Crypto Wallet To Bank Account

If you're looking to cash out your crypto holdings, you'll need to know how to transfer your coins or tokens from your wallet to your bank account. In this article, we'll show you how to do just that.

How to Transfer Your Crypto Wallet to a Bank Account

To transfer your crypto wallet to a bank account, follow these steps:

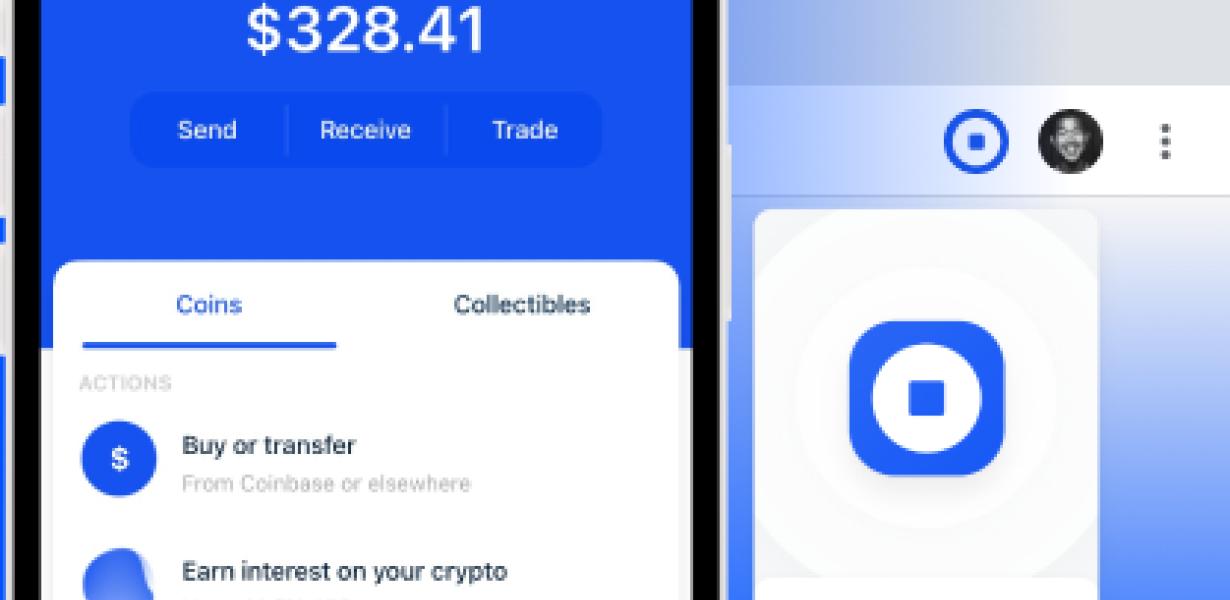

1. Open a web browser and go to https://www.coinbase.com/.

2. On the homepage, click on the “Accounts” link in the top right corner.

3. Click on the “Deposit Bitcoin” button in the top left corner.

4. Enter the amount of bitcoin you want to deposit in the “Amount” field and click on the “ Deposit ” button.

5. Select a bank account in the “Bank Account” field and click on the “Submit” button.

6. Your bitcoin will be deposited into your bank account within a few minutes.

3 Easy Steps to Converting Your Crypto Wallet to a Bank Account

1. Log in to your crypto wallet and find the “Withdraw” tab.

2. Choose your bank and fill in the required information.

3. Click “Withdraw” to complete the process.

How to Safely Convert Your Crypto Wallet to a Bank Account

There are a few ways to safely convert your crypto wallet to a bank account.

One way is to use a company like Coinbase or another crypto-to-fiat exchange. They will help you transfer your crypto holdings to a bank account, and then you can withdraw the money as needed.

Another option is to use a cryptocurrency wallet service like Jaxx. They will help you move your coins from your crypto wallet to a bank account, and then you can use the funds as you please.

Finally, you can also use an online crypto-to- fiat converter like CoinToUSD. They will help you convert your coins into US dollars, which you can then use as you please.

How to Quickly Convert Your Crypto Wallet to a Bank Account

There are a few ways to quickly convert your crypto wallet to a bank account.

The first option is to use a crypto-to-crypto exchange. These exchanges allow you to trade one cryptocurrency for another. After you have traded your coins, you can then use a bank transfer to convert them to a bank account.

The second option is to use a crypto-to-fiat exchange. These exchanges allow you to trade one cryptocurrency for another. After you have traded your coins, you can then use a bank transfer to convert them to a bank account.

The third option is to use a software wallet. These wallets are offline and do not require you to connect to the internet. After you have created an account, you can then use the software wallet to convert your coins to a bank account.

5 Tips for Converting Your Crypto Wallet to a Bank Account

1. Get a crypto wallet that supports bank accounts.

2. Sign up for a crypto-to-crypto exchange that allows you to convert your crypto holdings into fiat currency.

3. Deposit your crypto holdings into your bank account.

4. Buy fiat currency with your crypto holdings.

5. Use your crypto holdings to purchase goods and services.

The Best Way to Convert Your Crypto Wallet to a Bank Account

There is no one “best” way to convert your crypto wallet to a bank account. However, some methods are more straightforward and secure than others.

The simplest way to convert your crypto wallet to a bank account is to use a virtual private network (VPN). A VPN encrypts all of your traffic and routes it through an intermediary server, making it difficult for anyone to track your activity.

Some of the most popular VPNs include NordVPN and IPVanish. Both offer a free trial so you can test out their services before committing to a subscription.

Another option is to use a cryptocurrency exchange. Exchanges allow you to trade your crypto tokens for traditional currencies, such as USD or EUR.

Most exchanges offer a user-friendly interface and provide detailed instructions on how to convert your crypto wallet to a bank account.

Finally, you can also use a cryptocurrency wallet aggregator. These platforms allow you to combine multiple wallets into one account so you can easily move your funds between them.

Overall, there is no one “best” way to convert your crypto wallet to a bank account. However, using a VPN, an exchange, or a wallet aggregator is likely the easiest and most secure option.

The Safest Way to Convert Your Crypto Wallet to a Bank Account

The safest way to convert your crypto wallet to a bank account is to use a custodian service. These services will securely store your crypto assets and then provide you with a bank account in which to deposit them.

The Fastest Way to Convert Your Crypto Wallet to a Bank Account

If you want to convert your crypto wallet to a bank account, the fastest way is to use a crypto-to-crypto exchange.

10 Tips for Converting Your Crypto Wallet to a Bank Account

There are a few things you can do in order to convert your crypto wallet to a bank account.

1) Make sure you have a good understanding of the different types of wallets and what they offer. A crypto wallet is a digital platform that allows you to store, send and receive cryptocurrencies. There are three main types of wallets: desktop, mobile and online. Desktop wallets are installed on your computer and are used to store your coins offline. Mobile wallets are downloaded onto your mobile device and can be used to store your coins online. Online wallets are accessed through a web browser.2) Decide how you want to store your coins. Your options include: storing them on a digital platform such as Coinbase or Kraken; storing them on a physical medium such as a paper wallet; or using a hybrid approach, such as storing them on a digital platform and using a physical medium to store a backup.3) Verify your identity. Before you can open a bank account, you need to verify your identity. To do this, you will need to provide proof of residence, identity documents and proof of income.4) Prepare your tax documents. Before you can open a bank account, you will need to prepare your tax documents. This includes filling out a TIN form, filing your taxes and supplying proof of residence, identity documents and income.5) Verify your credit score. Before you can open a bank account, you will need to verify your credit score. This will involve providing copies of your credit reports and any other documents that may be required by your bank.6) Deposit funds into your bank account. Once you have verified your identity and prepared your tax documents, you can deposit funds into your bank account. This can be done through a digital or physical platform.7) Set up a bank account. After depositing funds into your bank account, you can set up a bank account. This can be done through a digital or physical platform.8) Use your bank account to buy cryptocurrencies. Once you have set up a bank account, you can use it to buy cryptocurrencies. This can be done through a digital or physical platform.9) Use your bank account to withdraw cryptocurrencies. Once you have set up a bank account, you can use it to withdraw cryptocurrencies. This can be done through a digital or physical platform.10) Use your bank account to transfer cryptocurrencies to another wallet. Once you have set up a bank account, you can use it to transfer cryptocurrencies to another wallet. This can be done through a digital or physical platform.

How to Successfully Convert Your Crypto Wallet to a Bank Account

1. Go to your bank website and create an account. If you already have a bank account, you can use that to sign up for a crypto account.

2. Once you have created your account, go to the "My Accounts" tab and click on the "Digital Assets" button.

3. Under the "Digital Assets" tab, click on the "Cryptocurrencies" button.

4. On the "Cryptocurrencies" page, click on the "Convert" button.

5. On the "Convert" page, enter the amount of cryptocurrency you want to convert into fiat currency and select the bank account you want to send the money to.

6. Click on the "Convert" button and the money will be transferred to your bank account.

How to Avoid Common Mistakes When Converting Your Crypto Wallet to a Bank Account

There are a few key things to keep in mind when converting your crypto wallet to a bank account.

1. Make sure you have accurate and up-to-date information about your holdings.

2. Ensure that you have transferred all of your coins and tokens to a new wallet or account before converting.

3. Double check the bank’s terms and conditions before opening an account. Some banks may charge hefty fees for using cryptocurrencies.

4. Make sure you have all the relevant documents, such as proof of address and identity, to open an account.

5. Keep track of your spending and review your bank statements regularly to ensure that your funds are being transferred correctly.

What You Need to Know Before Converting Your Crypto Wallet to a Bank Account

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are not legal tender, and their value is volatile.

Before converting your cryptocurrency wallet to a bank account, you should understand the risks involved. Cryptocurrencies are not legal tender, and their value is volatile. Moreover, cryptocurrencies are not backed by any government or financial institution, and there is no guarantee that they will retain their value. Finally, cryptocurrency wallets are not insured, so you may lose all of your money if your cryptocurrency wallet is hacked.