How to do metamask taxes?

If you own cryptocurrency, you may be required to pay taxes on your digital assets. Metamask can help you keep track of your crypto taxes. Here's how to do it: 1. Go to the Metamask website and create an account. 2. Connect your Metamask account to your exchange account. 3. Track your trades and transactions. 4. Calculate your capital gains and losses. 5. File your taxes!

How to use Metamask for your taxes

Metamask is a Chrome browser extension that helps you manage your crypto assets and taxes. To use Metamask for your taxes:

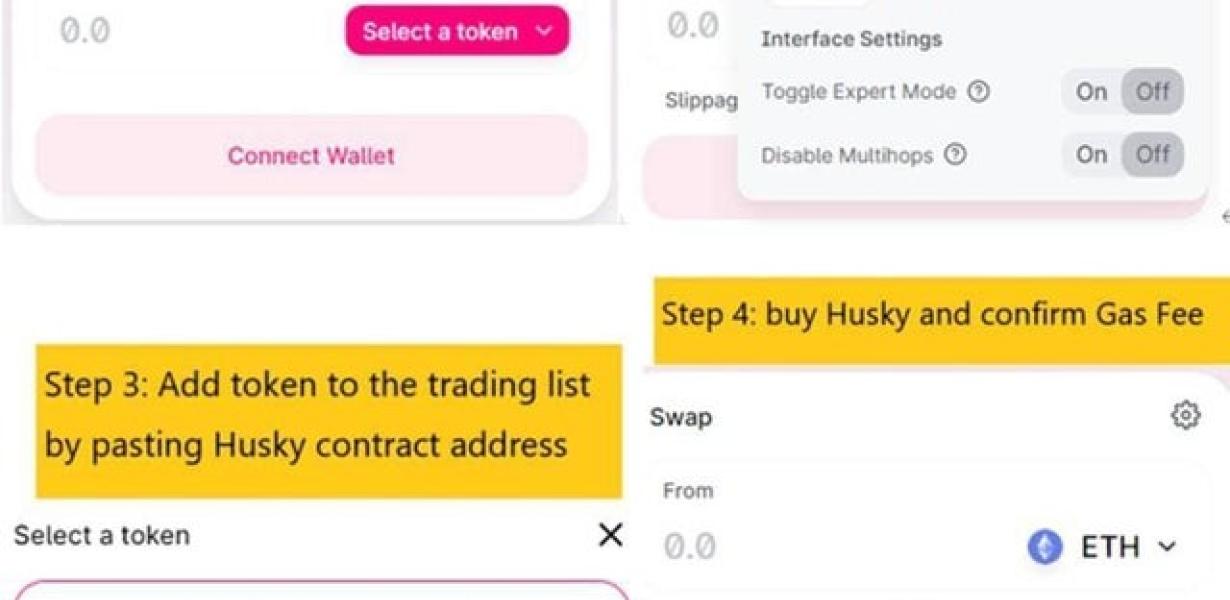

1. Open the Metamask extension.

2. Click on the "Add account" button.

3. Select your cryptocurrency wallet from the list of options.

4. Fill in your account's details, including your Ethereum address.

5. Click on the "Generate private key" button.

6. Copy the generated private key and store it securely. You will need this to access your funds in your wallet.

7. Click on the "Connect" button.

8. Enter your personal tax info, such as your taxpayer ID number and filing status.

9. Click on the "Save" button.

10. Close the Metamask extension.

How to keep track of your Metamask taxes

1. login to Metamask and click on the three lines in the top left corner of the main screen.

2. Under "account settings", click on "taxes".

3. Under "taxes", you will see a list of all your Metamask taxes. Click on the one you want to track.

4. Under "tax details", you will see how much tax you have paid, how much you still owe, and how much time you have until you have to pay it.

How to file your Metamask taxes

1. Go to MyEtherWallet.com and sign in.

2. Click on the "Contracts" tab and select the Metamask contract you want to file taxes on.

3. On the "Metamask Contract Info" page, under "Taxes" click on the "File Taxes" button.

4. Fill out the form with the relevant information and click on the "Upload File" button.

5. Metamask will automatically calculate and send your taxes to the appropriate jurisdiction.

What you need to know about Metamask taxes

Metamask taxes are taxes that are paid on cryptocurrency transactions. Every time you make a purchase with cryptocurrency, you may be subject to taxes depending on your country's tax laws.

When you use Metamask to make a purchase, the platform will automatically collect the necessary taxes for you. However, if you are not comfortable with this process, you can elect to pay the taxes yourself.

Most countries have specific tax laws that apply to cryptocurrencies. If you are not familiar with these laws, you may want to speak with a taxation specialist to ensure that you are paying the correct taxes.

6 tips for doing your Metamask taxes

1. Make sure your Metamask account is set up correctly – Metamask accounts need to be configured correctly in order to collect taxes correctly. Make sure you have a Metamask address, and that you’re using the correct Metamask token for your taxes.

2. Verify your tax information – Once you have your Metamask account configured and verified, you can verify your tax information by clicking on “Verify My Taxes.” You’ll need to provide your name, country of residence, and Metamask address to verify your taxes.

3. Claim your taxes – Once you have verified your taxes and found the correct Metamask token, you can claim your taxes by clicking on the “Claim My Taxes” button. You’ll need to provide your name, country of residence, and Metamask address to claim your taxes.

4. Pay your taxes – Once you have claimed your taxes and paid them using the correct Metamask token, you will receive a confirmation email. You can then safely delete your Metamask account and any associated data.

How to make sure you're doing your Metamask taxes right

There are a few things you can do to make sure you're doing your Metamask taxes right:

1. Make sure you're depositing your tokens into a compatible wallet. Metamask supports a variety of different wallets, so be sure to choose the right one for your holdings.

2. Review your transaction history. Metamask will track all of your transactions, so be sure to review your past transactions to make sure you're following the correct tax rules.

3. Consult with a tax professional if you have any questions about your Metamask taxes. They can help you navigate the complex tax laws surrounding cryptocurrency investments.