Liquidity Mining

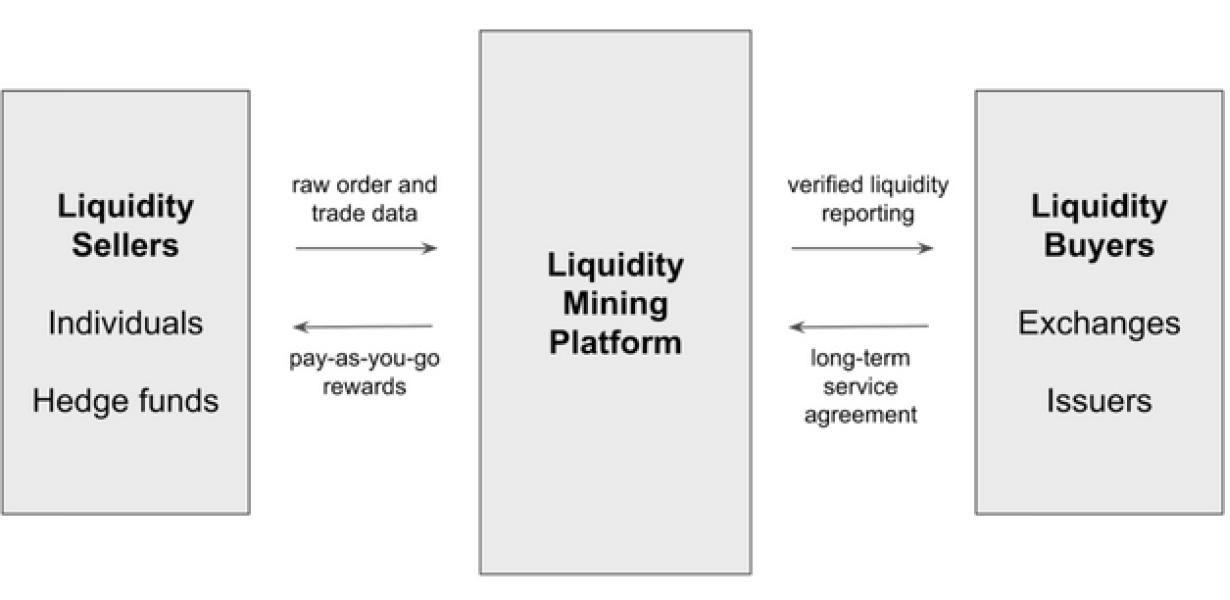

Liquidity mining is a type of mining in which miners are rewarded with tokens for providing liquidity to a protocol. This is done by buying and selling assets on behalf of the protocol in order to maintain a healthy balance of buy and sell orders. In return, miners receive a portion of the fees that are generated from these trades. Liquidity mining provides an incentive for users to participate in aprotocol and helps to ensure that there is always a liquid market for the underlying asset. It is a relatively new concept but has already been adopted by a number of protocols including MakerDAO, Compound, and Kyber Network.

How to Use Liquidity Mining to Maximize Your Crypto Earnings

Liquidity mining is a process by which miners attempt to earn cryptocurrency by buying and holding assets that can be easily converted into coins or tokens. While it is possible to mine cryptocurrencies using traditional methods, liquidity mining is an attractive option for those looking to increase their earnings potential.

There are a few key considerations when using liquidity mining:

1. The asset you choose to mine should have a high liquidity. This means that there is a high volume of trading activity surrounding the asset, which makes it easier for miners to purchase and sell the asset on a regular basis.

2. The asset should have a low price volatility. This means that the price of the asset is relatively stable, which makes it easier for miners to predict the future value of their holdings.

3. The asset should have a low mining difficulty. This means that it is easy for miners to find new blocks, which gives them an incentive to hold onto the asset.

4. The asset should have a low circulating supply. This means that there are not many coins or tokens in circulation, which makes it harder for miners to acquire an excessive amount of the asset.

5. The asset should have a high market capitalization. This means that the value of the asset is high relative to the number of coins or tokens in circulation.

Once you have determined which assets meet these criteria, you can begin mining them using a mining pool. Mining pools are groups of miners who combine their resources to help find new blocks more quickly. By joining a mining pool, you can increase your chances of earning rewards from the mining process.

What is Liquidity Mining and How Does it Work?

Liquidity mining is a process of extracting value from cryptocurrency networks by buying and selling cryptocurrencies. This is done by purchasing a cryptocurrency when its price is low and then selling it when its price is high.

The Benefits of Liquidity Mining for Crypto Investors

There are many benefits of liquidity mining for crypto investors. Here are just a few:

1. Liquidity gives investors a way to get their hands on cryptocurrencies that they may not be able to purchase directly.

2. It allows for arbitrage opportunities, which can allow investors to take advantage of price discrepancies between different markets.

3. Liquidity also provides a way for new investors to get involved in the cryptocurrency market without having to invest a large amount of money.

4. It helps to ensure that cryptocurrencies remain liquid and usable, since there is always a demand for them.

5. Finally, liquidity can also help to stabilize prices and increase the overall value of a cryptocurrency.

How Liquidity Mining Can Help Grow the Crypto Economy

The crypto economy is still in its early stages. There are a number of challenges that need to be addressed in order for the industry to grow. One of the biggest challenges is how to increase liquidity. Liquidity mining is one way that can help address this issue.

Liquidity is the ability of an asset to be exchanged quickly and at a fair price. It is important for the crypto economy to have a high level of liquidity in order to support a wide range of trading activities. Liquidity mining is a way to increase the liquidity of the crypto market.

Liquidity mining is a process of mining digital tokens that have a low supply. This makes the tokens more valuable as they are scarce. The process of liquidity mining is designed to create new and more valuable tokens.

There are a number of ways that liquidity mining can help increase the liquidity of the crypto market. One way is by creating new tokens. This increases the overall supply of the tokens, which makes them less valuable. Another way is by selling tokens that are already in circulation. This reduces the amount of tokens available and makes them more valuable.

Overall, liquidity mining is a helpful tool in increasing the liquidity of the crypto market. It can help to create new and more valuable tokens, which in turn supports wider trading activity.

The Risks of Liquidity Mining for Crypto investors

Liquidity mining is a popular way for cryptocurrency investors to make money by buying and selling digital assets. However, there are risks associated with liquidity mining.

One risk is that liquidity miners may not be able to sell their coins quickly enough when prices drop. This could lead to them losing money if the price of the coin falls below their initial investment.

Another risk is that liquidity miners may not be able to find new coins to buy when prices are high. This could lead to them losing money if the price of the coin goes up too high.

Overall, liquidity mining is a risky investment strategy that is best suited for experienced investors who are comfortable with risk.

What Experts Are Saying About Liquidity Mining

There is no one-size-fits-all answer to this question, as the liquidity mining industry is still in its early stages of development. However, some experts believe that liquidity mining could have a significant impact on the overall cryptocurrency market.

According to CCN, liquidity mining could help to improve the overall liquidity and stability of the cryptocurrency market. It could also help to attract new investors and traders to the market.

Some experts believe that liquidity mining could also help to reduce the volatility of the cryptocurrency market. This could help to make it more attractive for investors and traders.

Overall, liquidity mining could have a significant impact on the overall cryptocurrency market. It could help to improve the liquidity and stability of the market, and it could also reduce the volatility of the market.

The Pros and Cons of Liquidity Mining

There are a few pros and cons to liquidity mining, depending on the individual. For some, it can be a quick and easy way to get started in the cryptocurrency world. On the other hand, liquidity mining can also be a risky investment, since it is based on the assumption that the cryptocurrency will continue to be traded and exchanged.

Is Liquidity Mining Right for You?

The answer to this question largely depends on your business and what you hope to achieve through liquidity mining. If you are looking to increase the liquidity of your assets and raise capital quickly, then liquidity mining may be a good option for you. On the other hand, if you are looking to build a more long-term, stable business model, then liquidity mining may not be the best solution for you.