Trust Wallet Tax Reporting

If you're a US taxpayer and you use Trust Wallet to store your cryptocurrency, you may be wondering how to go about reporting your taxes. Here's a brief guide on Trust Wallet tax reporting. When it comes to cryptocurrency taxes, there are a few things to keep in mind. First, you'll need to calculate your capital gains or losses for the year. This can be done by taking into account the purchase price of your cryptocurrency, the sales price, and any fees associated with the transactions. Once you have your capital gains or losses figured out, you'll need to report them on your tax return. If you have a gain, it will be taxed as ordinary income. If you have a loss, you may be able to deduct it from other forms of income. Trust Wallet does not currently have a built-in tax reporting feature, but there are a few third-party tools that can help you with this. One option is to use a service like CoinTracker, which can help you automatically generate your tax reports. Another option is to export your Trust Wallet data into a CSV file and then import it into a tax software like TurboTax. This will allow you to more easily calculate your gains and losses and file your taxes. Whatever method you choose, make sure to keep accurate records of your cryptocurrency transactions so that you can properly report them come tax time.

How to Use Trust Wallet for Tax Reporting

The first step is to create an account on Trust Wallet. After creating an account, users will need to provide some basic information, such as their name and email address.

Once users have provided their basic information, they will be able to access their Trust Wallet account. From here, users will be able to view all of the transactions that have taken place in their account.

Next, users will need to select the transactions that they would like to report. After selecting the transactions, users will need to click on the “Report” button.

From here, users will be able to provide the relevant information for their tax filings. For example, users can provide their income information, expenses information, and more.

Finally, users will need to complete the tax filing form. After completing the form, users will need to send it to the appropriate tax authority.

The Benefits of Using Trust Wallet for Tax Reporting

There are many benefits of using Trust Wallet as your go-to tax reporting platform. First and foremost, it’s user-friendly and easy to use, which makes it a great choice for people who are new to filing taxes or those who need help getting started. Second, Trust Wallet offers a wide range of features that make it ideal for tax preparation and filing. Third, Trust Wallet is secure and reliable, which means that you can trust that your information will be kept private and confidential. Finally, Trust Wallet offers a variety of helpful resources and support, so you can get the most out of using it.

Why You Should Use Trust Wallet for Tax Reporting

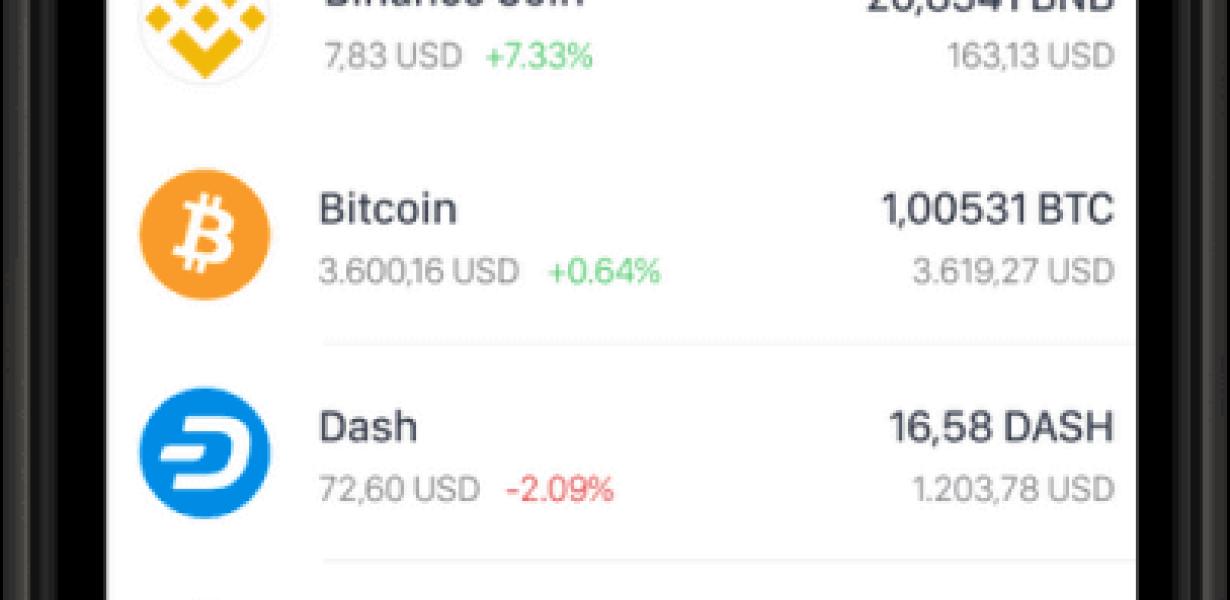

Trust Wallet is a great option for tax reporting because it offers a user-friendly interface and supports a variety of currencies. Additionally, the app is easy to use and provides accurate tax reports.

5 Reasons to Use Trust Wallet for Tax Reporting

1. Trust Wallet is a secure and easy-to-use tax platform.

2. It has a wide range of features to help you with tax reporting, including a tax calculator, automatic filing, and more.

3. The platform is mobile-friendly, so you can use it on the go.

4. It offers a variety of security features, including two-factor authentication and a secure vault to store your data.

5. The Trust Wallet team is dedicated to providing helpful and reliable support.

The Advantages of Using Trust Wallet for Tax Reporting

There are a few advantages to using Trust Wallet for tax reporting. First, it is an easy-to-use platform that allows users to manage their tax filings in a simple and organized way. Second, it offers quick and easy access to tax information, which can help reduce the time needed to file taxes. Finally, Trust Wallet offers a variety of security features that can help protect your personal information and financial data.

How Trust Wallet Can Help You with Your Taxes

One of the great things about using a trust wallet is that it can help you with your taxes. By using a trust wallet, you can keep track of all of your assets and transactions in one place. This can make it easier to keep track of your finances and ensure that you are paying your taxes accurately.

The Simplicity of Using Trust Wallet for Tax Reporting

The simplicity of using Trust Wallet for tax reporting is that it is a mobile app that allows users to electronically file their taxes. This app makes tax filing easy by providing users with step-by-step instructions on how to complete their taxes. Additionally, Trust Wallet offers a variety of helpful features, such as the ability to create and save tax returns, track your tax progress, and receive real-time notification updates about your tax filing status. Overall, using Trust Wallet for tax reporting is a simple and easy process that will help you get your taxes filed and processed quickly.

The Ease of Use When it Comes to Trust Wallet and Taxes

One of the biggest benefits of using a trust wallet is that it is extremely easy to trust. This is because trust wallets are built on the blockchain, which is a secure system that allows for transparency and accountability. Additionally, trust wallets also take care of all the tax paperwork for you, so you don't have to worry about any of that.

How Trust Wallet Makes Tax Reporting Easy

One of the benefits of using a trust wallet is the ease with which taxes can be filed. When using a trust wallet, all transactions are recorded on the blockchain, which makes it easy to track taxes owed. Additionally, trust wallets offer features such as automatic tax reporting, which makes it easy to keep track of tax obligations.