Coinbase Tax Documents

If you're a US-based Coinbase user, you may have to provide some tax documents to the IRS. Here's what you need to know.

Coinbase Tax Documents: How to File Your Taxes for Bitcoin and Other Cryptocurrencies

Coinbase is a popular platform for buying, selling and trading cryptocurrencies, such as Bitcoin.

To file taxes on your cryptocurrency profits, follow these steps:

1. Open Coinbase and sign in.

2. On the main screen, click on the Account tab.

3. Under Accounts and Transactions, click on Taxable Accounts.

4. On the Taxable Accounts page, select the account you want to file taxes for.

5. Under Transactions, click on Report Transactions.

6. On the Report Transactions page, under Transactions Summary, click on Taxable Transactions.

7. Under Taxable Transactions, click on the transactions you want to report and then click on Report Transaction.

8. On the Report Transaction page, under Details, fill in the information required for the tax form, such as your name, address and taxpayer identification number.

9. Click on Submit.

10. You will receive an email notification confirming the filing of your taxes.

Everything You Need to Know About Coinbase Tax Documents

Coinbase is a digital asset exchange and mobile app that allows users to buy, sell, store, and use cryptocurrencies.

According to Coinbase’s website, the company’s “primary mission is to create an open financial system for the world.” As such, Coinbase complies with all applicable domestic and international tax laws.

In order to ensure compliance, Coinbase has developed an extensive tax compliance program. This program includes the following:

• Recording of customer transactions and account balances

• Creation of tax reports

• Disclosure of relevant tax information to the IRS and other tax authorities

• Participation in anti-money laundering and counter-terrorism financing programs

If you are an individual living in the United States, Coinbase will provide you with a tax identification number (TIN) and information about how to file your taxes. If you are a business entity, Coinbase will provide you with a federal tax identification number (EIN).

How to File Coinbase Tax Documents: A Step-By-Step Guide

1. Access your Coinbase account.

2. Click on the menu button in the top-right corner of the screen.

3. Select "Taxes & Fees."

4. On the Taxes & Fees page, click on the "File Taxes" button.

5. On the File Taxes page, select the country you are filing taxes for and click on the "Start Tax Filing" button.

6. Fill out the required information and click on the "Submit" button.

7. Coinbase will now send you a confirmation email and will process your taxes.

What Are Coinbase Tax Documents and How Do I File Them?

Coinbase is a digital currency and payment service provider headquartered in San Francisco, California. Coinbase allows its users to buy, sell, transfer, and store digital currencies such as Bitcoin, Ethereum, and Litecoin. Coinbase also provides a digital wallet for storing these currencies.

To file taxes on income from digital currencies, you must first report your total income from all sources on your tax return. You then must calculate your taxable income and submit your tax return using the correct form(s).

To report your digital currency holdings on your tax return, you will need to submit a Form 8949. This form is used to report your total Bitcoin, Ethereum, and Litecoin holdings as well as any other taxable assets that you have acquired during the calendar year.

You can file Form 8949 with your tax return or you can submit it electronically using the Coinbase online service.

Coinbase Tax Documents: The Ultimate Guide

If you are an individual taxpayer, here is a guide to the Coinbase Tax Documents:

1. Income Statement: This document displays your total income for the year, as well as any deductions you may have taken.

2. W-2: This document is sent to employees and shows their salary and other taxable income.

3. 1099-Misc: This document is sent to individuals who have earned income above certain thresholds. It may include things like rent, dividends, and royalties.

4. 1099-K: This document is sent to individuals who have earned income above certain thresholds. It may include things like capital gains, losses, and IRA distributions.

A Beginner's Guide to Coinbase Tax Documents

Coinbase is one of the most popular and well-known digital currency exchanges in the world. It allows its users to buy, sell, and store a variety of digital currencies, including Bitcoin, Ethereum, and Litecoin.

As a result, Coinbase users may be subject to tax obligations related to their digital currency transactions. This guide provides a brief overview of the tax documents that Coinbase users may need to file with the IRS, as well as tips on how to properly document and report their digital currency transactions.

What Are Coinbase Users Required to File With the IRS?

Coinbase users are required to file Form 1040, Schedule C, and Form 8949, Foreign Account Tax Compliance Act (FATCA) Information Statement, with the IRS if they have:

More than $10,000 in gross income from U.S. sources during the year from digital currency transactions; or

A foreign account that contains more than $10,000 at any time during the year from digital currency transactions.

What Are Some tips for properly documenting and reporting digital currency transactions on IRS tax forms?

1. Make a list of all digital currency transactions that you made during the year. This will help you keep track of your total income and taxes due from your digital currency transactions.

2. Include the name of the digital currency(s) involved in each transaction, as well as the amount of each transaction.

3. Keep track of the date and time of each transaction, as this information will help you accurately report your income and taxes due.

4. If you are reporting your digital currency transactions on a quarterly basis, make sure to include this information on each tax form that you file.

5. If you are filing your tax forms electronically, make sure to include all of the required information in the correct format. For example, if you are filing your tax forms using TurboTax, be sure to include all of the required information in the correct fields on your tax form.

How to Read and Understand Coinbase Tax Documents

When you sign up for Coinbase, you are automatically enrolled in their customer service and support program. This program includes access to tax documents that can help you understand your cryptocurrency tax obligations.

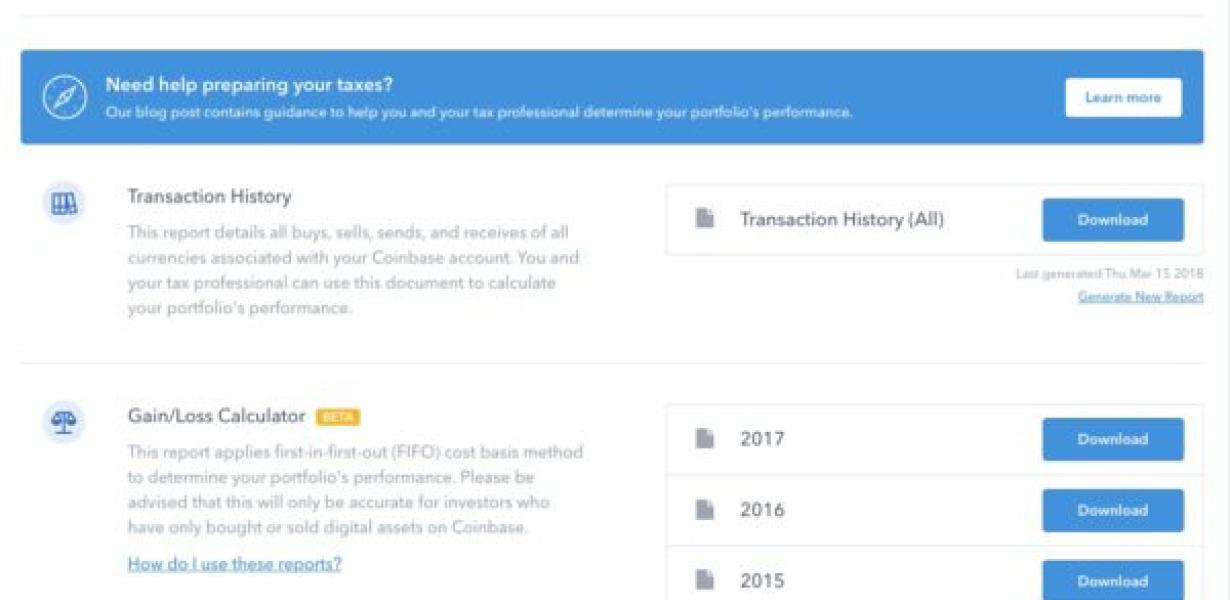

To access these documents, first open the customer service and support program. From there, click on the Tax Documents link. This will take you to a page where you can download various tax documents.

The documents that you can download include the following:

1. Coinbase Tax Form

2. Coinbase W-2 Form

3. Coinbase 1099-MISC Form

4. Coinbase Q&A

Each of these documents will provide you with important information about your cryptocurrency tax obligations. For example, the Coinbase Tax Form will tell you how much tax you will owe, and the Coinbase W-2 Form will provide you with your employer's information related to your salary and wages.

Overall, these documents can be very helpful when it comes to understanding your cryptocurrency tax obligations. If you have any questions about them, feel free to reach out to Coinbase's customer service and support team.

Everything You Need to Know About Filing Coinbase Tax Documents

If you are a taxpayer and use Coinbase to buy and sell digital assets, you may need to file a tax return and report your cryptocurrency transactions. Here is everything you need to know about filing Coinbase tax documents:

1. You need to file a tax return if you are a US taxpayer.

2. You need to report your cryptocurrency transactions on your tax return.

3. You need to include your Coinbase account number and transaction details on your tax return.

4. You may need to pay taxes on your cryptocurrency transactions.

5. You can find more information about filing taxes and cryptocurrency transactions on the IRS website.

What to Do With Coinbase Tax Documents

If you have Coinbase tax documents, you should keep them safe and protect them from theft or destruction. You can store them in a secure location, such as a fireproof safe, or on a computer that is protected with a password.

How to File Your Coinbase Taxes

If you use Coinbase to buy and sell cryptocurrencies, you will need to file taxes on your income and gains. Here's how to do it:

1. Open up Coinbase and click on the "Accounts" tab.

2. Under "Your Account," click on the "Taxes" heading.

3. On the "Taxes" page, you will need to fill out your tax information.

4. Click on the "File Taxes" button to submit your taxes.

5. Coinbase will send you a tax bill in the mail. You will need to pay your taxes by the due date listed on the bill.

What Are Bitcoin Taxes and How Do I Pay Them?

There is no definitive answer to this question as it depends on each individual's tax situation. However, generally speaking, Bitcoin and other cryptocurrencies are treated as property, meaning that you will likely have to pay taxes on any profits you make from trading or mining them.

Depending on your country of residence, you may also have to pay capital gains taxes on any profits you make from selling your Bitcoin or other cryptocurrencies. If you're not sure whether you need to report your Bitcoin gains or losses on your tax return, speak to a tax professional.

Paying Taxes on Bitcoin: What You Need to Know

Since Bitcoin is a digital asset, it operates on a decentralized network. This means that there is no central authority that can levy taxes on Bitcoin transactions. Instead, Bitcoin taxes are levied by the Bitcoin network itself.

Each Bitcoin transaction is assigned a unique identifier, called a coinbase. This coinbase is used to calculate the taxes owed on a Bitcoin transaction.

The tax rate for Bitcoin transactions is 0.25%. This means that each Bitcoin transaction is taxed at a rate of 0.25% of the total value of the transaction.

The tax obligations associated with a Bitcoin transaction are determined by the jurisdiction in which the Bitcoin user is located. For example, the US Internal Revenue Service (IRS) considers Bitcoin to be property subject to federal income tax. Accordingly, US citizens and residents who engage in Bitcoin transactions are responsible for paying taxes on those transactions.