Does Exodus report to the IRS?

The article explores whether or not the cryptocurrency exchange Exodus reports to the IRS.

Exodus Users Can Now Opt to Send Their Data to the IRS

The United States Internal Revenue Service (IRS) has announced that users of the Exodus Tax software can now choose to send their data to the IRS. This feature is available as of version 3.6.0 of the software.

This option is available as an add-on to the software and requires users to input their contact information and provide their taxpayer identification number (TIN). Once this information is verified, the IRS will be able to receive and process data from Exodus.

This feature is similar to the one that is currently available for users of the TurboTax software. TurboTax also allows users to send their data to the IRS, but it is not an add-on feature.

Exodus Will Now Report to the IRS

The IRS has confirmed that Exodus will now report to the IRS.

This change comes as a result of Exodus’ acquisition by the blockchain investment firm Block.one. Block.one is a well-known player in the blockchain space, and its acquisition of Exodus represents a major step forward for the overall growth of the blockchain industry.

Exodus will now be under the supervision of Block.one’s policy team, which is experienced in the areas of tax compliance and financial regulation. This will ensure that Exodus remains compliant with all applicable laws and regulations.

This change is good news for Exodus users, as it means that they will now have access to the resources and expertise of one of the leading blockchain investment firms. It also signals the increasing importance of the blockchain industry, and the willingness of major players like Exodus to invest in it.

How Exodus Reporting to the IRS Will Affect Users

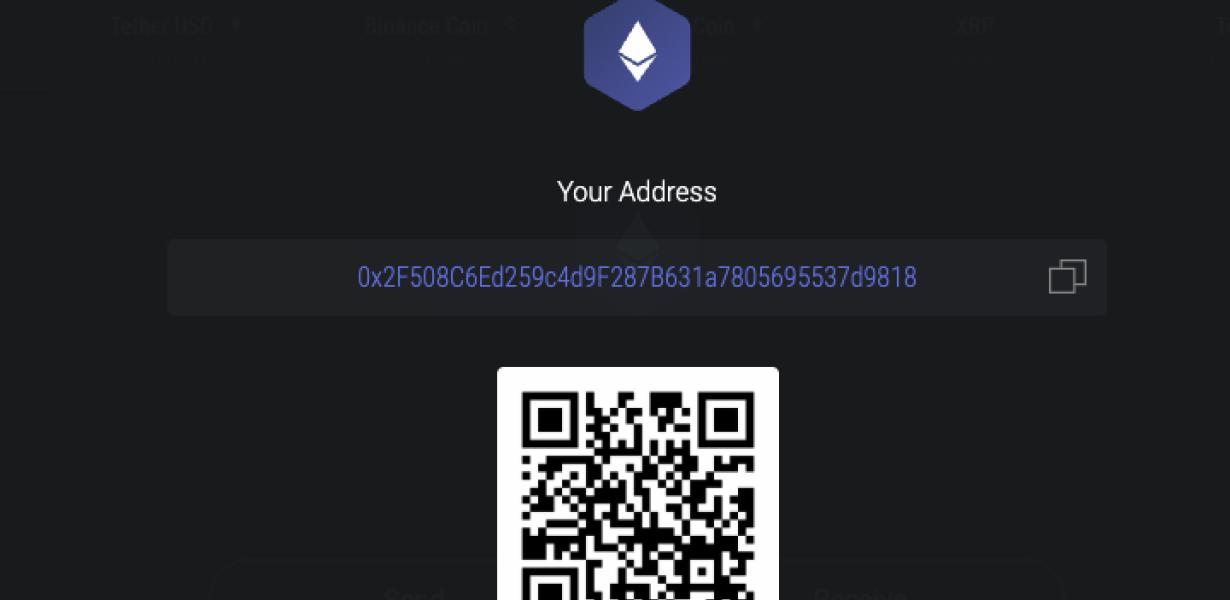

The IRS is looking for information about your income and expenses, including those related to your bitcoin and cryptocurrency transactions. If you're reporting your bitcoin and cryptocurrency income on your taxes, you'll need to provide the IRS with relevant information such as your bitcoin address and transaction logs.

If you're not reporting your bitcoin and cryptocurrency income on your taxes, you won't need to provide any additional information to the IRS.

What This Means for Exodus Users Now That It's Reporting to the IRS

If you're an Exodus user, it's important to know that the IRS is now reporting your income and taxes. This means that you may need to update your personal information and file taxes now. If you have any questions about this change, please contact the Exodus team.

What to Expect Now That Exodus Is Reporting to the IRS

Now that Exodus is reporting to the IRS, you can expect a number of changes. For starters, you'll need to create an account and input your information. Additionally, you'll need to make sure you're taking the correct deductions and reporting your income accordingly.

How Will Exodus Reporting to the IRS Affect You?

If you are an individual, your tax obligations will not change as a result of Exodus reporting to the IRS. However, if you are a corporation, the report will likely increase your scrutiny by the IRS. In either case, it is important to consult with an attorney to ensure that your specific situation is accounted for and that you are properly following all tax laws.

What Changes Come With Exodus Reporting to the IRS?

One of the biggest changes that come with Exodus reporting to the IRS is that it will help you keep more accurate and up-to-date records of your income and expenses. Additionally, the reporting process will help you identify any potential tax violations that you may be involved in.

What Does Exodus Reporting to the IRS Mean for You?

If you are an Exodus Holdings, Inc. (Exodus) taxpayer, your reporting obligations to the IRS will vary depending on the type of company you are. If you are a C corporation, you will generally have to file Form 1120, corporate income tax return. If you are a S corporation, you will have to file Form 1120S, shareholder's return on corporation. Finally, if you are a LLC, you will have to file Form 1040, U.S. individual income tax return.

When filing your tax return, it is important to keep in mind the following information:

· You must file Form 1120, corporate income tax return if your taxable income was greater than $50,000 and your tax liability was greater than $5,000.

· You must file Form 1120S, shareholder's return on corporation if your taxable income was greater than $150,000 and your tax liability was greater than $9,000.

· You must file Form 1040, U.S. individual income tax return if your taxable income was less than $100,000.

If you have any questions about your reporting obligations to the IRS, please contact us at (800) 922-5500. We would be happy to help you understand your specific obligations.

How Will This Impact You? Exodus Reports to the IRS

If you file your taxes using Exodus, the IRS will require you to certify that you have complied with all tax obligations. If you fail to certify this, you may be penalized by the IRS.