Coinbase Fees

Coinbase is a digital asset exchange company headquartered in San Francisco, California. They broker exchanges of Bitcoin (₿), Ethereum (Ξ), Litecoin (Ł) and other digital assets with fiat currencies in 32 countries, and bitcoin transactions and storage in 190 countries worldwide.

coinbase fees: what they are and how to avoid them

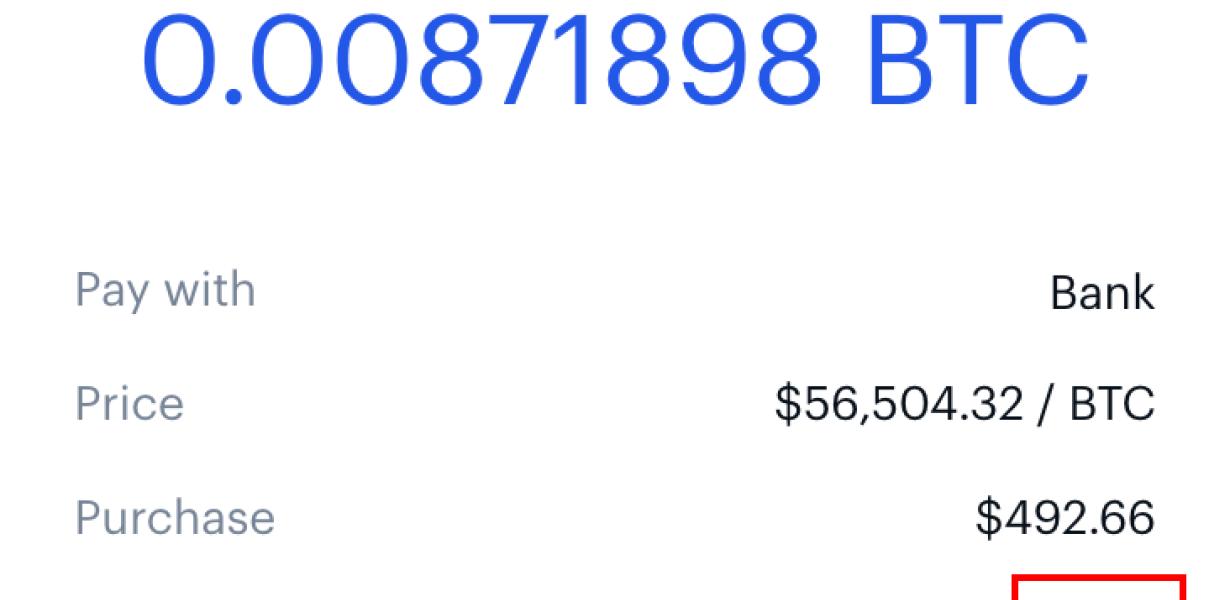

Coinbase charges a 1.49% fee on all bitcoin transactions. To avoid this fee, you can use the Coinbase wallet, GDAX, or Binance.

The hidden costs of using Coinbase

Coinbase is one of the most popular digital wallets available on the market. It's also one of the most popular ways to buy and sell bitcoin, Ethereum, and other cryptocurrencies.

But there are some hidden costs to using Coinbase. Here are five of them:

1. Fees

Coinbase charges a 1.49% fee on all transactions. That can add up over time. For example, if you make 10 transactions a month, Coinbase will charge you $4.49 in fees.

2. Deposits and withdrawals

Coinbase also charges a 3.99% fee on deposits and a 1.99% fee on withdrawals. That can add up over time if you make a lot of transactions.

3. Security

One downside of using Coinbase is that your funds are not FDIC-insured. This means that you may not be able to get your money back if Coinbase is hacked.

4. Bitcoin volatility

Bitcoin is a very volatile currency. This means that the price of bitcoin can change rapidly, which could affect the amount that you pay in fees and withdrawal fees.

5. Bitcoin scalability

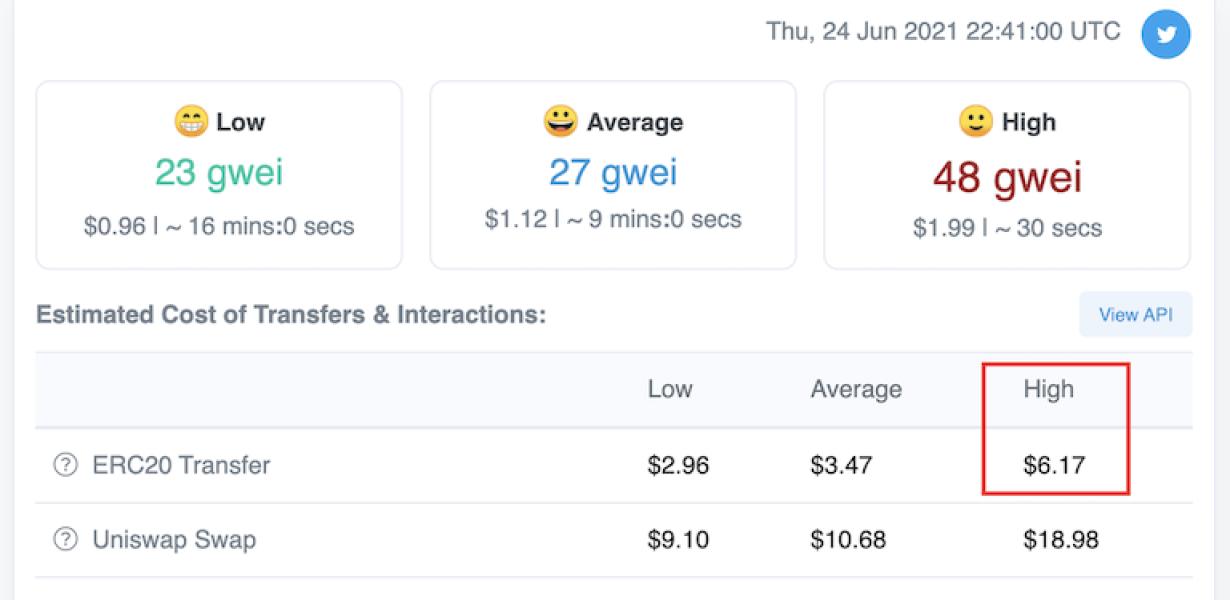

Bitcoin has been known to have problems with scalability, which means that it's not able to handle large numbers of transactions. Coinbase is currently the only digital wallet that allows you to buy and sell bitcoin, Ethereum, and other cryptocurrencies.

How to save on Coinbase fees

Coinbase offers a variety of ways to save on fees, including:

1. Sign up for a Coinbase account with a linked bank account. This will allow you to transfer funds between your Coinbase account and your bank account at no cost.

2. Use the Coinbase wallet to buy and sell digital assets. By using the Coinbase wallet, you will avoid paying fees associated with buying and selling digital assets on other exchanges.

3. Use the Coinbase wallet to store digital assets. by storing your digital assets in the Coinbase wallet, you will avoid paying fees associated with other storage platforms.

5 tips to avoid high Coinbase fees

1. Choose a Coinbase wallet that supports low fees. Coinbase offers a variety of wallets, including mobile and desktop apps.

2. Avoid sending large amounts of bitcoin (or any cryptocurrency) at once. Sending large amounts of cryptocurrency can result in high Coinbase fees.

3. Wait until Coinbase reduces its fees before sending cryptocurrency. Coinbase occasionally reduces its fees in order to compete with other Bitcoin exchanges.

4. Use the Coinbase buy/sell feature to transfer cryptocurrency without paying fees. Using the buy/sell feature will allow you to transfer cryptocurrency without paying fees, but you will have to wait for Coinbase to complete the transaction.

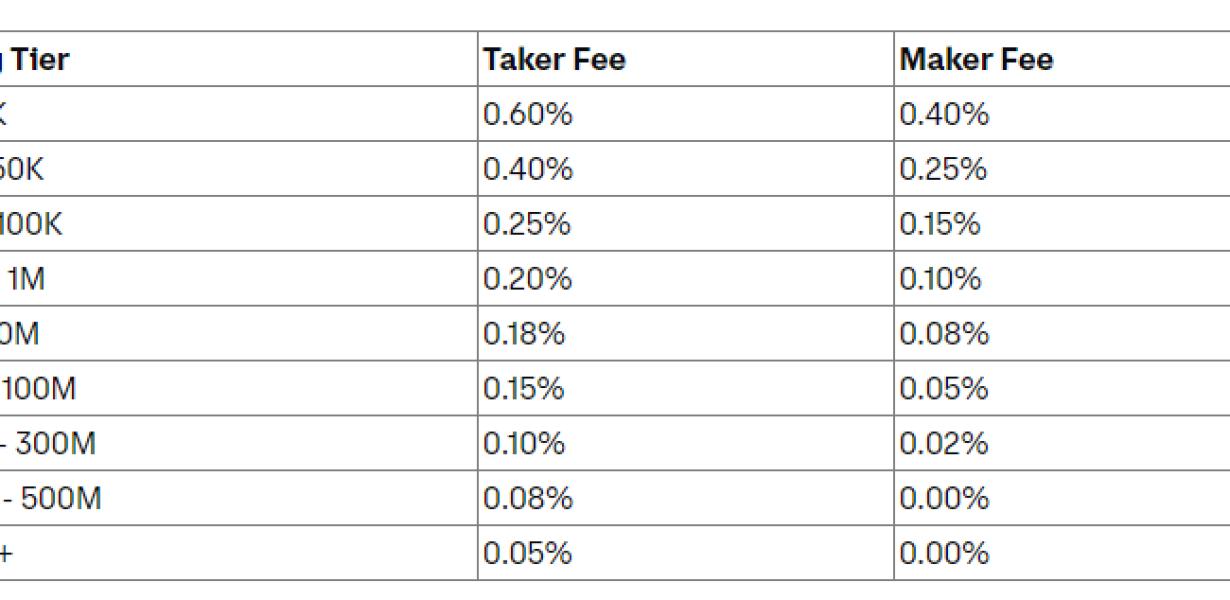

5. Compare Coinbase fees with other Bitcoin exchanges. Compare Coinbase fees with other Bitcoin exchanges before sending cryptocurrency. You may be able to find a Bitcoin exchange that charges lower fees than Coinbase.

How to beat the Coinbase fee system

Coinbase has a fee system where you have to pay a fee for every transaction that you make. There are a few ways that you can avoid paying these fees.

1. Use Coinbase’s debit card

If you want to use Coinbase’s debit card, you can avoid paying fees by using the debit card instead of transferring money. This will cost you a 3% fee, but it will be cheaper than paying the fees for each transaction.

2. Use Coinbase’s bank account

Another way to avoid fees is to use Coinbase’s bank account. This will cost you a 2.7% fee, but it will be cheaper than paying the fees for each transaction.

3. Use Coinbase’s transfer service

If you want to use Coinbase’s transfer service, you can avoid paying fees by transferring money using this service. This will cost you a 1.5% fee, but it will be cheaper than paying the fees for each transaction.

3 tricks to pay less in Coinbase fees

1. Use a debit card

When you use a debit card to purchase cryptocurrencies, Coinbase deducts a 2.9% processing fee from your total purchase. This fee is lower than the standard 3.99% Coinbase fee.

2. Use a bank account

If you have a bank account, Coinbase will charge you a flat 0.5% fee for each purchase. This fee is lower than the standard 2.9% Coinbase fee.

3. Use an escrow service

If you want to buy cryptocurrency without paying any fees, you can use an escrow service like Bitrated. Bitrated charges a 0.5% fee for each purchase, but this fee is waived if the purchase is completed through their escrow service.

Avoiding Coinbase fees: is it worth it?

Coinbase is a popular cryptocurrency exchange that charges fees for its services. However, there are a number of exchanges that do not charge fees, so it is worth considering which one is best for you.

How much do Coinbase fees really cost?

Coinbase charges a 1% fee on all transactions.

How to make the most of Coinbase without paying fees

If you don't want to pay Coinbase's fees, there are a few things you can do to make the most of their platform. First, make sure you have a Coinbase account and have downloaded the Coinbase app. Next, make sure you have a bank account linked to your Coinbase account. Finally, make sure you have enough money in your Coinbase account to cover the fees associated with using the platform.

The ultimate guide to avoiding Coinbase fees

When you first sign up for Coinbase, you'll be asked to create an account. Once you've created your account, you can begin to buy and sell cryptocurrencies.

To help you avoid Coinbase fees, follow these steps:

1. Use Coinbase to buy cryptocurrencies

When you want to buy cryptocurrencies, use Coinbase. Coinbase is one of the most popular ways to buy and sell cryptocurrencies.

Coinbase charges a 1.49% fee for all cryptocurrency transactions. This fee is included in the price of each cryptocurrency you purchase.

2. Use Coinbase to sell cryptocurrencies

When you want to sell cryptocurrencies, use Coinbase. Coinbase is one of the most popular ways to sell cryptocurrencies.

Coinbase charges a 3.99% fee for all cryptocurrency transactions. This fee is included in the price of each cryptocurrency you sell.

3. Use a different cryptocurrency exchange

If you want to avoid Coinbase fees, you can use a different cryptocurrency exchange. Some of the most popular cryptocurrency exchanges that don't charge Coinbase fees include Binance and KuCoin.

The lowdown on Coinbase fees: everything you need to know

Coinbase, one of the world’s leading cryptocurrency exchanges, charges 0.25% on all incoming and outgoing transactions. This fee is charged regardless of the amount of money being transferred. Additionally, Coinbase charges $0.99 per month for its premium account, which allows users to buy and sell cryptocurrencies with increased liquidity and security.

Your guide to Coinbase fees: what they are and how to avoid them

Coinbase is a popular platform for buying and selling cryptocurrencies, and it charges fees for both transactions. Here's a guide to Coinbase fees and how to avoid them.

Coinbase charges a 1% fee on all transactions. This fee is included in the price of each cryptocurrency you buy or sell on Coinbase.

To avoid this fee, you can use a debit card or bank account to buy cryptocurrencies on Coinbase. Alternatively, you can use a cryptocurrency exchange like Binance or Kraken to buy and sell cryptocurrencies.

Coinbase also charges a 3-5% fee on cryptocurrency withdrawals. This fee is included in the price of each cryptocurrency you withdraw from Coinbase.