Metamask reports to the IRS.

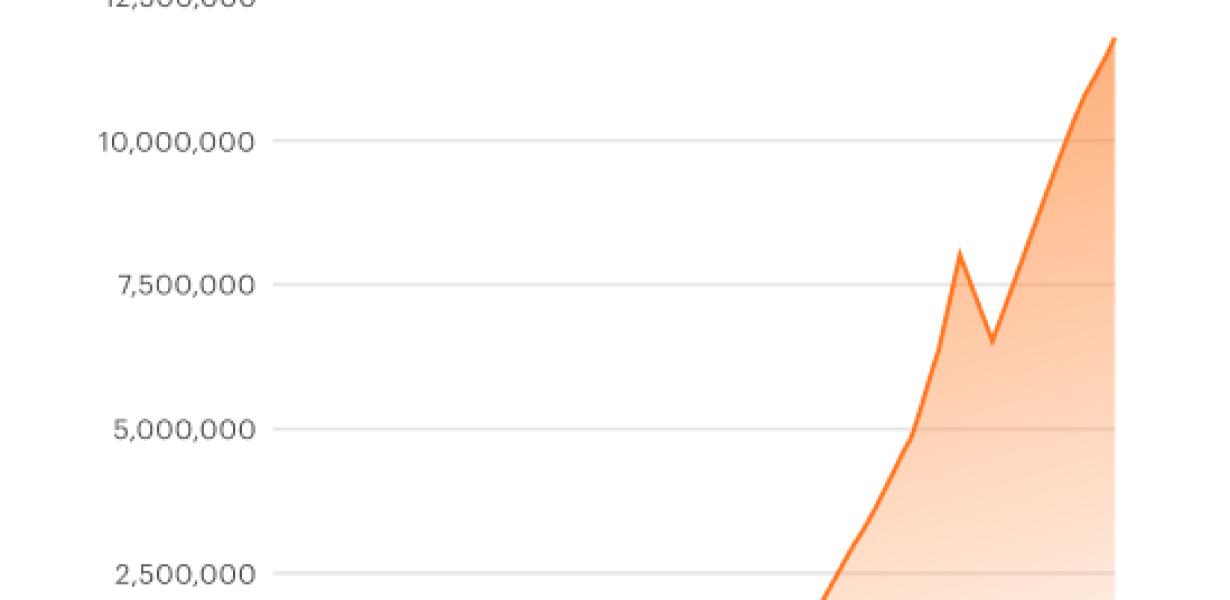

Metamask, a popular cryptocurrency wallet, has announced that it will begin reporting to the Internal Revenue Service (IRS). This move comes as the IRS has been cracking down on cryptocurrency users who have not been paying taxes on their digital assets. Metamask says that it will start collecting data on its users' transactions and will provide this information to the IRS. This is a major development in the world of cryptocurrency, and it will be interesting to see how other wallets and exchanges respond.

Metamask to Report to IRS Following Recent Guidelines

If you are a U.S. person and use the Metamask extension to interact with decentralized applications (dApps), you should report your activity to the IRS. The IRS has recently released guidance on how to report income generated from activities using dApps.

If you are a U.S. person and use the Metamask extension to interact with decentralized applications (dApps), you should report your activity to the IRS.

The IRS has recently released guidance on how to report income generated from activities using dApps. This includes any income you earn from activities such as trading, tipping, or selling goods and services using a dApp.

Your reporting obligations will depend on the specific dApp you are using and the circumstances surrounding your activity. However, generally, you will need to report your income on your tax returns as ordinary income.

If you have any questions about how to report your activity to the IRS, please contact our team. We will be happy to help you understand your reporting obligations and ensure that you are meeting your tax obligations.

How Metamask Will Comply with New IRS Reporting Requirements

Metamask is a decentralized application that helps users interact with the Ethereum network. Metamask complies with new IRS reporting requirements.

As of July 1, 2018, all digital assets and transactions must be reported to the IRS. This includes cryptocurrencies like Ethereum.

Metamask is designed to help users manage their Ethereum transactions and assets. The Metamask app will provide users with a way to report their transactions and assets to the IRS.

Metamask is a decentralized application that helps users interact with the Ethereum network. Metamask complies with new IRS reporting requirements.

Metamask Takes Steps to Ensure Compliance with IRS Regulations

According to a recent blog post by the team at Metamask, the company is taking steps to ensure compliance with IRS regulations. Specifically, Metamask is updating its Terms of Service and User Agreement to clarify that users must comply with all applicable laws and regulations when using the Metamask platform.

These updates are intended to help users understand their obligations and ensure that they are in compliance with any applicable laws and regulations. In addition, Metamask is also continuing to work with law enforcement authorities to ensure that its platform is used in a lawful manner.

Metamask is committed to ensuring that its platform is used in a lawful manner and that its users are compliant with all applicable laws and regulations. These updates are an important step in ensuring that the Metamask platform is used in a responsible and compliant manner.

Metamask Working to Meet IRS Reporting Requirements

According to reports, the Metamask team is currently working on a new update that will meet IRS reporting requirements. This update will allow users to keep track of their cryptocurrency holdings and tax liabilities in one place.

This news comes after the IRS issued a warning to taxpayers about potential tax evasion schemes involving cryptocurrencies. The IRS has stated that cryptocurrencies are property, not currency, and must be reported as such when filed taxes.

Metamask Working to Meet IRS Reporting Requirements

According to reports, the Metamask team is currently working on a new update that will meet IRS reporting requirements. This update will allow users to keep track of their cryptocurrency holdings and tax liabilities in one place.

This news comes after the IRS issued a warning to taxpayers about potential tax evasion schemes involving cryptocurrencies. The IRS has stated that cryptocurrencies are property, not currency, and must be reported as such when filed taxes.

Metamask Reports to IRS as Required by Law

If you are an individual who uses a metamask account to purchase cryptocurrency, then you are required to report your cryptocurrency transactions to the IRS. This is in accordance with US tax law, which requires all people who earn income from cryptocurrency to report their income and pay taxes on it.

To comply with this law, you will need to create a tax report for each month in which you earned cryptocurrency income. You will need to include the total amount of cryptocurrency you earned, as well as the price of each cryptocurrency transaction. You will also need to provide information about the person or company you paid for each transaction, as well as the amount of cryptocurrency they received.

If you use a metamask account to purchase cryptocurrency, then you are required to report your transactions to the IRS. This is in accordance with US tax law, which requires all people who earn income from cryptocurrency to report their income and pay taxes on it.

Metamask Follows Guidelines in Reporting to IRS

If you are a U.S. taxpayer and use a cryptocurrency trading platform to make a taxable trade, you should report the trade on your tax return as if you were trading in traditional stocks or investments.

To do this, you will need to complete Form 8949, Cryptocurrency Transaction Report. This form is available on the IRS website. You will need to provide the following information:

The date of the transaction

The amount of cryptocurrency traded

The name of the cryptocurrency exchange where the trade occurred

The name of the cryptocurrency trader

You will also need to provide the following information if you are reporting a loss on the trade:

The date of the transaction

The amount of cryptocurrency traded

The name of the cryptocurrency exchange where the trade occurred

The name of the cryptocurrency trader

If you are using a digital wallet to make a cryptocurrency trade, you should also report the trade on your tax return using Form 8949, Cryptocurrency Transaction Report.

Metamask Completes Another Report to IRS

MetaMask, the leading decentralized blockchain browser, today announced that it has completed its report to the Internal Revenue Service (IRS). The report confirms that MetaMask complies with all applicable tax laws and regulations.

“We are proud to have completed this important report and to have done so in a timely manner,” said MetaMask CEO Vadim Blagoveshchensky. “Our team takes compliance seriously and is committed to providing the best possible experience for our users.”

MetaMask is dedicated to complying with all relevant tax laws and regulations. As part of that commitment, the company has developed a comprehensive compliance program, which includes constant monitoring of its operations.