Taxes For Trust Wallet

If you're looking for a digital wallet to store your cryptocurrency, you may be wondering if Trust Wallet is the right choice. In this article, we'll take a closer look at Trust Wallet and whether or not it's a good option for storing your digital currency. Trust Wallet is a digital wallet that supports a variety of different cryptocurrencies. You can use Trust Wallet to store your Bitcoin, Ethereum, Litecoin, and other digital assets. Trust Wallet is a Hierarchical Deterministic (HD) wallet, which means that your private keys are generated from a single seed phrase. One of the advantages of Trust Wallet is that it offers support for multiple languages. You can use Trust Wallet in English, Spanish, French, German, Italian, Portuguese, Russian, and Chinese. Trust Wallet is also one of the few digital wallets that offer support for Trezor hardware wallets. If you have a Trezor device, you can use it with Trust Wallet to store your cryptocurrency offline in cold storage. Overall, Trust Wallet is a good choice for those looking for a digital wallet to store their cryptocurrency. It offers support for multiple languages and Trezor hardware wallets, and it's easy to use.

How to File Taxes for Trust Wallet Users

If you are a Trust Wallet user, follow these steps to file taxes:

1. Open the Trust Wallet app and click on the three lines in the top left corner.

2. Under "Accounts and Accounts Receivable," click on "File Taxes."

3. On the "File Taxes" page, enter your information and click on "Submit."

4. You will now receive a notification that your taxes have been filed.

What Taxes You Need to Pay as a Trust Wallet User

There are a few taxes you may need to pay as a trust wallet user. For example, if you are using your trust wallet to store assets for someone else, you may need to pay income tax on those assets. Additionally, if you are using your trust wallet to invest in securities, you may need to pay capital gains or income tax on those investments.

The Different Types of Taxes You May Owe as a Trust Wallet User

There are many types of taxes that you may be responsible for as a trust wallet user. Some of the most common taxes include income taxes, estate taxes, and gift taxes.

Income Taxes

As a trust wallet user, you may be liable for income taxes on any profits that you earn from your trust wallet activities. Income taxes may be based on your overall income or on the income that you earn from your trust wallet investments.

Estate Taxes

If you are the trustee of a trust, you may also be responsible for estate taxes. Estate taxes are taxes that are levied on the assets of a deceased person or on the assets of a person who has died without leaving a will.

Gift Taxes

You may also be responsible for gift taxes if you give money or assets to someone else as a gift. Gift taxes are a tax that is levied on gifts that are over a certain threshold.

How to Avoid Paying Taxes on Your Trust Wallet Earnings

Trust wallets are a new way to store and earn bitcoins. Unlike traditional bitcoin wallets, which are operated by individuals, trust wallets are operated by a trust. This means that the trust is responsible for all aspects of the wallet's operation, including handling of user funds and payments to miners.

Since trust wallets are operated by a trust, it is important to understand how trusts are taxed. The Internal Revenue Service (IRS) treats a trust as a separate entity for tax purposes. This means that the trust is responsible for paying taxes on its own income, including any bitcoin earned from the trust wallet.

To avoid paying taxes on your trust wallet earnings, it is important to follow the trust's tax guidelines. In addition, it is also important to keep track of your trust wallet's earnings and expenses so that you know exactly where your money is going.

What to Do If You Can't Pay Your Taxes on Time

If you can't pay your taxes on time, you may have to file a tax return late. You may also be subject to penalties and interest.

How to Lower Your Taxes as a Trust Wallet User

There are a few ways to lower your taxes as a trust wallet user. The easiest way is to use a trust account to hold your assets, rather than using a personal account. This will reduce your taxable income. Another way to reduce your taxes is to invest in tax-advantaged accounts, such as 401(k)s and IRAs. Finally, you can use tax deductions and credits to reduce your taxes even further.

Should You Use a Tax Professional to Help with Your Trust Wallet Taxes?

There is no one-size-fits-all answer to this question, as the best way to handle your trust wallet taxes will depend on your specific situation. However, if you are unsure about how to file your taxes or if you have questions about specific trust wallet tax laws, it is always a good idea to consult with a tax professional.

5 Tips for Filing Your Trust Wallet Taxes

1. Consult a professional tax advisor to help you file your trust wallet taxes.

2. Review the specific trust wallet tax requirements for your specific situation.

3. Make sure you have all the required documents and information to file your trust wallet taxes.

4. File your trust wallet taxes as soon as possible to avoid penalties.

5. Keep a copy of your trust wallet tax forms for future reference.

3 Common Mistakes People Make When Filing Their Trust Wallet Taxes

1. Filing their trust wallet taxes late.

2. Not properly documenting their trust wallet transactions.

3. Not accurately tracking their trust wallet investments.

How to Get the Most Out of Your Tax Return as a Trust Wallet User

There are a few things to keep in mind when using a tax return as a trust wallet. First, make sure to include all of your income and expenses on your tax return. This will help you track your progress and make sure you are getting the most out of your trust wallet.

Second, make sure to itemize your deductions on your tax return. This will allow you to maximize the benefits of your trust wallet and get the most money back from the government.

Finally, make sure to keep track of your money. You should review your trust wallet account every quarter to make sure you are getting the most out of your trust funds.

What to Do If You Think You Owe Too Much in Trust Wallet Taxes

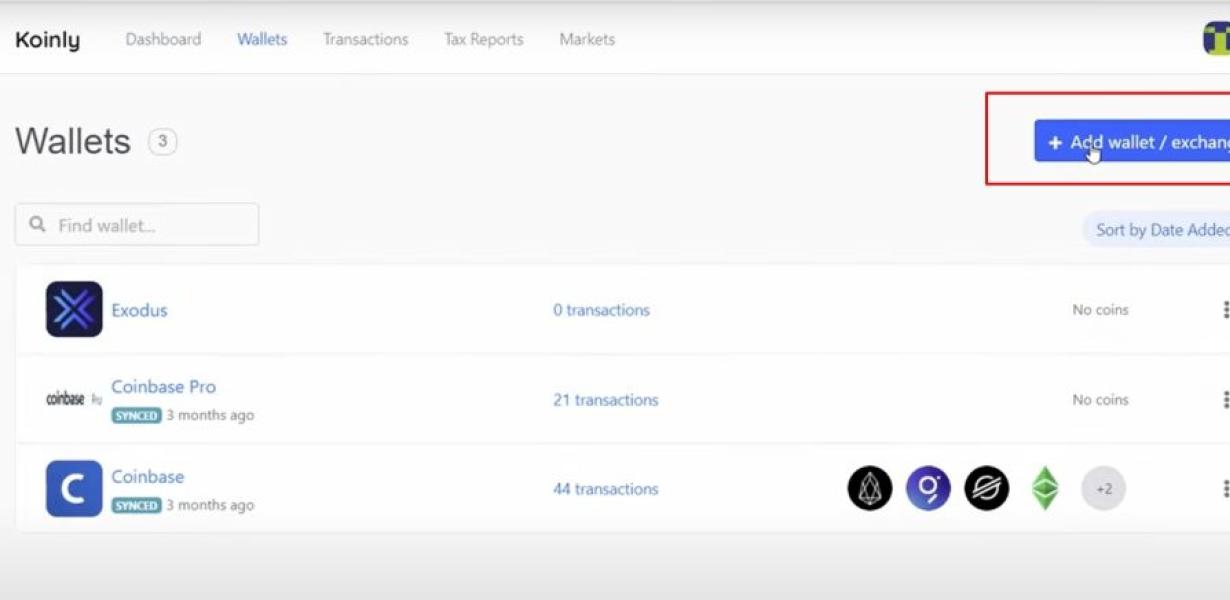

If you think you may owe taxes in relation to your trust wallet, there are a few things you can do to try and rectify the situation. First and foremost, you should consult with a tax professional to get an accurate estimate of your taxes due. Additionally, you can use a tax preparation software program to help you organize and file your taxes quickly and easily. Finally, you can make sure to keep accurate records of all transactions made in your trust wallet, in case you need to file a claim for a refund.

How to Appeal a Trust Wallet Tax Decision

If you disagree with a trust wallet tax decision, you may be able to appeal the decision. To appeal a trust wallet tax decision, you must first contact the IRS and submit a petition for review. The IRS will then review your case and make a decision. If the IRS decides to uphold the original trust wallet tax decision, you may have to pay the taxes that were imposed. If the IRS decides to overturn the trust wallet tax decision, you may be able to avoid paying the taxes.