Trust wallet reports to the IRS.

Trust wallet reports to the IRS that it is holding $100 in Bitcoin for John Doe.

Trust Wallet Report To IRS: What You Need To Know

If you are an individual who owns a business, then you should be familiar with the tax implications of conducting business through a digital wallet. In this article, we will provide you with a summary of what you need to know in order to report your cryptocurrency transactions to the IRS.

What Is A Digital Wallet?

A digital wallet is a software application that allows you to store your cryptocurrencies offline. This means that you do not have to rely on a third party to store your coins, and you can control your own private keys.

How Do I Report My Cryptocurrency Transactions To The IRS?

The first step is to create a digital account with the IRS. The IRS has created a digital account specifically for reporting cryptocurrency transactions. You can find more information about creating an account on the IRS website.

Once you have created an account, you will need to deposit your cryptocurrencies into your digital account. You can do this by transferring your coins to a digital wallet that the IRS has approved. Alternatively, you can sell your cryptocurrencies and pay taxes on the profits using the digital account.

Once you have deposited your cryptocurrencies into your digital account, you will need to report your transactions. You can do this by filing Form 1040, Schedule C, or Form 1040NR. You will need to include all of the information that you used to purchase and sell your cryptocurrencies.

Remember, it is important to keep track of all of your cryptocurrency transactions in order to ensure that you are paying the correct taxes. If you have any questions about reporting your cryptocurrency transactions to the IRS, please feel free to contact us.

Everything You Need To Know About Trust Wallet And Reporting To The IRS

If you are an individual taxpayer and you use Trust Wallet to pay your taxes, you should familiarize yourself with the following:

Trust Wallet is a digital wallet that allows taxpayers to make tax payments online.

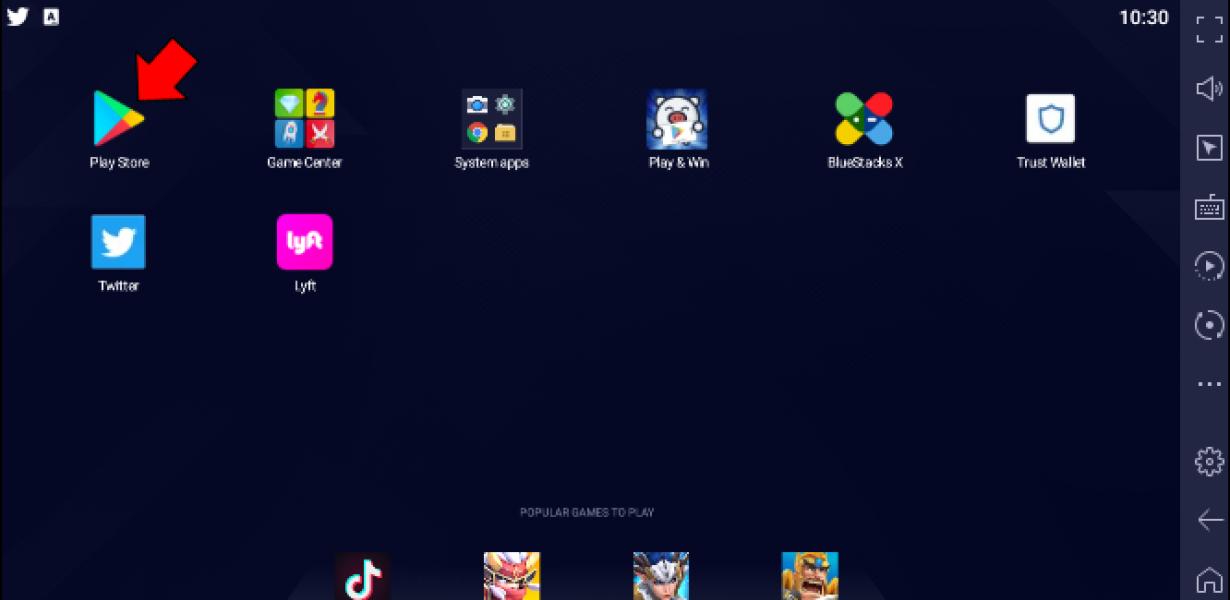

To use Trust Wallet, you must first create an account. After you have created your account, you can then login and access your account.

When you make a tax payment using Trust Wallet, the payment is processed through a third-party payment processor.

If you have questions about how to report your income and taxes using Trust Wallet, please contact our support team. Our team members are experts in IRS tax reporting requirements and can help you navigate the process.

Trust Wallet: How to Properly Report to the IRS

If you are an individual taxpayer, you will need to report income and deductions on Form 1040. To properly report income and deductions, you will need to keep track of the following information:

Your gross income

Your deductions

Your Adjusted Gross Income (AGI)

Your gross income is the total amount of money you earn from your job, investments, and other sources. Your deductions are the expenses that you can reduce your gross income by. Your AGI is the total of your gross income and your deductions.

To report your income and deductions to the IRS, you will need to complete Form 1040. You will also need to submit copies of your tax returns to the IRS.

What is Trust Wallet and Why Should I Report It To The IRS?

Trust Wallet is a mobile app that allows users to store and manage their cryptocurrencies. Because the app allows users to store their cryptocurrencies in a digital wallet, it could be considered a cryptocurrency exchange. If you use Trust Wallet to trade cryptocurrencies, you may be considered a cryptocurrency trader and may need to report your income and gains on Form 1040.

The Benefits of Using Trust Wallet and How to Report It To The IRS

If you are a taxpayer and use Trust Wallet to pay your taxes, you may be able to claim some of the benefits associated with using the trust wallet. For example, if you use Trust Wallet to pay your taxes through an account that you own, you may be able to claim a deduction for the amount that you paid in taxes using the trust wallet. Additionally, if you use Trust Wallet to pay your taxes through an account that is owned by someone else, you may be able to claim a deduction for the amount that you paid in taxes using the trust wallet. Finally, if you use Trust Wallet to pay your taxes through an account that is held by a trustee, you may be able to claim a deduction for the amount that you paid in taxes using the trust wallet.

How to Use Trust Wallet and Ensure You're Reporting It To The IRS Correctly

When you use Trust Wallet to make a tax payment, you'll need to report the payment to the IRS correctly. Here are some tips:

1. Report the payment as income.

If you're making a payment through Trust Wallet, you should report it as income. This means you'll need to include the payment in your taxable income for the year in which it was made.

2. Report the payment as a credit against your taxes.

If you're using Trust Wallet to make a tax payment, you can also choose to report it as a credit against your taxes. This means that the IRS will consider the payment to be a reduction in your taxes due.

3. Use Trust Wallet's estimated tax calculator to see how the payment will affect your taxes.

If you're using Trust Wallet to make a tax payment, we recommend using our estimated tax calculator to see how the payment will affect your taxes. The calculator will help you figure out how much of the payment will be used to reduce your taxes, and how much will be used to cover your costs associated with filing taxes.

8 Reasons Why You Should Be Using Trust Wallet and How to Report It

1. Trust Wallet is one of the most user-friendly wallets on the market.

2. It allows you to store a variety of cryptocurrencies, including bitcoin, ethereum, and litecoin.

3. The wallet also supports the storage of ERC20 tokens.

4. The trust wallet team is constantly working to improve the user experience.

5. If you have lost your trust wallet password, you can easily reset it.

6. If you experience any problems with the trust wallet, you can easily contact the support team for help.

7. The trust wallet is highly secure, making it a great choice for storing your cryptocurrency assets.

8. The trust wallet allows you to make transactions with ease, making it a perfect choice for everyday use.

Make Sure You're Reporting Trust Wallet To The IRS Properly

If you are a trust wallet holder and you have not yet filed your tax return, you should do so as soon as possible. You should also make sure that you are reporting trust wallet holdings accurately on your tax form. If you have any questions about how to correctly report your trust wallet holdings, you should contact your tax preparer or an accountant.

Trust Wallet: The Complete Guide to Reporting It To The IRS

If you are a taxpayer and you use a cryptocurrency wallet to pay your taxes, you should report it to the IRS. Here is a guide to reporting it to the IRS.

What is a Cryptocurrency Wallet?

A cryptocurrency wallet is a digital account where you can store your cryptocurrencies. Cryptocurrency wallets allow you to send and receive cryptocurrencies, as well as store them.

How Do I Report My Cryptocurrency Wallet To The IRS?

To report your cryptocurrency wallet to the IRS, you will first need to determine if you are considered a taxpayer. If you are a taxpayer, you must report your cryptocurrency wallet to the IRS as part of your tax return.

Once you have determined if you are a taxpayer, you need to report your cryptocurrency wallet to the IRS using the correct form. The form you will need to use depends on the type of cryptocurrency wallet you are using.

For example, if you are using a traditional cryptocurrency wallet, you will need to report it using Form 1099-K. If you are using a cryptocurrency exchange wallet, you will need to report it using Form 1099-B.

Once you have reported your cryptocurrency wallet to the IRS, you should keep track of the information used to report it. This information includes your wallet address, type of cryptocurrency wallet, and the amount of cryptocurrency you have in your wallet. You should also keep track of the date you filed your tax return and the cryptocurrency values at that time.