Metamask Taxes

Metamask is a digital asset platform that allows users to buy, sell, and store cryptocurrencies. The platform recently announced that it will be adding a new feature that will allow users to pay their taxes using the cryptocurrency. This new feature will be available to users in the United States, and will allow them to pay their federal and state taxes using the cryptocurrency. This new feature is a positive development for the cryptocurrency community, as it shows that the platform is willing to work with the government to help make the tax system more efficient.

Metamask and Taxes: What You Need to Know

If you use a metamask to purchase cryptocurrency, there are a few things you need to know about taxation.

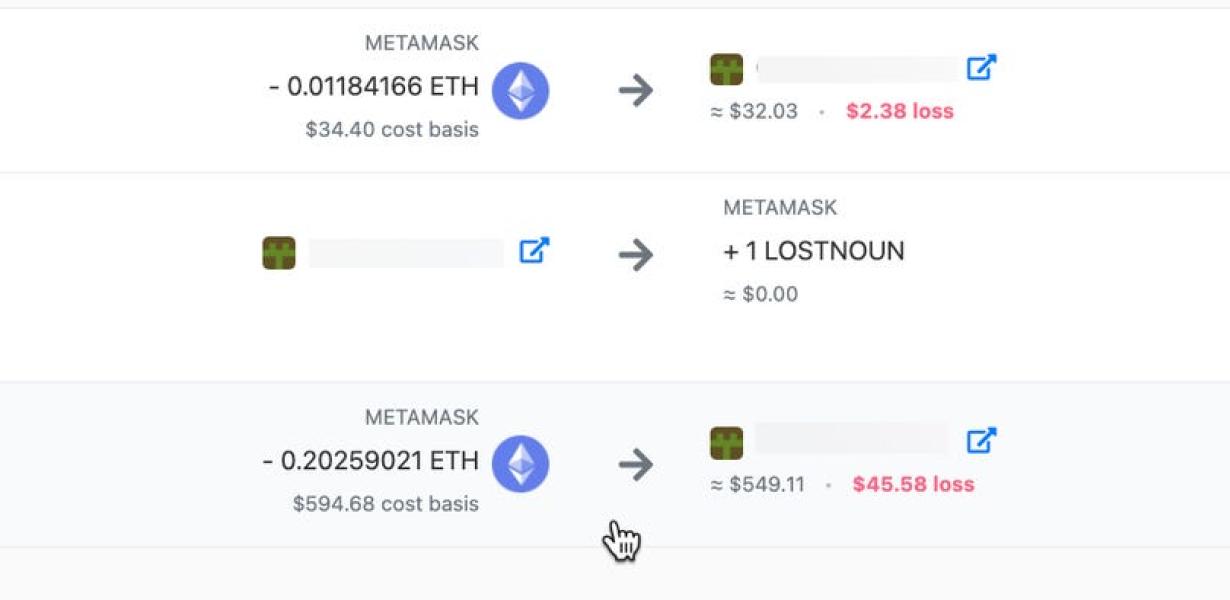

First, cryptocurrency is treated as property for tax purposes. This means that you will owe tax on the value of your cryptocurrency holdings at the time of purchase, as well as any gains or losses you may experience in the future.

Second, you will need to file a tax return reporting your cryptocurrency holdings and any associated gains or losses. You will also need to pay tax on any income generated from your cryptocurrency holdings.

Finally, if you are a US taxpayer, you may also be subject to capital gains taxes if you sell your cryptocurrency holdings.

The Ultimate Guide to Metamask & Taxes

If you are a cryptocurrency investor, you likely use Metamask to manage your holdings and transactions. Here we provide an overview of how Metamask works and how it may affect your taxes.

What is Metamask?

Metamask is a browser extension that allows users to manage their cryptocurrency holdings and transactions. It uses the ethereum blockchain to manage user accounts and transactions.

How Does Metamask Work?

When you install the Metamask extension, it creates a new ethereum wallet on your computer. This wallet has the ability to hold ether and other cryptocurrencies. You can then use this wallet to manage your holdings and transactions.

When you make a purchase or send a transaction, Metamask will use the ethereum blockchain to verify the transaction. This process is known as “proof-of-stake”.

Metamask also provides a security feature. When you open the extension, it will ask you to select a password. This password is used to protect your account from unauthorized access.

How Does Metamask Affect My Taxes?

Metamask is a digital asset management tool. This means that it may be treated as a “digital asset” for tax purposes.

As a digital asset, Metamask may be subject to capital gains or losses when you sell or trade your holdings. It may also be subject to income or gift taxes.

If you use Metamask to make a purchase or send a transaction, the transaction may also be subject to value-added tax (VAT).

Everything You Need to Know About Metamask & Taxes

Metamask is a blockchain-based platform that allows users to manage their identities and transactions in a secure and compliant way.

When using Metamask, users will need to pay taxes on their crypto transactions. There is no one-size-fits-all answer to this question, as the tax rules for cryptocurrency vary from country to country. However, there are some general tips that can help.

For example, if you are a US citizen, you will likely need to report your crypto gains on your tax return. If you are not a US citizen, you may still be subject to tax laws in your country of residence, so it is important to consult an accountant or tax specialist to find out more.

In addition, it is important to keep track of your Metamask account and tokens. If you lose your Metamask wallet or passphrase, you will not be able to access your tokens or account. Make sure to keep copies of all important documents, such as your Metamask account login information and your private key.

Metamask & Taxes: The Complete Guide

If you are using a metamask to hold your ETH and ERC20 tokens, then you will likely need to pay taxes on those holdings. This guide will help you understand the tax implications of owning cryptocurrency and how to pay taxes on your holdings.

What is a Metamask?

A metamask is a tool that allows you to interact with the Ethereum network and hold your own Ethereum and ERC20 tokens. Metamasks work by allowing you to hold your tokens in a separate account from the one you use to interact with the Ethereum network.

How Does a Metamask Work?

When you first install a metamask, it will generate a new address for you to use. This address will be unique to your metamask and will not be associated with any other account. To use your metamask, you will need to send your tokens from your main account to the metamask address. Once your tokens have been sent to the metamask address, you can use the metamask to interact with the Ethereum network.

How Do I Pay Taxes on My Cryptocurrency Holdings?

If you are using a metamask to hold your cryptocurrency, then you will likely need to pay taxes on those holdings. There is no single answer to this question since tax laws vary from country to country. However, there are some general tips that can help you manage your tax obligations.

First, it is important to understand that cryptocurrency is treated as property for tax purposes. This means that you will need to pay taxes on the value of your cryptocurrency holdings as well as any income that you earn from those holdings.

Second, it is important to keep track of your cryptocurrency holdings. You will need to track the value of your holdings and report any changes in value to the appropriate tax authority. This information will help you calculate your taxes and ensure that you are paying the correct amount.

Finally, it is important to remember that cryptocurrency is a volatile asset. This means that your income may fluctuate significantly from year to year. If this is the case, be sure to adjust your taxes accordingly.

A Beginner's Guide to Metamask & Taxes

Metamask is a web browser extension that allows users to interact with decentralized applications (dApps) and smart contracts.

As a decentralized application and smart contract platform, Metamask has its own set of tax implications. Here we provide a beginner's guide to help you understand the basics of taxes and how they apply to Metamask.

What is a decentralized application?

A decentralized application is a type of software that runs on a blockchain network. This means that it is decentralized, meaning that it is not subject to the control of any single party.

What is a smart contract?

A smart contract is a type of contract that is powered by blockchain technology. It is a digital record of a transaction between two parties. Smart contracts are enforced by a code that is stored on a blockchain.

How does Metamask work?

Metamask works by allowing users to interact with decentralized applications and smart contracts. It acts as a gateway between these applications and the blockchain network.

How do taxes apply to Metamask?

When you use Metamask to access dApps or smart contracts, you are interacting with these applications on behalf of yourself. As a result, you are responsible for any taxes that may apply.

For example, if you use Metamask to purchase goods or services from a dApp or smart contract, you will likely have to pay taxes on these transactions. You may also have to pay taxes on any profits that you make from using Metamask.

It is important to keep track of your tax obligations when using Metamask. If you have any questions about taxes or how they apply to Metamask, please contact your accountant or tax specialist.

How to Use Metamask for Taxes

Metamask is a web application that allows users to interact with the Ethereum blockchain. It can be used to pay bills, send and receive ether, and more.

To use Metamask for taxes, first create an account. Once you have created your account, open the Metamask application and click on the "Create a new wallet" button.

Next, enter your metamask address and password into the "Address" and "Password" fields, respectively. Click on the "Create wallet" button.

Once you have created your Metamask wallet, you will need to add a new account. To do this, click on the "Add account" button on the left-hand side of the Metamask application.

Enter the account's name and email address into the " Account Name " and " Email " fields, respectively. Click on the "Create account" button.

Now that you have added both accounts, you can start transacting with Ethereum. To pay a bill with Metamask, first open the Metamask application and click on the "Ether" tab.

Next, select the bill you want to pay from the list of bills. On the right-hand side of the screen, you will see information about the bill, including its id and amount.

To send ether to another account with Metamask, first open the Metamask application and click on the "Send Ether" tab.

Next, enter the recipient's address into the "To" field and the amount of ether you want to send into the "Amount" field. Click on the "Send Ether" button.

The ins and outs of Metamask and taxes

Metamask is a digital asset management (DAM) platform that allows users to interact with decentralized applications (dApps) and smart contracts.

When using Metamask, users will need to pay taxes on any cryptocurrency or token earnings. Like other cryptocurrencies and tokens, these earnings will be taxable if they are considered to be capital gains or losses.

Metamask also has a built-in tax calculator to help users figure out their tax liabilities.

What to consider when using Metamask for taxes

When using Metamask for taxes, it's important to consider the various tax laws that may apply. For instance, if you're a cryptocurrency investor, you may be subject to capital gains taxes. Additionally, if you're using Metamask to purchase assets such as cryptocurrencies or digital tokens, you may need to pay taxes on those transactions. To avoid potential taxes, it's important to consult with a tax professional.