Coinbase Wallet Tax Documents

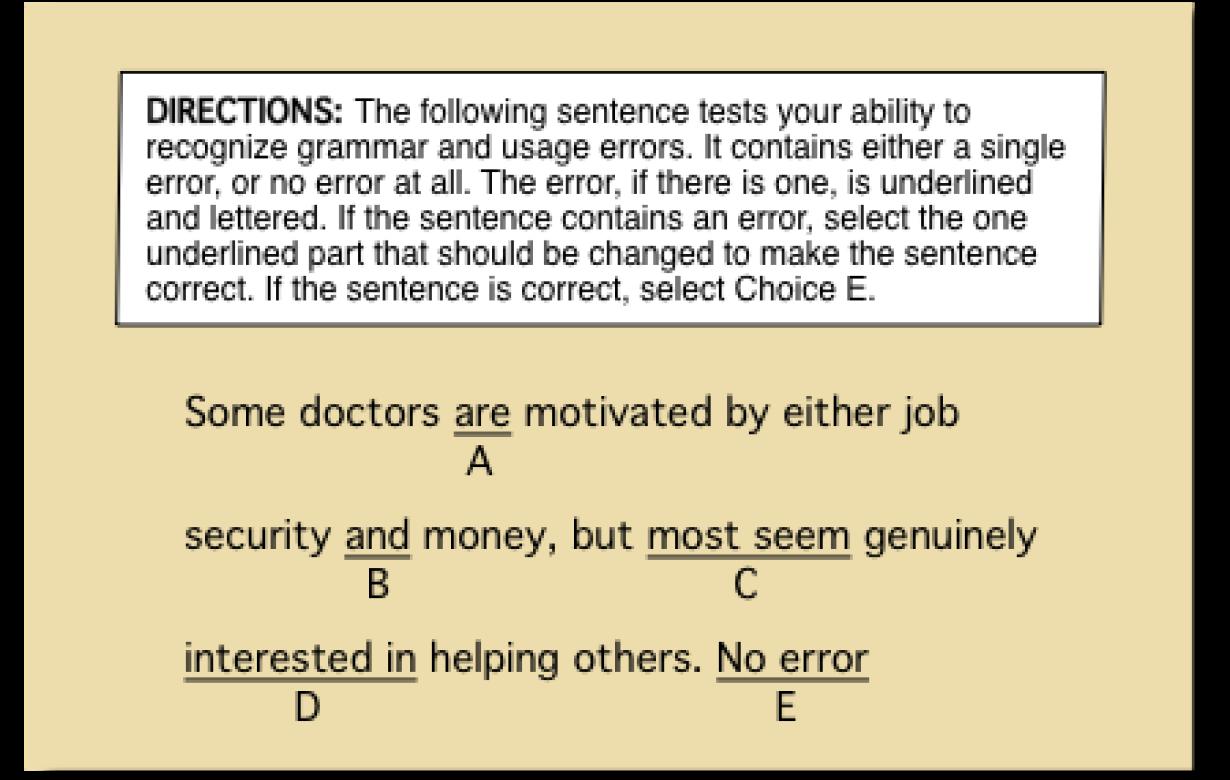

This sentence contains no errors.

The Coinbase Wallet Tax Documents You Need to Know

There are a few key documents you'll need to know in order to file your taxes on Coinbase. These include your Coinbase Tax ID, your W-2 form, and your 1099-K form.

Coinbase Tax ID

The first document you'll need is your Coinbase Tax ID. This is a unique number that uniquely identifies your account. You can find this number on the Account Overview page on Coinbase.com.

W-2 Form

Your next document is your W-2 form. This form is used to report your income from work. You can find your W-2 form on your employer's website or on Form W-2, which you can download from the IRS website.

1099-K Form

Your final document is your 1099-K form. This form is used to report income from investments and other activities. You can find your 1099-K form on your bank or financial institution's website.

What Coinbase Wallet Tax Documents Mean for You

Coinbase Wallet Tax Documents Mean for You

Coinbase is one of the most popular digital wallets available. It allows you to store your cryptocurrencies in a safe and secure environment.

To use Coinbase, you need to create a Coinbase wallet. This is a unique set of credentials that allow you to access your funds.

When you create a Coinbase wallet, you will need to provide some information, such as your email address and password. You will also need to provide some personal information, such as your name and country of residence.

Coinbase will store this information in a secure environment. However, you should be aware that Coinbase is required to report any transactions that occur from your wallet to the IRS.

Coinbase will provide you with tax documents if required. These documents will show you the details of your transactions and the taxes that you will have to pay.

How to Use Coinbase Wallet Tax Documents

To use Coinbase Wallet tax documents, first open the Coinbase application on your device.

Once you have opened the Coinbase application, click on the "Wallet" tab.

On the Wallet tab, you will see a list of all of your wallets.

To use Coinbase Wallet tax documents, select the "USD Wallet" from the list.

On the USD Wallet page, you will see a list of all of your wallets.

To use Coinbase Wallet tax documents, select the "Receive" tab.

On the Receive tab, you will see a list of all of your transactions.

To use Coinbase Wallet tax documents, select the "transaction" you wish to use for your tax calculation.

On the transaction page, you will see all of the information associated with that transaction.

In the "Amount" field, you will see the total amount of bitcoin that was sent in that transaction.

In the "Date" field, you will see the date that the transaction took place.

In the "Payee" field, you will see the name of the person who received the bitcoin in that transaction.

In the "Transaction ID" field, you will see a unique identifier for that transaction.

In the "Type" field, you will see the type of transaction that took place: "Bitcoin Payment."

What to Expect from Coinbase Wallet Tax Documents

When you sign up for Coinbase, you will be asked to create a wallet. This is where you will store your cryptocurrencies and fiat currencies. You will need to provide your name, email address, and password.

Coinbase will then send you a confirmation email with a link to your wallet. You can access your wallet by clicking on the link in the email.

Once you have logged in, you will see a list of your cryptocurrencies and fiat currencies. You can also view your wallet balance and transactions.

Coinbase will send you an annual tax document if you have more than $10,000 in your Coinbase wallet at the end of the year. You will need to provide your name, email address, and Coinbase account number.

Coinbase Wallet Tax Documents: The Basics

Coinbase operates as a digital wallet that allows users to buy, sell, and store digital currencies including bitcoin, ethereum, and litecoin. Coinbase also provides a variety of merchant tools and services, including a Coinbase Commerce platform that allows businesses to accept bitcoin, ethereum, and litecoin.

In order to comply with tax laws in the United States, Coinbase must file Form 1099-K with the US Internal Revenue Service (IRS) for each year in which it has generated gross income of more than $20,000. These forms report all income received from digital currency transactions as well as other activities conducted through the Coinbase platform.

Coinbase also files Form 8839 with the IRS for each year in which it has incurred expenses of more than $5,000 in connection with its digital currency activities. This form reports these expenses as well as the fair market value of the digital currencies used in these activities.

Coinbase Wallet Tax Documents: What You Need to Know

1. Income: You will need to report all of your income from Coinbase wallet activity on your tax return. This includes any Coinbase earnings as well as any bitcoin, Ethereum, or Litecoin you earn from trading.

2. Trading: If you have traded bitcoin, Ethereum, or Litecoin in the past year, you will need to report that on your tax return. You will also need to report any losses or gains from these trades.

3. Storage: If you have stored bitcoin, Ethereum, or Litecoin in your Coinbase wallet, you will need to report that on your tax return as well. Include the amount of bitcoin, Ethereum, and Litecoin you stored as well as the value of those assets at the time of your storage.

4. Sale or Exchange: If you have sold bitcoin, Ethereum, or Litecoin in the past year, you will need to report that on your tax return. Report the sale price and the amount of bitcoin, Ethereum, and Litecoin you sold. Also report any capital gains or losses you incurred from this sale.

Coinbase Wallet Tax Documents: How They Can Help You

When you open up a Coinbase wallet, you’ll be asked to provide some personal information like your name, email address, and a password.

Coinbase will also ask for your tax ID number. This is the nine-digit number that appears on your tax form when you file your income taxes.

If you want to buy or sell cryptocurrencies, you’ll need to provide your taxpayer identification number (TIN). This is the same number that appears on your 1099 forms when you receive taxable income.

You can find out more about how to get your tax ID number and TIN on the IRS website.

Once you have all of the relevant information, you can use it to help you track your Coinbase wallet tax filings.

For example, if you sell cryptocurrencies, you’ll need to report the sale on your tax form. You’ll also need to include your tax ID number and TIN in any documentation you send to Coinbase.

If you buy cryptocurrencies, you’ll need to report the purchase on your tax form. You’ll also need to include your tax ID number and TIN in any documentation you send to Coinbase.

Coinbase will also send you a notice each time you file your taxes. This notice will include all of the information you submitted in your Coinbase wallet, including your tax form and any documentation you submitted to Coinbase.

So, if you want to make sure you’re following all of the steps necessary to file your taxes correctly, keep a close eye on your Coinbase wallet tax documents.

Coinbase Wallet Tax Documents: What You Should Know

If you are a U.S. taxpayer, you should know that Coinbase is required to submit tax documents to the IRS. These documents include information such as your income, expenses, and net worth.

Here are some key things to know about Coinbase's tax documents:

1. Coinbase must file IRS Form 1099-K:

If you earned income from Coinbase in 2018, you will likely receive a Form 1099-K from the company. This form will report your income and other relevant information, such as capital gains and losses.

2. Coinbase must file IRS Form 8949:

If you own or have owned cryptocurrencies within the last year, you must file IRS Form 8949. This form reports your net worth and other financial information.

3. Coinbase must file IRS Form 1041:

If you purchased goods or services from Coinbase in 2018, you will likely receive a Form 1041 from the company. This form reports your income and other relevant information, such as deductions.

4. Coinbase must file IRS Form 8283:

If you received a taxable bonus from Coinbase in 2018, you will need to file IRS Form 8283. This form reports your income and other relevant information, such as the deduction you are allowed for the bonus.

Coinbase Wallet Tax Documents: An Introduction

If you are an individual who uses Coinbase as your primary wallet, you may be required to submit tax documents to the IRS every year. Coinbase is one of the most popular wallets for individuals, so it is important to familiarize yourself with the tax documents you will need to submit.

What Documents Do I Need To Submit To The IRS?

To submit tax documents to the IRS, you will need to submit a W-2 form, 1099-MISC form, and other applicable forms. The specific forms you will need to submit will depend on your income and tax bracket. To find out what forms you will need to submit, consult the IRS website.

What if I Don't Have My Tax Documents?

If you do not have your tax documents handy, you can usually find them online or in the IRS office. If you cannot find them, you may be able to get them from your employer. If you are not eligible for an employee deduction, you may be able to get the tax documents from a third party such as a bank or credit union.