask values are not reported on Form 1040.

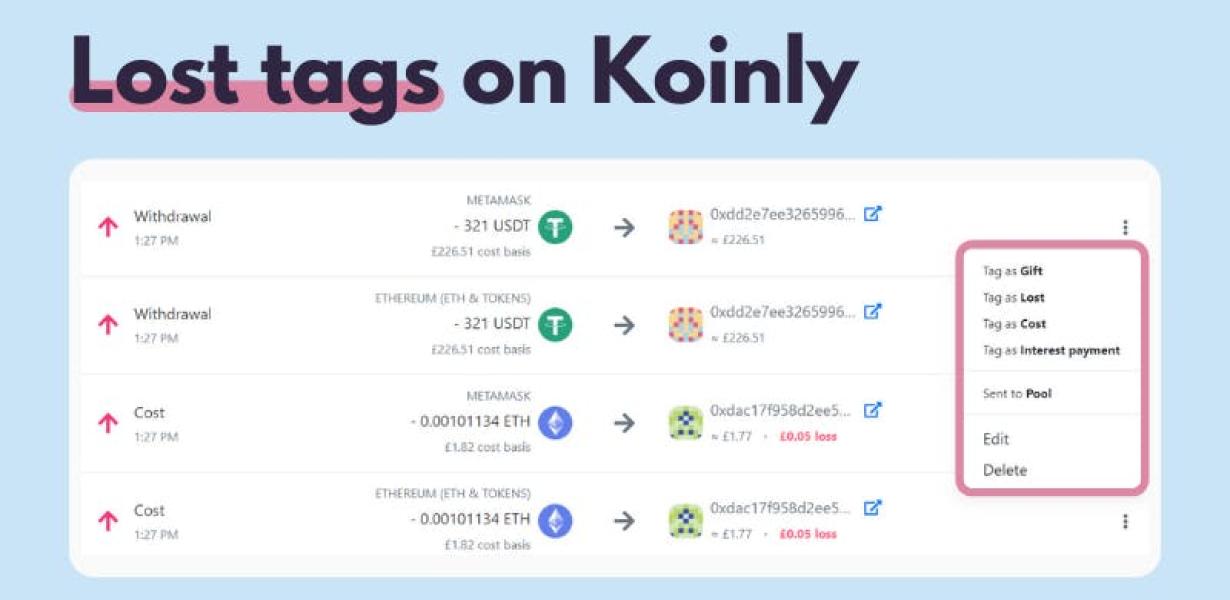

Don't Forget to Report Your Metamask Usage When Filing Your Taxes

It's important to report any activity on your Metamask account, including purchases and transactions, when filing your taxes. This will help ensure that you are receiving the correct tax treatment for your Metamask activity.