The wallet trust deficit looks bad.

The article discusses how people are generally distrustful of wallets, and how this could be detrimental to the cryptocurrency industry.

The Dwindling Trust in Our Wallets

The trust we place in our wallets has diminished in recent years. This is evidenced by the rise of mobile wallets and other digital payment methods.

A study by Cambridge Analytica found that 62% of Americans have less trust in banks than they do in email addresses. And a survey by Bankrate revealed that 66% of Americans have less trust in banks than they do in social media.

This trend is likely due to the fact that banks have been shown to be involved in unethical practices such as Libor rigging, money laundering, and consumer abuse. In addition, banks have been criticized for their slow response to the financial crisis, which led to widespread consumer debt and foreclosure.

Mobile wallets and other digital payment methods offer an alternative to traditional banks. They are more secure because they are not linked to individual bank accounts. And they are convenient because they are accessible from any device.

However, digital payment methods do have some limitations. For example, they are not as reliable as traditional banks when it comes to making transactions in difficult-to-access locations. And they are not always available in areas where traditional banks are available.

Overall, the trust we place in banks has decreased over the past few years. This is likely due to the many ethical issues that banks have been involved in, as well as their slow response to the financial crisis. However, mobile wallets and other digital payment methods offer an alternative that is more secure and convenient.

The Lack of Trust When It Comes to Our Wallets

"When people don't trust their wallets, they're more likely to carry large sums of cash, which can be dangerous if lost or stolen."

There is a lack of trust when it comes to our wallets. When people don't trust their wallets, they're more likely to carry large sums of cash, which can be dangerous if lost or stolen. Additionally, if someone has their wallet stolen, they may not be able to access their funds and may have to go through the process of replacing all of their cards.

The Wallet Trust Deficit: Why Are We So Distrusting?

There is a lot of distrust in the financial system, and it is understandable. The Wallet Trust Deficit is a statistic that reflects our overall distrust of banks and the financial system.

The Wallet Trust Deficit measures how much people distrust their banks and believe that banks will not protect their money. In 2017, the Wallet Trust Deficit was at its highest level since 2004. This means that more than half of Americans (54%) do not have confidence in their banks to protect their money.

There are a few reasons why people might have less trust in banks. One reason is that we have seen a number of incidents where banks have been involved in major scandals. For example, HSBC was caught laundering money for Mexican drug cartels, and Wells Fargo was fined for opening up unauthorized accounts in customers' names. These incidents have led to a lot of people distrusting banks and believing that they will not protect their money.

Another reason why people might have less trust in banks is because the banking system is complex. It can be difficult to understand how the banking system works, which can lead to confusion and mistrust.

Overall, the Wallet Trust Deficit reflects our overall distrust of banks and the financial system. It is an important statistic because it helps us to understand how people are feeling about the financial system.

How Our Wallet's Lack of trust is Impacting Us

When we don't have faith in our wallet, we are less likely to use it as our main form of payment. For example, if we don't have faith that our wallet can hold enough money, we may not purchase items with it. If we don't have faith that the company we are buying from is legitimate, we may not purchase from them. This lack of trust can ultimately have a negative impact on our economy and overall well-being.

The Negative Consequences of a Wallet Trust Deficit

A wallet trust deficit is when a large number of people trust a digital wallet less than they trust traditional banks. This could lead to a decrease in the use of digital wallets, which could in turn lead to a decrease in the value of those wallets. Additionally, a wallet trust deficit could lead to a decrease in the amount of money that people are willing to spend on digital goods and services.

Can We Overcome Our Wallet Trust Deficit?

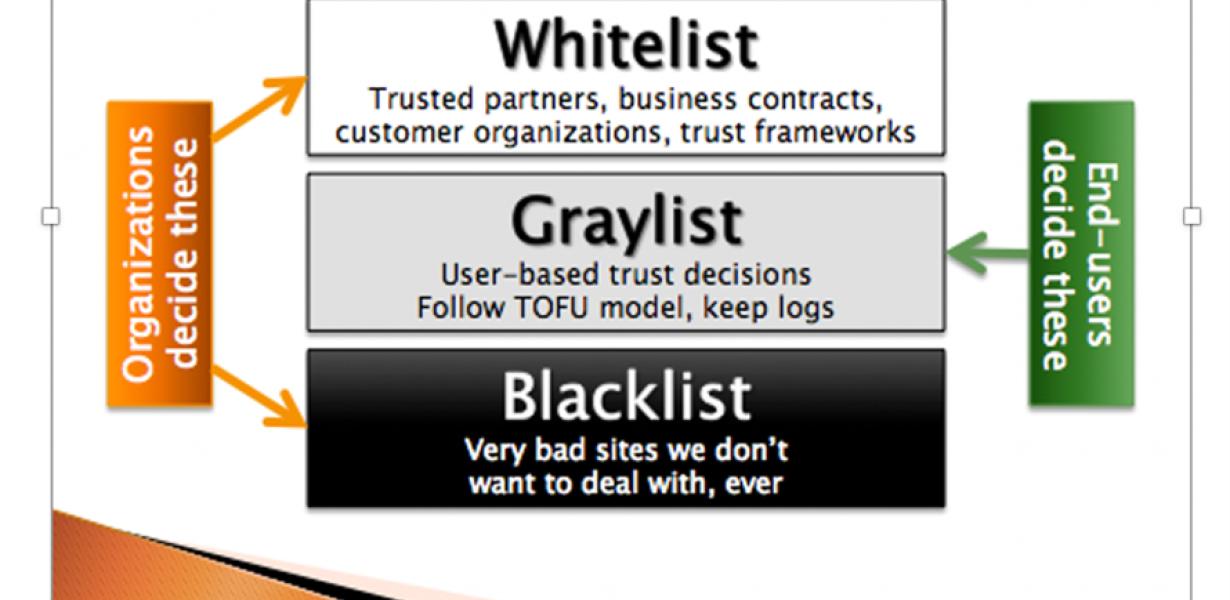

There is no easy answer to this question, as it will largely depend on the specific context and behaviors within which people operate. However, there are a few steps that could be taken in order to improve trust in wallets and cryptocurrencies more broadly.

One potential approach would be to increase transparency and accountability within the cryptocurrency ecosystem. This could include ensuring that all relevant details about wallet operators and coins are available publicly, as well as taking measures to ensure that stolen coins are quickly replaced.

Another potential step would be to develop more secure and user-friendly wallets. This could include developing features that allow users to track their assets and transactions in real time, as well as implementing more sophisticated security measures such as 2-factor authentication.

Ultimately, it will be important for cryptocurrency users to take active responsibility for safeguarding their personal information and funds – both within the context of wallets and beyond. By working together, we can help create a more trustful and secure cryptocurrency ecosystem for all.