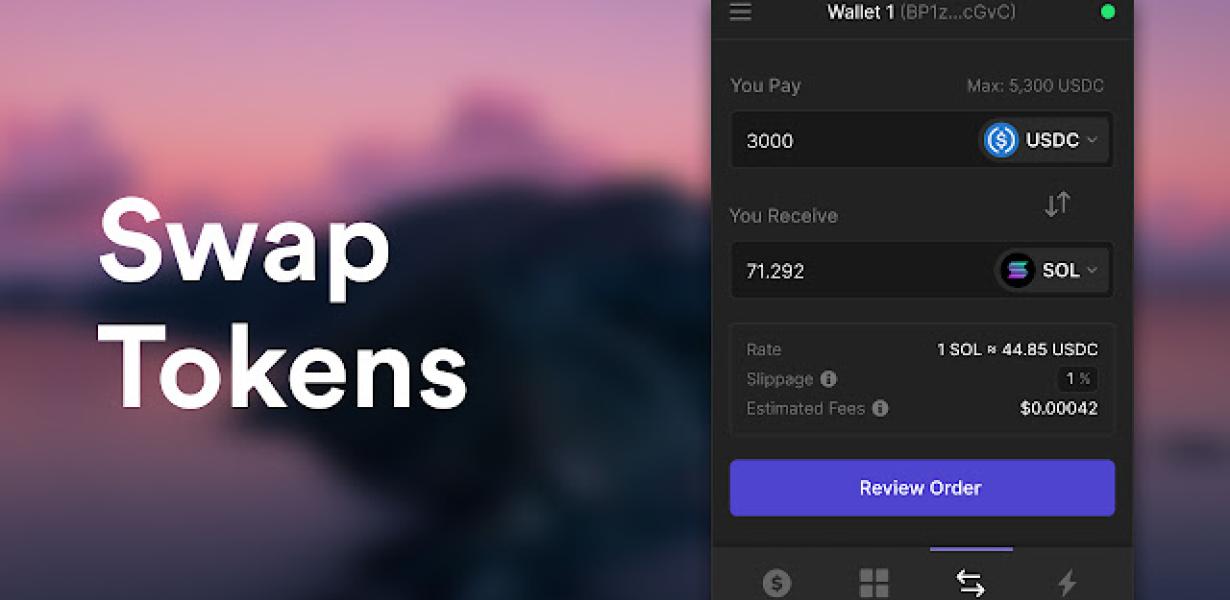

Phantom Wallet Fees

When you send or receive cryptocurrencies, you may notice a small fee attached to the transaction. These fees go to the "miners" who validate and process the transactions. However, some wallets will charge an additional "phantom" fee on top of the miners' fees. These phantom fees can be quite costly, and they are often hidden in the wallet's terms and conditions. Be sure to check your wallet's fees before sending or receiving any cryptocurrency!

The fees you didn't know were hiding in your wallet

There are a number of fees that can sneak up on you when you're not paying attention. For example, when you're using your credit card, there are usually fees associated with that. And even if you're using a debit card, there can be fees for using that too.

There are also fees associated with bank account transactions. For example, if you're depositing money into your bank account, you might have to pay a fee for that. And if you're withdrawing money from your bank account, you might have to pay a fee for that too.

And finally, there are fees associated with using certain types of loans. For example, if you're borrowing money to buy a car, you might have to pay a fee for that.

How to avoid phantom wallet fees

There is no one-size-fits-all answer to this question, as the best way to avoid phantom wallet fees will vary depending on your specific circumstances. However, some tips to avoiding phantom wallet fees include using a wallet that is compatible with the network you are using, using a wallet that has been recommended by friends or family, and using a wallet that has been officially endorsed by the network you are using.

The true cost of those free wallets

If you use a free wallet, you’re going to have to pay for storage and processing fees. These fees can add up over time, especially if you don’t use your wallet often. Additionally, free wallets may not offer the same level of security as more expensive options. Finally, free wallets may not offer the same level of features as more expensive options, such as the ability to store multiple currencies.

How to spot a wallet with hidden fees

There are a few ways to spot a wallet with hidden fees. First, check the fees associated with sending and receiving transactions. Often, wallets with high fees will also have high transaction minimums, which can make it difficult to use the wallet. Second, look for wallets that offer a variety of payment methods, as these wallets are likely to have lower fees. Finally, be sure to read the terms and conditions of the wallet before signing up, as some wallets may have hidden fees that are not always mentioned in the app's description.

The best wallets for avoiding fees

There are a few different ways to avoid fees when using cryptocurrency. The three most popular methods are:

1. Use a wallet that doesn't charge fees

Some wallets, like Coinomi, don't charge any fees. This means that you can keep your coins in the wallet and use them as you please without worrying about any additional costs.

2. Use a wallet that charges low fees

Some wallets, like Jaxx, charge very low fees. This means that you can easily send and receive cryptocurrencies without having to worry about any additional costs.

3. Use a wallet that charges high fees

Some wallets, like Coinbase, charge high fees. This means that you will have to pay a fee each time you want to send or receive cryptocurrencies.

How to keep your wallet from costing you more than it should

When you're shopping for a wallet, keep in mind that the more features it has, the more expensive it will be. A simple, basic wallet will cost less than a more feature-rich wallet.

Also, make sure to choose a wallet that is comfortable to carry and fits your lifestyle. Some people prefer small wallets that can fit in a pocket, while others prefer larger wallets that can hold more money.