Is moving crypto to a wallet taxable?

When it comes to cryptocurrency, taxes are a hot topic. And with good reason - the IRS has made it clear that they consider crypto to be taxable property. So what does that mean if you're thinking of moving your crypto from one wallet to another? Generally speaking, any time you sell, trade, or otherwise dispose of cryptocurrency, you may be subject to capital gains taxes. That means that if you move crypto from one wallet to another, and the value of the crypto has increased since you acquired it, you may owe taxes on the sale. Of course, there are always exceptions to the rule, so it's important to speak with a tax professional before making any decisions about your crypto holdings. But in general, if you're thinking of moving crypto around, it's best to be aware that you may be triggering a taxable event.

How to avoid paying taxes on your cryptocurrency earnings

There is no one definitive answer to this question. Some people may opt to keep their cryptocurrency earnings outside of the traditional financial system, in order to avoid paying taxes on them. Others may use tax-deductible cryptocurrency investment accounts to report their earnings. Ultimately, it is important to consult with a tax professional to find the best way to account for and report cryptocurrency income.

3 Ways to Minimize Taxes on Your Cryptocurrency Profits

1. Hold your cryptocurrency in a taxable account

If you hold your cryptocurrency in a taxable account, you will have to pay taxes on your profits. This means that you will need to track your cryptocurrency holdings and report your income accordingly.

2. Use a tax-deferred investment vehicle

One way to minimize taxes on your cryptocurrency profits is to use a tax-deferred investment vehicle. This will allow you to defer paying taxes on your profits until later, when they are withdrawn from the investment vehicle.

3. Use a foreign exchange trading strategy

Another way to minimize taxes on your cryptocurrency profits is to use a foreign exchange trading strategy. This will allow you to trade your cryptocurrency for other currencies and avoid paying taxes on the profits from those trades.

The Tax implications of holding Cryptocurrency

Cryptocurrencies are not considered to be legal tender in any jurisdiction, meaning that they cannot be used to purchase goods and services. This means that any taxes that may be associated with holding or trading cryptocurrencies may not apply.

Do you have to pay taxes on cryptocurrency?

No, there is no tax obligation related to cryptocurrency. However, any gains or losses from trading or investing in cryptocurrencies should be reported on your tax return.

How to reduce taxes on your cryptocurrency income

There is no one-size-fits-all answer to this question, as the amount of taxes that you pay on your cryptocurrency income will depend on your specific situation. However, some tips on how to reduce your tax burden on cryptocurrency income include:

File your cryptocurrency income as taxable income . Unlike traditional currency, cryptocurrency is considered taxable income when it is converted into fiat currency or used to purchase goods and services. This means that you will need to report your cryptocurrency income on your tax return, and pay taxes on it accordingly.

. Unlike traditional currency, cryptocurrency is considered taxable income when it is converted into fiat currency or used to purchase goods and services. This means that you will need to report your cryptocurrency income on your tax return, and pay taxes on it accordingly. Use tax deductions to reduce your tax liability . There are a number of tax deductions available that can help you reduce your tax bill on cryptocurrency income. These include expenses related to trading and holding your cryptocurrency, such as fees for exchanges and storage services. You can also deduct losses you incur when trading cryptocurrency, provided that you have taken reasonable precautions to protect your investment.

. There are a number of tax deductions available that can help you reduce your tax bill on cryptocurrency income. These include expenses related to trading and holding your cryptocurrency, such as fees for exchanges and storage services. You can also deduct losses you incur when trading cryptocurrency, provided that you have taken reasonable precautions to protect your investment. Claim the foreign earned income exclusion . If you are living outside of the United States, you can exclude up to $102,000 in foreign earned income from your taxable income. This means that you will not have to pay taxes on this income.

. If you are living outside of the United States, you can exclude up to $102,000 in foreign earned income from your taxable income. This means that you will not have to pay taxes on this income. Consider using an estate planning tool to reduce your tax burden. Estate planning tools can help you distribute your cryptocurrency inheritance tax-free. In addition, they can help you make other estate-related decisions, such as how much money to leave to your heirs and which assets to sell down before death.

If you are unsure about how to reduce your tax burden on cryptocurrency income, speak with a tax professional. They can help you figure out the best way to structure your finances so that you pay the least amount of taxes possible.

What you need to know about paying taxes on cryptocurrency

There is no one right way to pay taxes on cryptocurrency – it depends on your individual situation. However, some common tips for paying taxes on cryptocurrency include:

1. File your taxes early

The sooner you file your taxes, the sooner you can get your money back. This is especially important if you're using cryptocurrency to pay your taxes.

2. Pay your taxes in cryptocurrency

If you're able to pay your taxes in cryptocurrency, it can be a good way to avoid any extra fees. Cryptocurrency platforms like Coinbase allow you to pay your taxes in cryptocurrency, which can help you save money on the transaction.

3. Consult a tax professional

If you don't feel comfortable filing your taxes yourself, or if you have more questions about paying taxes on cryptocurrency, consult a tax professional. They can help you navigate the tax laws specific to cryptocurrency, and they can also help you prepare and file your taxes correctly.

How to keep more of your money when moving cryptocurrency to a wallet

When you move your cryptocurrency to a wallet, make sure you do so securely. Some tips to keep your money safe when moving your cryptocurrency include:

1. Use a reputable and reliable wallet provider.

2. Choose a wallet that is easy to use and has good security features.

3. Store your cryptocurrency in a cold storage wallet.

4. Make sure to backup your wallet files.

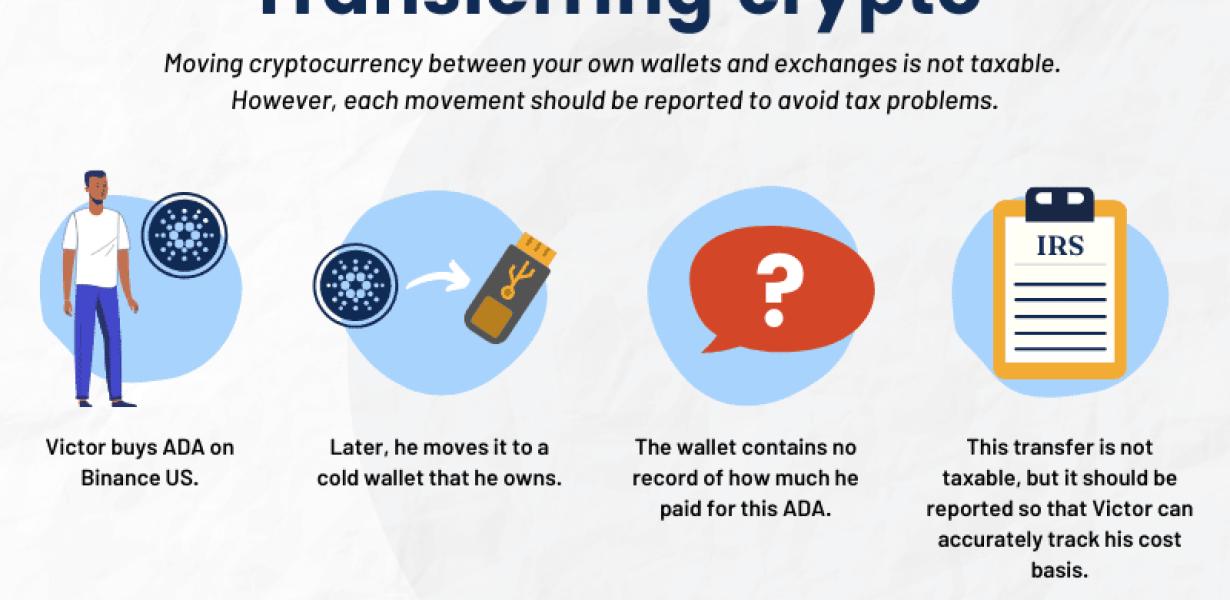

Learn the tax implications of transferring cryptocurrency to a wallet

Cryptocurrency is treated as property for tax purposes. When you transfer cryptocurrency to a wallet, you are essentially transferring the ownership of the cryptocurrency. The tax implications of transferring cryptocurrency to a wallet depend on the type of wallet you use and the country you are in.

Save money by understanding the tax rules for moving cryptocurrency to a wallet

There are a few important things to keep in mind when moving cryptocurrency to a wallet. First, any cryptocurrency you move must be converted into a supported currency before it can be stored in a wallet. This can be done through an exchange or by using a cryptocurrency wallet that supports the conversion of supported currencies.

Second, cryptocurrency transactions are subject to federal and state taxes. This means that if you are moving cryptocurrency from a wallet that you own to a wallet that you do not own, you may have to pay taxes on the value of the cryptocurrency that you are transferring. If you are moving cryptocurrency from a wallet that you do not own to a wallet that you do own, you will not have to pay taxes on the value of the cryptocurrency that you are transferring.

Finally, keep in mind that cryptocurrency wallets are not insured and are not guaranteed to be safe from theft. Always make sure to backup your cryptocurrency wallet password and keep your cryptocurrency offline if possible to protect it from theft.