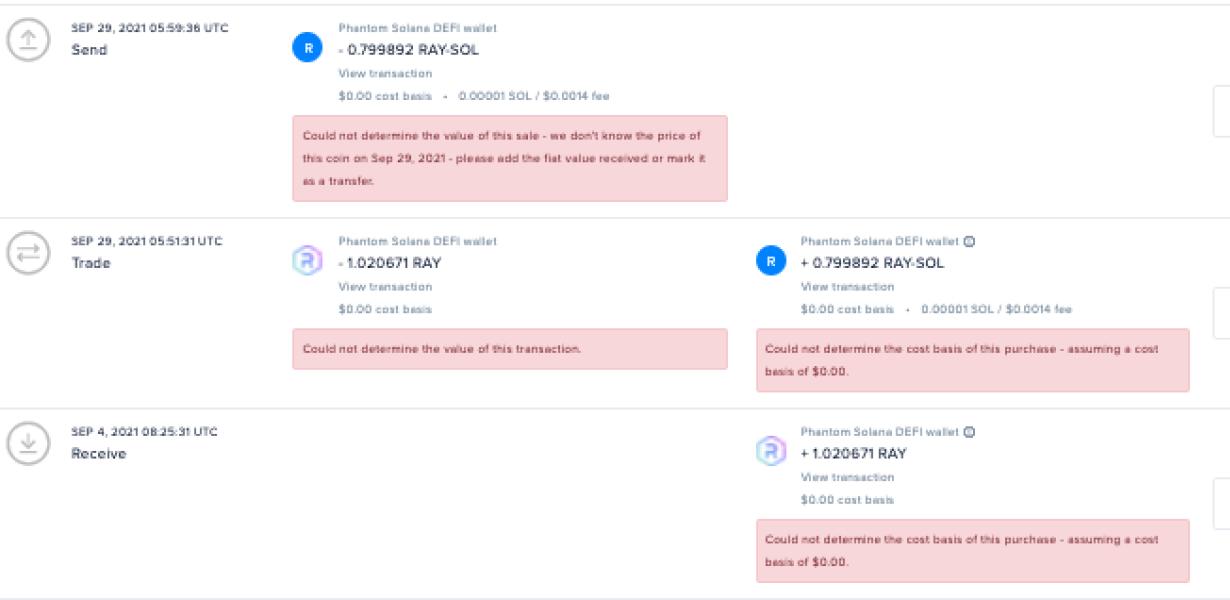

Does the Phantom wallet report to the IRS?

The Phantom wallet is a digital currency wallet that allows users to store, send, and receive digital currencies. The Phantom wallet does not report to the IRS.

The phantom wallet: does it report to the IRS?

There is no definitive answer to this question as it depends on the specific Phantom wallet features and how they are configured. However, most likely, the phantom wallet would not report to the IRS since it would not contain any actual financial information.

How the phantom wallet affects your taxes

The phantom wallet affects your taxes in a few ways. First, when you use the phantom wallet, you are not actually spending or earning money. This means that you do not have to report any of your transactions as income or deductions. Additionally, if you lose your phantom wallet, you will not have to worry about losing any of your funds.

The pros and cons of using a phantom wallet

There are a few pros and cons to using a phantom wallet. One pro is that it can keep your personal information private. Another pro is that it can help you avoid spending money unnecessarily. However, a con of using a phantom wallet is that it can be difficult to keep track of your money.

What you need to know about the phantom wallet and your taxes

There’s a new type of wallet that’s been cropping up on the internet and in some people’s pockets – the phantom wallet. Phantom wallets are wallets that don’t actually hold any money. Instead, they rely on a digital payment system to store and manage your money.

phantom wallets are not subject to taxation

There are a few important things to keep in mind when using a phantom wallet: first, phantom wallets are not subject to taxation. This means that you won’t have to pay any taxes on the income that you earn in your phantom wallet. Second, phantom wallets are not insured. This means that if your money is lost or stolen, you won’t be able to get it back. Finally, phantom wallets are not backed by any physical assets. This means that there is no guarantee that your money will be available when you need it.

How to use a phantom wallet without triggering an IRS audit

There is no one-size-fits-all answer to this question, as the best way to use a phantom wallet may vary depending on your individual circumstances. However, some tips on how to use a phantom wallet without triggering an IRS audit include:

1. Make sure all of your income and expenses are accurately documented. This will help ensure that any money you spend using a phantom wallet is accurately accounted for and doesn't trigger an IRS audit.

2. Use a phantom wallet only for legitimate financial transactions. Don't use it to store any kind of illegal or illicit funds. Doing so could lead to an IRS audit.

3. Keep your phantom wallet completely confidential. Don't share it with anyone, and make sure no one knows where it is stored. This will help prevent others from accessing your money and potentially triggering an IRS audit.

What are the tax implications of using a phantom wallet?

There are a few tax implications to keep in mind when using a phantom wallet. First, any earnings you generate in the wallet are considered taxable income. Additionally, any transfers you make from the wallet are also taxable, as are any fees you may incur. Finally, if you want to keep your earnings in the wallet indefinitely, you may need to pay taxes on them each year.

How to keep your phantom wallet activity off the IRS radar

The easiest way to keep your phantom wallet activity off the IRS radar is to use a virtual private network (VPN). A VPN encrypts all of your traffic, making it difficult for anyone to track your activities. Additionally, using a VPN will make it difficult for the IRS to identify your physical location.

Are phantom wallets safe from IRS scrutiny?

Phantom wallets are not specifically addressed in the Internal Revenue Code, but as long as the funds are not connected to any taxable income, they should not be subject to scrutiny. If the funds in a phantom wallet are used for illegal activities, however, they may be subject to investigation by the IRS.

How to use a phantom wallet without getting in trouble with the IRS

There is no one definitive answer to this question as the legality of using a phantom wallet varies from state to state. However, some tips on how to use a phantom wallet without getting in trouble with the IRS include:

1. Make sure to keep all documentation related to your phantom wallet account safe. This includes account numbers, bank statements, and other relevant information.

2. Only use your phantom wallet account for legitimate financial transactions. Do not use it to purchase items that you cannot afford or to make illegal transactions.

3. Keep a close eye on your bank statements and account balances to make sure that you are not overspending or engaging in any illegal activity. If you notice any suspicious activity, contact your bank immediately.

4. Do not share your phantom wallet account information with anyone else. Doing so could lead to legal trouble for you.

The risks and rewards of using a phantom wallet

There are a few risks and rewards associated with using a phantom wallet. First, phantom wallets can be dangerous if not used correctly. Second, phantom wallets can be difficult to use and maintain, which may lead to lost funds. Third, phantom wallets may not be as secure as traditional wallets, which could lead to theft. Finally, phantom wallets may not be as anonymous as users may hope, which could lead to identity theft.