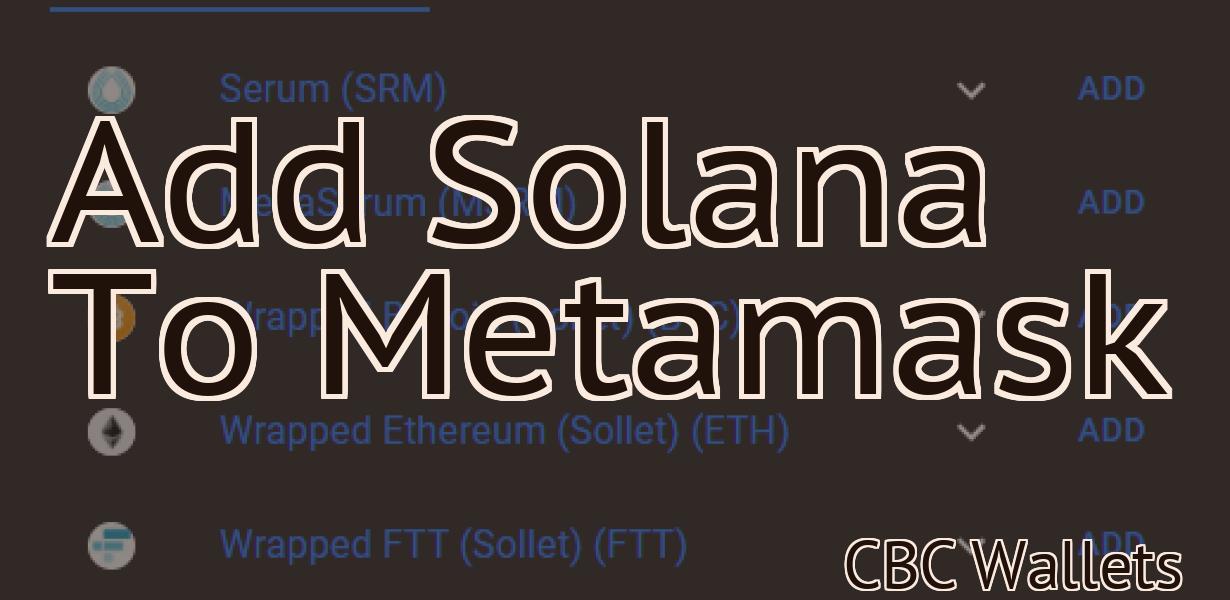

Does Metamask report to the IRS Reddit?

The article discusses whether or not the popular cryptocurrency wallet Metamask reports user data to the IRS. According to the article, Metamask does not currently report user data to the IRS, but the situation could change in the future.

Metamask and IRS: What You Need to Know

The application form for the IRS is Form W-4, Employee's Withholding Certificate.

In order to use the metamask application, you will need an Ethereum address. Metamask is a plugin for Chrome and Firefox that allows you to create and use Ethereum addresses.

To start using metamask:

1. Open Chrome or Firefox and click on the three lines in the top left corner of the browser window.

2. Click on the "add new account" button.

3. Enter your name, email address, and password.

4. Click on the "metamask" button in the bottom left corner of the window.

5. Click on the "get started" button.

6. Click on the "create a new wallet" button.

7. Click on the "Ethereum" button in the bottom right corner of the window.

8. Click on the "create a new account" button.

9. Enter your name, email address, and password.

10. Click on the "Metamask" button in the bottom right corner of the window.

11. Click on the "create a new wallet" button.

12. Fill out the information for your new Ethereum wallet.

13. Click on the "add account" button.

14. Enter your metamask address and password in the appropriate fields and click on the "submit" button.

How Metamask Works with the IRS

The IRS uses a variety of methods to collect taxes, including through individual tax returns and, more recently, through electronic filing of tax returns. When you electronically file your tax return using the IRS's e-file system, you can use metamask to securely authorize your tax return.

Metamask is a browser extension that helps you secure online transactions and protect your privacy. When you use metamask to authorize your tax return, metamask verifies your identity and finances and then encrypts the information you submit to the IRS. This helps keep your information private and secure.

To use metamask to authorize your tax return, first install the metamask extension on your browser. Next, open the metamask extension and click on the "Authorize Your Tax Return" button. You will be asked to enter your personal information, including your social security number. Once you have entered this information, you will be asked to confirm your identity by scanning a bar code or photograph. After you have completed these steps, metamask will generate a unique code that you can use to electronically file your tax return.

What Metamask Users Need to Know About Reporting to the IRS

If you are an individual who uses metamask to participate in the cryptocurrency market, you may need to know about reporting to the IRS. Reporting to the IRS means providing information about your income and assets. You may need to file a tax return, pay taxes, or claim a deduction.

You should consider the following when deciding whether or not to report your cryptocurrency income and assets to the IRS:

What is cryptocurrency?

Cryptocurrency is a digital or virtual asset that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

What is metamask?

Metamask is a desktop and mobile application that helps you use cryptocurrencies. Metamask allows you to keep your identity secret and allows you to spend cryptocurrencies without having to provide personal information.

What do I need to report if I use metamask?

If you use metamask to participate in the cryptocurrency market, you may need to report your income and assets. You may need to file a tax return, pay taxes, or claim a deduction.

How do I report my cryptocurrency income and assets using metamask?

To report your cryptocurrency income and assets using metamask, follow these steps:

1. Open metamask on your computer or mobile device.

2. Click on the “ Accounts ” button.

3. On the accounts page, under “ Transactions ”, click on the “ Transactions History ” tab.

4. Under “ Transactions History ,” click on the “ View Details ” button for the transaction you want to report.

5. Under “ Transaction Details ,” you will see information about the transaction, such as the date and time it happened, the amount of currency involved, and the address of the recipient.

6. To report the transaction, click on the “ Report to IRS ” button.

7. You will be prompted to provide your name, address, and Social Security number.

8. You will also be prompted to provide information about the transaction, such as the amount of cryptocurrency involved and the address of the recipient.

9. You will then be given the option to submit the report to the IRS online or by mail.

10. If you choose to submit the report by mail, you will be given the address where you can send the report.

11. After you submit the report, you will receive a confirmation message from the IRS.

Guidelines for Metamask Users When Reporting to the IRS

When filing your taxes, it is important to use the right tools for the job. Metamask is one such tool and can be used to report taxes.

When using Metamask, be sure to follow these guidelines to ensure a successful tax filing experience:

1. Use the correct address. When filing taxes through Metamask, you must use the correct address. This means providing the correct Tax ID and Social Security Number.

2. Double check your information. Make sure all of your information is correct before filing. Metamask will not allow you to file if your information is incorrect.

3. Sign in to Metamask. Before filing, you must sign in to Metamask. Metamask will then provide you with instructions on how to complete your tax filing experience.

4. Review your submission. Once you have completed your tax filing experience through Metamask, review it to make sure all of your information was entered correctly. If there are any errors, you can fix them before submitting your taxes.

How to Use Metamask with the IRS

If you are a U.S. taxpayer and want to use Metamask with the IRS, follow these steps:

1. Open Metamask.

2. Click on the "View Wallet Info" button in the upper right corner of the Metamask screen.

3. On the "View Wallet Info" screen, click on the "Send Ether & Tokens" tab.

4. In the "Ether & Tokens" tab, click on the "Add Custom Token" button.

5. On the "Add Custom Token" screen, enter the following information:

Token Name: IRS

Token Symbol: IRS

6. Click on the "Send Transaction" button.

7. In the "Transaction Details" screen, click on the "Metamask Integration" button.

8. On the "Metamask Integration" screen, click on the "Activate" button.

9. In the "Activate Metamask Integration" screen, confirm that the "IRS" token is now listed as a supported token.

10. Click on the "Close" button.

What to Expect When Filing Taxes with Metamask

When using Metamask, you will need to first create a new account. After that, you will need to install the Metamask extension. Once the extension is installed, you will be able to sign into your Metamask account and access your funds.

How Metamask Can Help You Save on Taxes

Metamask is a decentralized application that allows users to conduct transactions and interact with smart contracts without needing to install an Ethereum client. This makes it a great option for users who are not comfortable with the technical aspects of blockchain technology.

One of the main benefits of Metamask is that it can help you save on taxes. By using Metamask to interact with smart contracts, you can avoid having to pay tax on any profits you make. This is because smart contracts are considered legal documents, and as such, they are exempt from taxation.

To take advantage of this benefit, you will first need to set up Metamask. Once you have done this, you can start trading and investing in cryptocurrencies without worrying about taxes.

Tips for Getting the Most Out of Metamask and the IRS

Metamask is a great tool for securing your Ethereum and Bitcoin holdings, but there are a few things you can do to make the most of it. Here are four tips:

1. Keep your passwords safe

One of the best ways to protect your Metamask account is to keep your passwords safe. Make sure to never share your passwords with anyone, and make sure to change them regularly.

2. Use a strong password

Another way to protect your Metamask account is to use a strong password. Make sure to include at least eight characters, two of which should be capital letters.

3. Store your private keys offline

One of the best ways to protect your Metamask account is to store your private keys offline. This means that you won't need to worry about someone stealing your coins if they get access to your computer.

4. Use a hardware wallet

If you want to take the extra step to protect your Metamask account, you can use a hardware wallet like the Ledger Nano S. This will help ensure that your coins are never stolen by hackers.

Making the Most of Metamask and the IRS

Metamask is a great tool for managing your cryptocurrency holdings. It allows you to keep track of your holdings, make transactions, and receive notifications for price changes.

One important thing to keep in mind is that Metamask is not a tax software. While it helps you keep track of your cryptocurrency holdings and make transactions, it is not intended to provide tax advice. You should consult with a professional tax advisor if you have questions about how cryptocurrency holdings may affect your taxes.